Pivotal Moment For Markets

Price action;

- Equities gapped higher on a very weak Nonfarm Payroll report as FED rate will cut now within 2 weeks and by more than 25bps.

- However, having gapped higher, market sold off as FED now cutting into weakness rather than strength.

- Bonds rallied hard, yield on US 10 year dropping to 4.07.

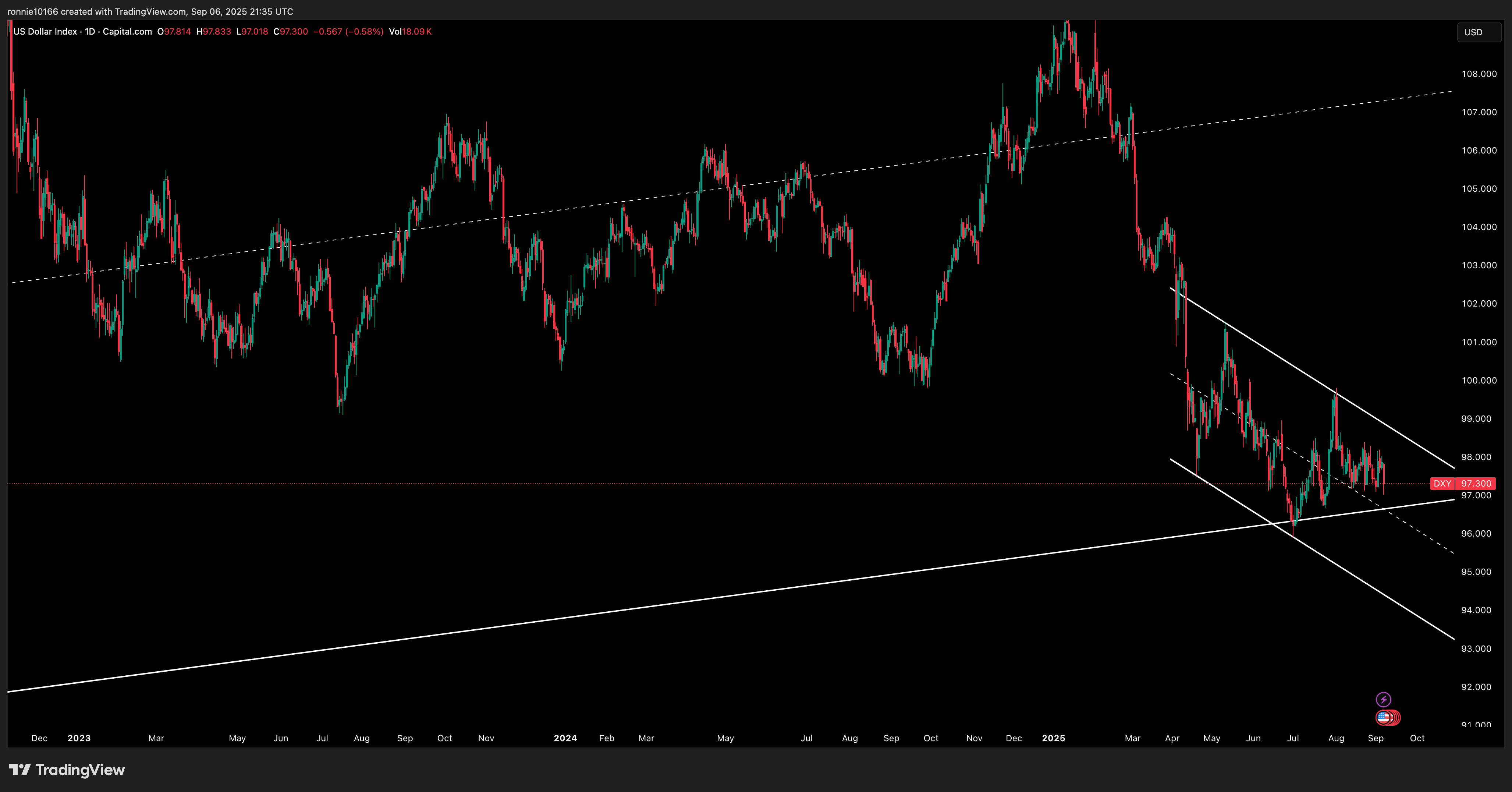

- USD weakened pushing EURO & Aussie to breakout levels

- Gold hits all time high above $3,500, Silver at $41

- Oil collapses as economy now not strong as Trump and Powell have been telling us

Friday's Economic Reports

Economic Indicators Released Overnight

Breaking

Treasury Secretary Bessent calls for entire review of Fed [investing.com]

Precious Metals / Commodities

Gold makes a new all time high. Amazingly powerful trend, target 4,000 for the move to the top of the trend channel.

