China Is Boxed In

Limit Up! --> Website | Substack | YouTube

Overnight

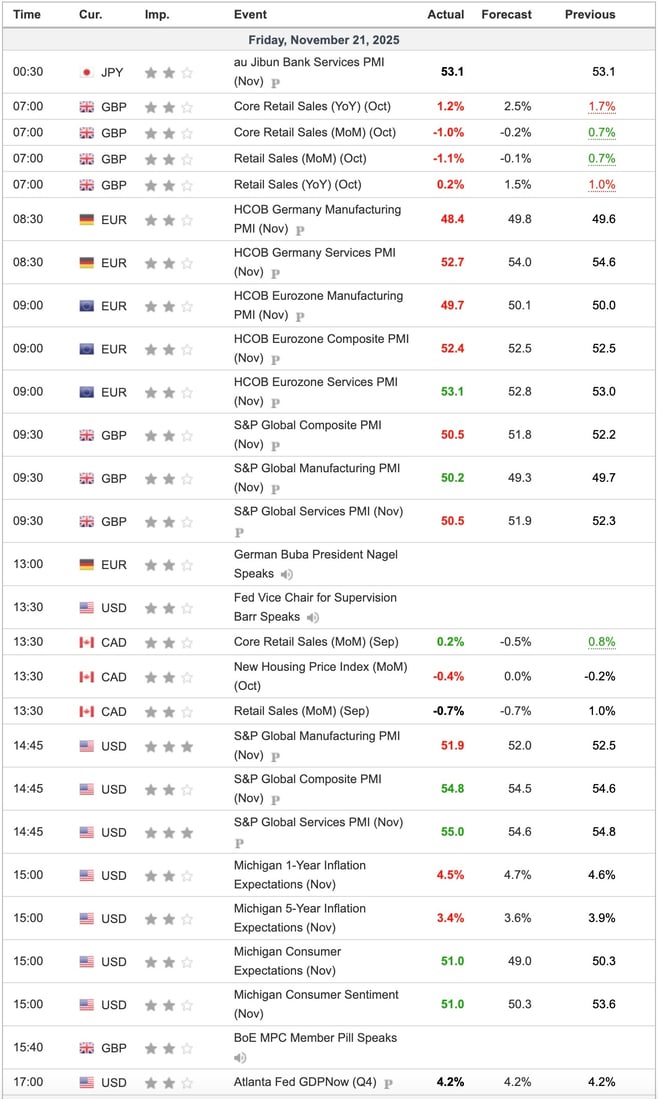

Economic Indicators Released Friday

No numbers then too many numbers.

- UK Retail Sales plummet

- EU PMIs softish

- US consumer sentiment low and inflation expectations now receding.

- Atlanta FED thinks Q4 GDP is running at 4.2% annualised.

Markets take a break, even Bitcoin, which has bounced back to 87.5k as we speak. It's Thanksgiving on Thursday so expect this week to be quiet but next week we'll be back with a vengeance.

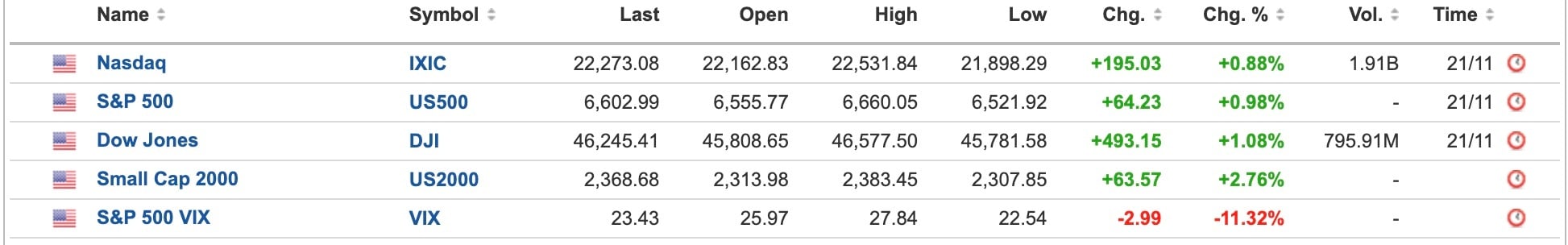

US Equities

Breaking

Japan on track to deploy missiles to island near Taiwan, Koizumi says [The Japan Times]

China's Gold Buys Triple, Support Next Leg Higher [Zerohedge]

'Almost Every German City Is Now On The Verge Of Bankruptcy' [Zerohedge]

U.S. Banks Shelve $20 Billion Bailout Plan for Argentina [Wall St Journal]

Precious Metals / Commodities

Gold is still in a bull market, just pausing to build up energy for the next leg up. China's relentless buying and QE coming everywhere near you, is the signal that any pause is a buying opportunity.

