Liberation Day II

Limit Up! --> Website | Substack | YouTube

Overnight

Economic Indicators Released Friday

We were watching the Silver short squeeze unfold when suddenly markets were nuked by Trump's most damaging post yet.

Trump caught global markets off guard big time on Friday, although it was clear that an enormous amount on insider trading was going on.

Bitcoin lost 10%, US equity indexes 3% and Japan/Chinese futures 5% plus. And at the close of the week, leaving Bitcoin as the only hedging mechanism over the weekend.

Trump plans 100pc tariff increase on China amid metals dispute [AFR]

US Equities

Breaking

Wall Street selloff raises worries about market downturn

Trump administration starts firing workers laid off in government shutdown [FT]

Insurers prepare for wave of First Brands claims [FT]

Bessent says US purchased pesos and finalized framework for $20 billion lifeline for Argentina [CNN]

Precious Metals / Commodities

What looked likely to be a bad day for Gold, turned out to be positive with price regaining $4,000.

The cost of borrowing silver for one month in London reached an annualised record of 35%. as price hit an all time high above $50.

Bullion banks, maybe US Treasury, have been trying to hold price down but he shortage is so acute now, and the losses of the paper traders so great that whatever happens price keeps bouncing back.

Remember when US regulators changed legislation to prevent Bunker Hunt cornering the market in 1980, bankrupting him. The same is coming.

Oil finally broke lower as the effects of Trump's tweet cascaded around the world. Oil, without the geopolitical risk for a change, shows exactly where the global economy is headed.

Bitcoin (& Crypto)

Massive capital destruction Friday night and Saturday morning as leveraged positions were stopped out. Biggest crash in crypto history but as I look at the price at 112k, it's only 10% off the all time high.

CRE / Banks / CLOs

|

|

|

Regional banks now being significantly impacted as CRE contagion grows. It would be headline news if everything else economically wasn't so bad.

United States

US Economic Indicators

All we can say is bond auctions went well and Bessent seems to be preparing for QE even though it's only the FED that can do so.

US Treasuries Risk Losing Haven Status, Pension Official Says [Bloomberg]

Fed's Williams tells New York Times he backs more rate cuts this year [Reuters]

USD lower on tariffs but it has still broken higher. Maybe a test of support before moving higher again.

US 10 Year Government Bond Yield Daily

Yields dropped on Friday as the tariff threats provide a significant challenge for the whole global economy.

China

No data this week as it was a holiday in China

Bond yields now rolling over and can only go down if Trump's tariff threat actually comes to fruition.

China 10 Year Government Bond Yield Daily

Europe

EU Economic Indicators

Shocking German Industrial Production numbers masked the contraction of both imports and exports in August, negative Factory Orders and flat Retail Sales.

Breaking back into the bull flag after a month above support, doesn't bode well. EUR/USD could easily sink to the bottom of the channel and then the 15 year downtrend.

United Kingdom

UK Economic Indicators

UK 10 Year Government Bond Yield Daily

Even UK yields are lower, mainly due to the government going into hiding.

Canada

Canada Economic Indicators

Better news employment-wise in Canada but if US is heading for recession, surely Canada has actually been there for some time.

USD/CAD confirming the breakout with the double bottom at 1.3700 providing the launching point.

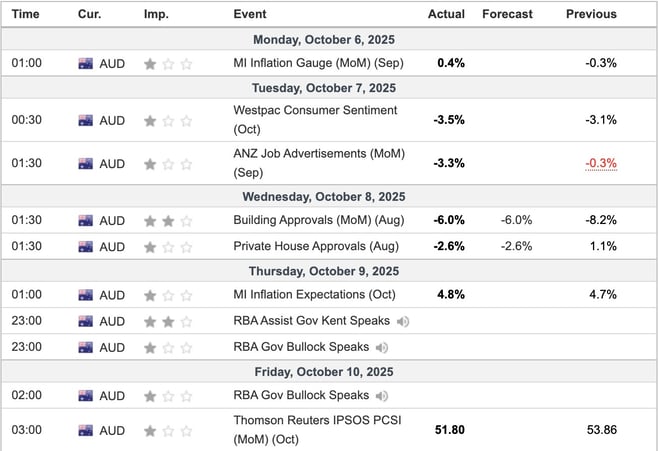

Australia

Australia Economic Indicators

Japan

Japan Economic Indicators

Some inflationary implications this week in Japan but in reality nothing to be concerned about.

USD/YEN price back to the midline of the uptrend so a chance to open a small long if you're not in already. The big drop on Friday just prior to Trump's tweet shows how insider trading is proliferating under Trump's leadership.

What's Next?

Hard hats on as some equity index futures were down 5% plus late Friday. Trump due to make another statement so we'll have to see what that's about first. Looks like the BLS will be releasing CPI and PPI data, but not employment data, at this stage. Anyway who needs NFP volatility this week?

This Week's Important Economic Indicators [London time]

![This Week's Important Economic Indicators [London time]](https://vip.suberia.capital/hs-fs/hubfs/12102025/indicators.jpg?width=658&height=673&name=indicators.jpg)

Ian Reynolds

Ian Reynolds

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(85).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(49).jpg)