Poland wants gold to constitute 30% of reserves, central bank chief says [TradingView]

India trims US debt, boosts gold reserves in $690 bn forex stockpile reshuffle: Report [MSN]

Silver hits $41but pivot line still constraining price, a break above targeting $45.50 by measured move.

The rollercoaster year for Oil continues as price plummets on weakened US economic perception.

Bitcoin (& Crypto)

BTC couldn't sustain the positive price action before NFP and leaves a long shadow above the bear flag.

CRE / Banks / CLOs

|

|

|

|

|

|

The haircuts are now spreading to pooled investments, and office contagion now spreading to multi-family. Against a backdown of overpriced and oversupplied residential markets and a hard meltdown in price in Canada and New Zealand, housing could yet again be the last straw.

United States

US Economic Indicators

The Nonfarm Payroll report ended a weak of poor economic data with a killer punch. Weaker manufacturing PMIs, lower job openings, Initial Jobless Claims ticking up and low ADP count and now a catastrophic NFP, particularly the monthly revisions, and with a bigger potential revision coming next week

China

China Economic Indicators

Not much data to digest but a slight uptick in economic activity. Yields still in secular decline despite the recent uptick.

China steps in to tame animal spirits as solar sector racks up billions in losses [FT]

China 30 Year Government Bond Yield Daily

Japan

Japan Economic Indicators

Japan is in limbo. CPI is declining but wage inflation rising. Low GDP. Demographics are really influencing Japan as the population get older but starts to decline in numbers. 9 million houses unoccupied is a testament to that.

Japan says no trade deal has been agreed yet Trump/Lutnick are crowing about the US$0.5T that Japan is supposed to pay to the US.

The most uncertainest place in the world.

USD/YEN finally making some sense.

Europe

EU Economic Indicators

All quiet economically but the usual suspects are causing trouble at the margin. France has taken Italy's mantle as core Europe's most ungovernable country. Germany remains the worst economy.

France is in big trouble, again. Can the ECB save it? [Investing.com]

French business warns of recession risk as political turmoil deepens [FT]

The Euro continues to outperform, as diversification flows away from Trump outweigh domestic issues.

United Kingdom

UK Economic Indicators

If the blood shedding has started in government and the people are taking back their rights, then surely UK is cheap here relatively. Both factors have to play out together, along with the IMF bailout which should be happening this week according to rumours in The City.

Gilts

A stunning reversal in yields for long Gilts and now we're back to the scene of the crime, managing to overcome 2 high profile government resignations in a week.

UK 30 Year Government Bond Yield Daily

Sales of new homes in London have collapsed to 'catastrophic' lows in 2025 says report [Yahoo! Finance]

UK factories stumble as new orders fall back, PMI shows [Reuters]

UK secures £10bn deal to supply Norway with warships [BBC]

Canada

Canada Economic Indicators

Canadian Economy Shrinks 1.6% as Trade War Crushes Exports [Bloomberg]

Europe’s biggest battery hope Northvolt files for bankruptcy in Sweden [AFR]

Canadian Real Estate Is Crashing At One of The Fastest Rates Ever [Better Dwelling]

Toronto condo market is in ‘free fall,’ federal housing minister says [The Star]

Canadian pension funds are some of the biggest in the world but now they're a bit smaller

Ontario Public Pension Fund (IMCO)- approximately $550 million

CAD Ontario municipal pension fund (OMERS) - Undisclosed exact amount, estimated to be 200M+

Government of Quebec - $270 million CAD

Quebec Public Pension Fund Manager - $200 million

CAD CPP Investments - $55M

Quebec declares Northvolt battery plant partnership dead, loses $270M investment [CBC]

Australia

Australia Economic Indicators

A sudden explosion of economic reports down under underline a struggling economy but with inflation, from last week, not as under control as we were lead to believe.

‘Fragile and unconvincing’: Why the economy is struggling to rebound [AFR]

Currency

Aussie Dollar having a really good go at breaking the 15 year downtrend. The more price hangs around the line, the bigger the move.

What's Next?

ECB monetary policy meeting before the FED this week after will be of key importance, along with US CPI and PPI. And US 10 and 30 year bond auctions.

Worst potential outcome would be perception of FED cutting into accelerating inflation. Those bond rallies could flip on a dime.

This Week's Important Economic Indicators [London time]

![This Week's Important Economic Indicators [London time]](https://vip.suberia.capital/hs-fs/hubfs/07092025/indicators.jpg?width=658&height=503&name=indicators.jpg)

Ian Reynolds

Ian Reynolds