Silver looks even better than Gold, as we consolidate at $50, the highest price in 50 years. Now confirmed as a critical mineral in the US, 5 years of deficit and QE coming.

A lot of experts now predicting Oil to double in price as energy becomes exponentially more expensive. That may not be the case if China and US go into recession. Price has been falling for 2 years, excluding geopolitical events, and if those events hadn't happened price would be $35.

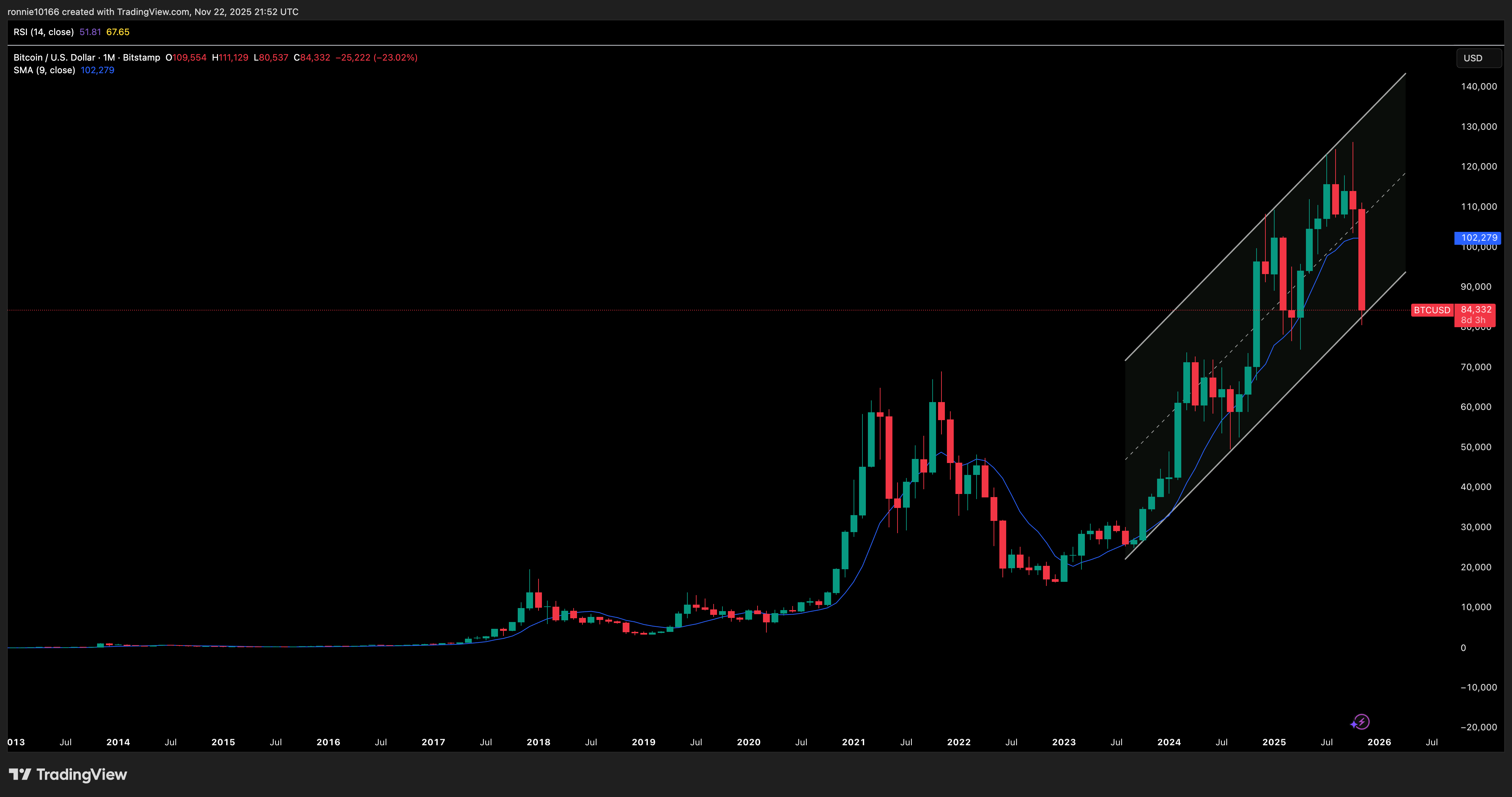

Bitcoin (& Crypto)

Bitcoin has had a truly ugly couple of months. But here we are, suddenly, at he bottom of the monthly channel. Now might well be the chance to buy, after all, everyone else thinks it's going down.

