Limit Up! 22 October 2025

Limit Up! --> Website | Substack | YouTube

Overnight

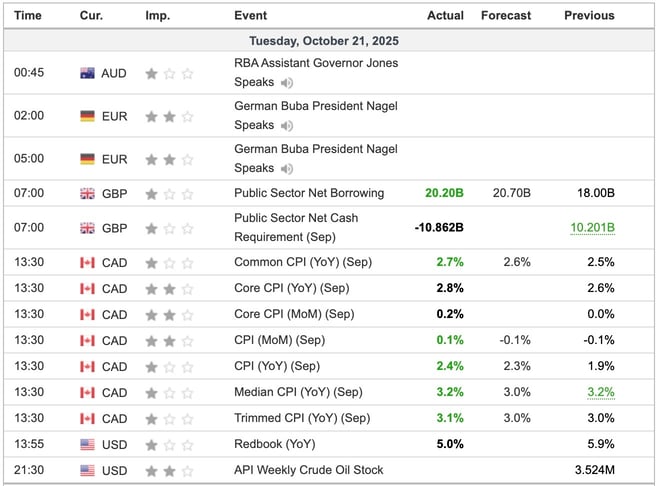

Economic Indicators Released Overnight

A terrible miss for Canadian CPI, following the higher than expected Resources and Industrial PPIs yesterday. Surely no more rate cuts and recession incoming. The dreaded stagflation.

The Gold and Silver parabolas finally broke taking price down 5% and 7% respectively.

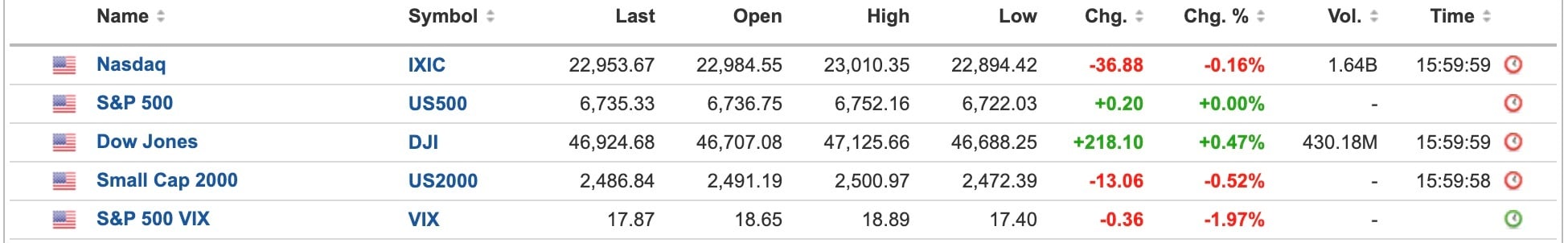

Equities were chilling.

US Equities

Breaking

Gold tumbles 6% in biggest sell-off since 2013 [FT]

US army taps private equity groups to help fund $150bn revamp [FT]

Japan stocks hit record as Sanae Takaichi becomes prime minister [FT]

BOJ Is Said to Be Closer to Rate Hike With Little Need to Rush [Bloomberg]