CRE / Banks / CLOs

|

|

|

United States

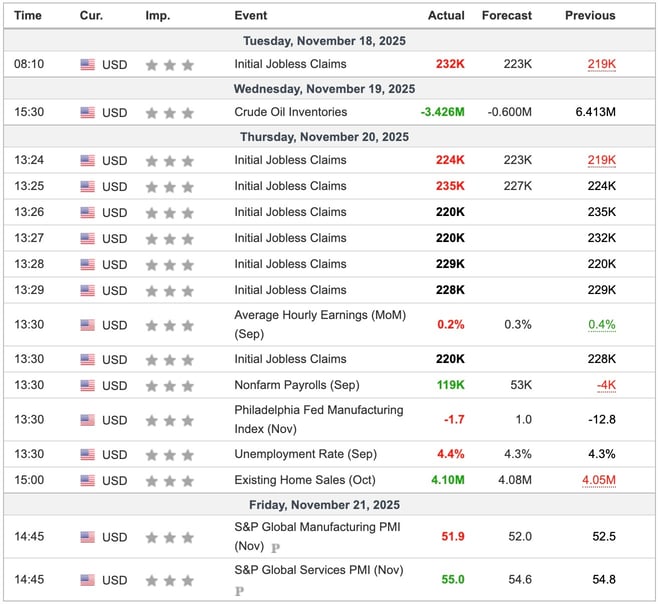

US Economic Indicators

All those Initial Jobless Claims's and basically no change. September's NFP was slightly higher than expected but old and inaccurate news.

DXY is at a fascinating point. It can't seem to leave the uptrend support. When it does it's going to be a massive move one way or the other, and most capital markets will be driven by it.

China

China Economic Indicators

Foreign Direct Investment down again adds to China's extreme economic woes. Yuan is treading water.

USD/OFFSHORE YUAN Monthly

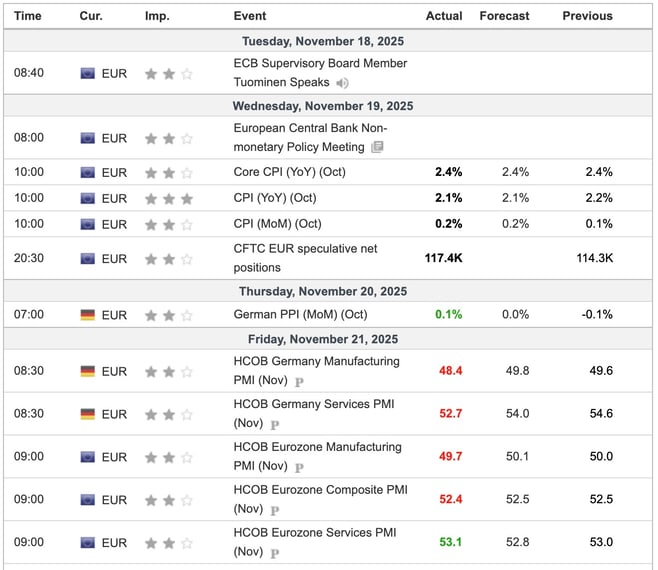

Europe

EU Economic Indicators

CPI can't seem to get any lower, even with a stagnant economy in Germany. The Euro is holding it's own even in the face of a recently resurgent DXY. Looks like a pause before continuation pointing to a weaker USD.

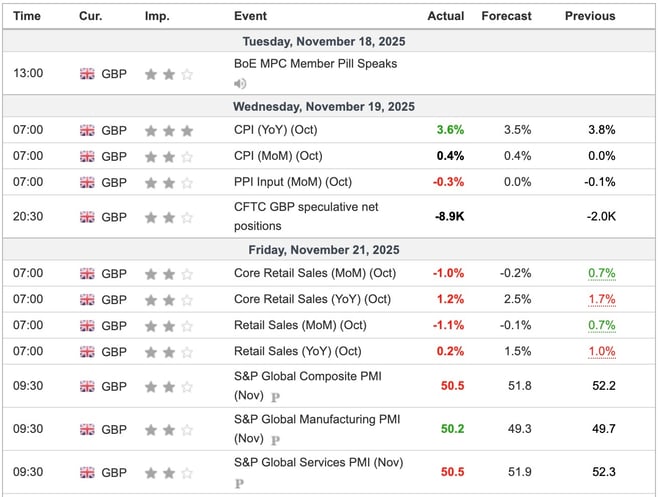

United Kingdom

UK Economic Indicators

CPI is edging up again even with a big miss in retail sales. This week's budget will be the culmination of many months speculation but will it be as bad as expected? Cable continues to follow EUR/USD in predicting a weaker USD.

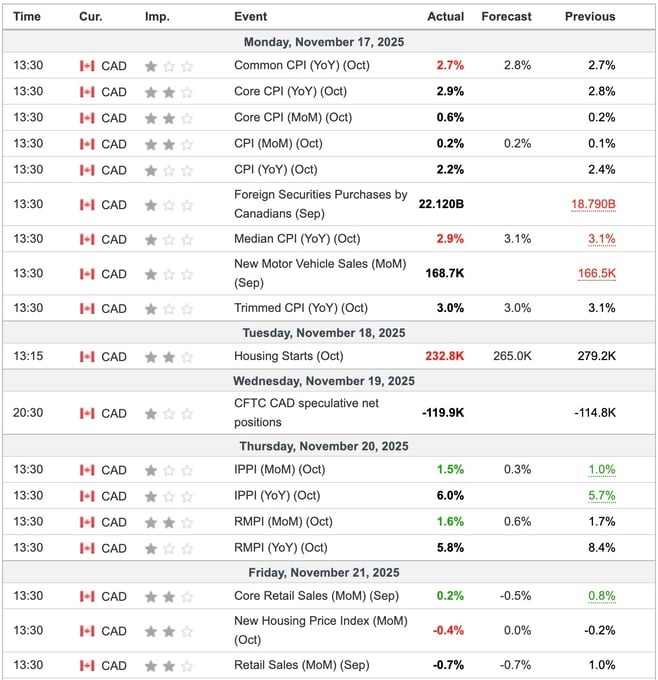

Canada

Canada Economic Indicators

Inflation is becoming a real problem in Canada and the BoC is bent on cutting. This will end badly. USD/CAD is beginning to price this in as USD/CAD follows USD/YEN, singling out the weakest currencies. This is why DXY is sitting on the fence - opposing forces.

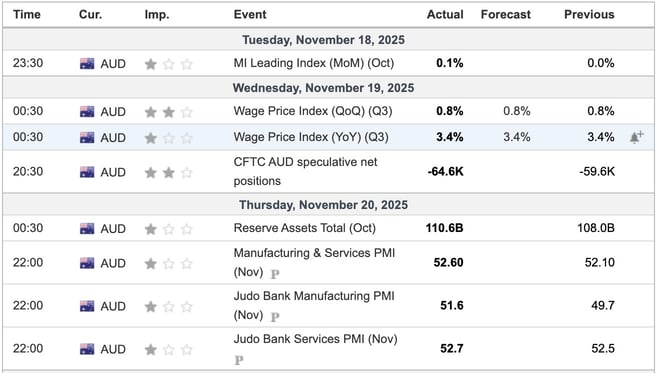

Australia

Australia Economic Indicators

We're looking for Aussie, to send USD signal.

Japan

Japan Economic Indicators

CPI too high, with a new Govt providing stimulus and the currency falls. USD,/YEN has broken out of a 2 year wedge and is approaching intervention levels.

What's Next?

Quiet into Thanksgiving but with US PCE monthly to deal with on Wednesday. Geopolitics may drive price even if traders don't want to play. A potential trade deal with China is on the cards next week and we're drifting ever closer to the FOMC on 10 Dec.

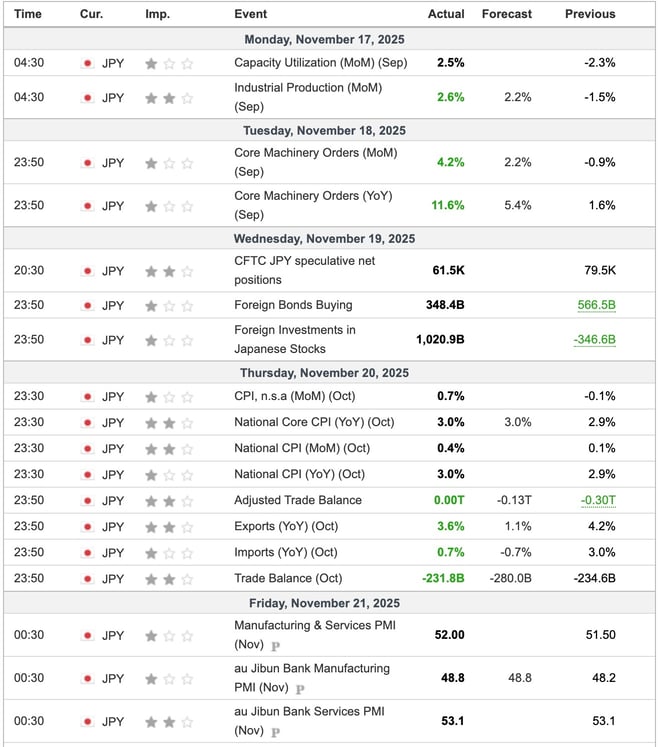

This Week's Important Economic Indicators [London time]

![This Week's Important Economic Indicators [London time]](https://vip.suberia.capital/hs-fs/hubfs/24112025/indicators.jpg?width=658&height=663&name=indicators.jpg)

Limit Up Podcast 10 November 2025

Ian Reynolds

Ian Reynolds

%20(1).webp?width=3000&height=3000&name=Podcast%20Template%20(1)%20(1).webp)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(32).jpg)