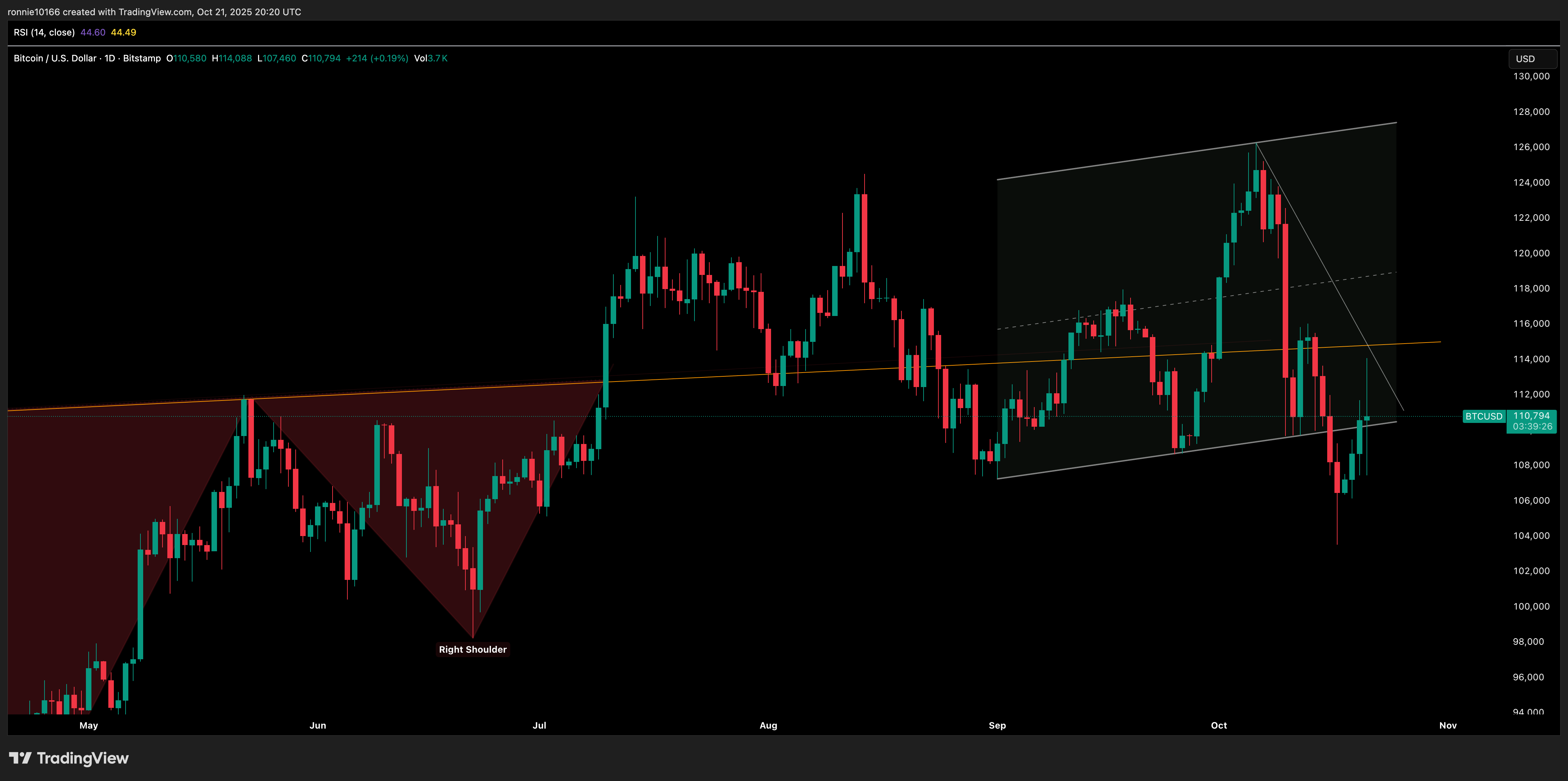

Bitcoin

A massive short-lived spike up to 114k shows how thin the market is without leverage traders. The 107.5k support seems to be firm at the moment but another retest of 104k will probably be on the cards. Read more

Commodities

Nowhere was the euphoria crushed harder than in Silver. We’d like to see price close above $48.50 to preserve the uptrend. The old pivot line may well come into play at 45.00 and we wouldn’t expect price to break below $40.00. Read more

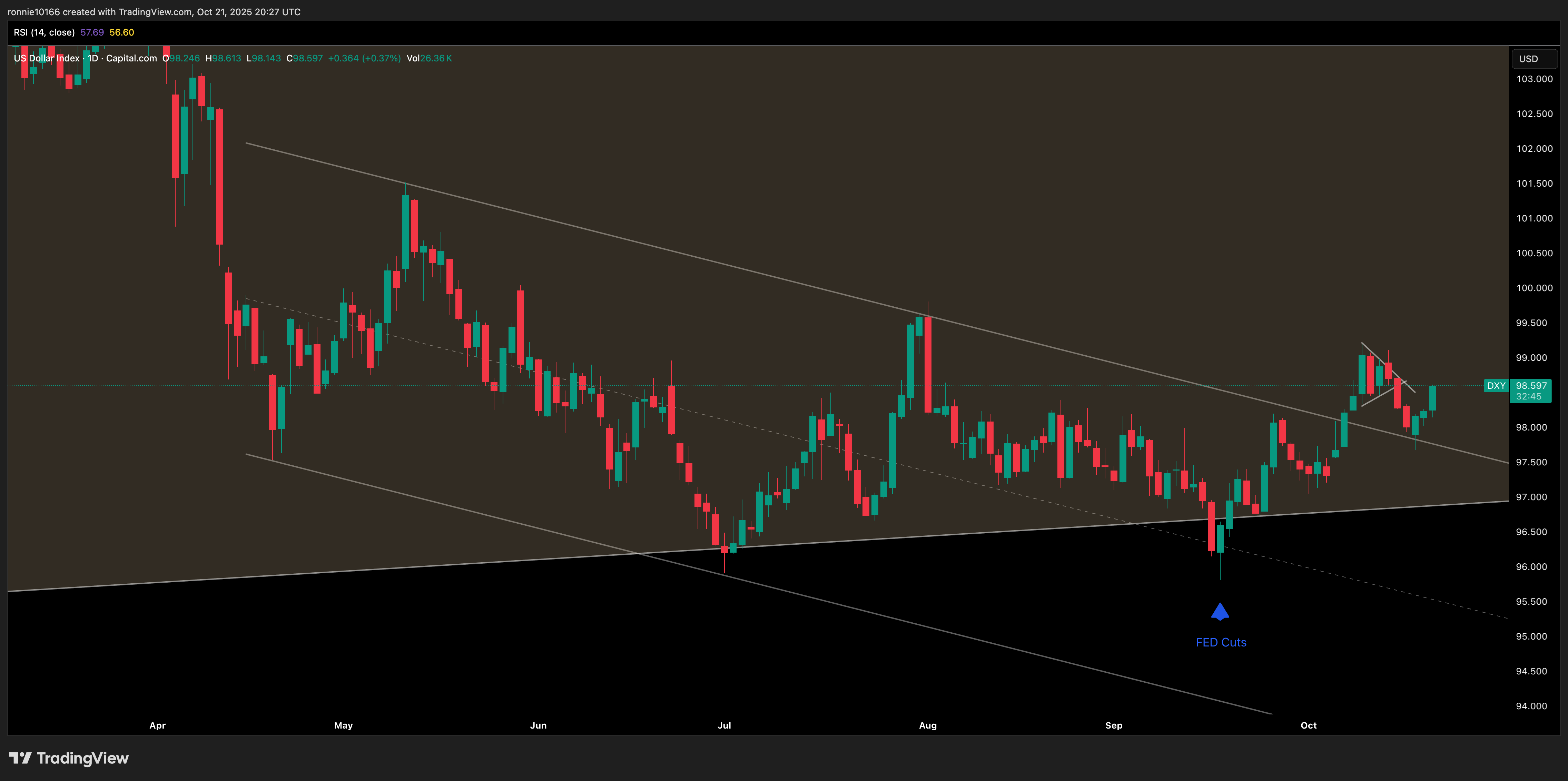

Foreign Exchange

DXY completed it test at the scene of the crime at 97.85 and now we’re bouncing higher. That pivot high at 99.00 is the key. Break that and there is plenty of upside potential and a possible trend confirmation. Read more

Equities

That resistance line is like a magnet for price. Amidst the insane sell-off in precious metals and the volatility in Bitcoin, equities did nothing more than consolidate at all time highs.

More on Substack

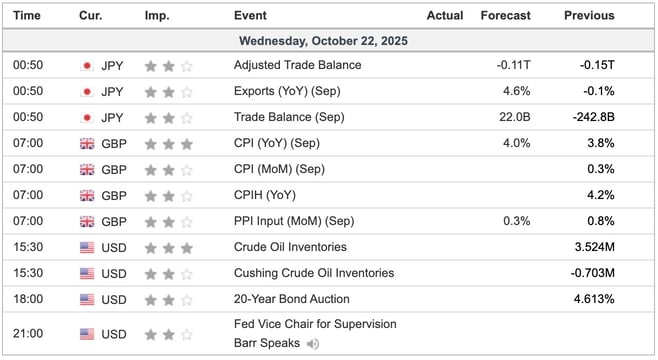

Economic Indicators Today

Ian Reynolds

Ian Reynolds

.jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(13).jpg)