Limit Up! 7 November 2025

Limit Up! --> Website | Substack | YouTube

Overnight

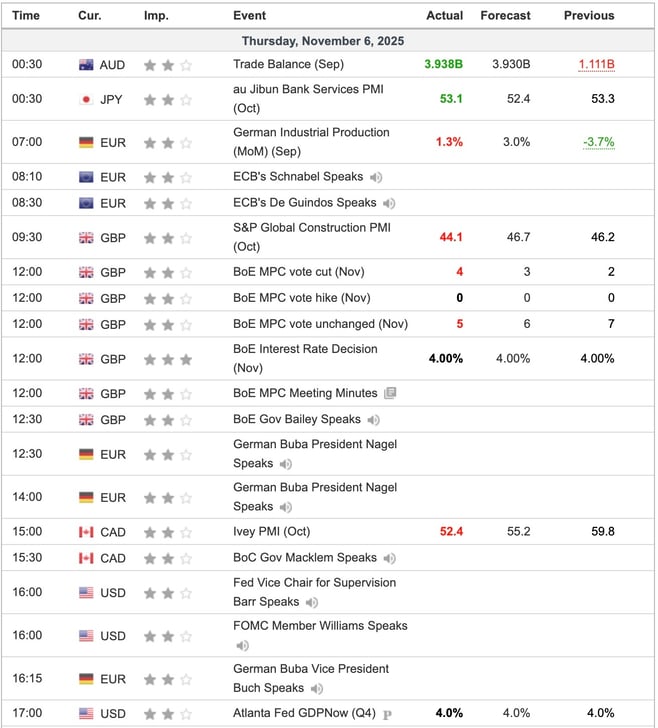

Economic Indicators Released Overnight

Comments of government support by OpenAI's CFO spoked investors and the subsequent walk-back made it even worse. The message is crystal clear: there's no more cash in the investment pipeline.

Altman Says OpenAI Doesn’t Want a Government Bailout For AI [Bloomberg]

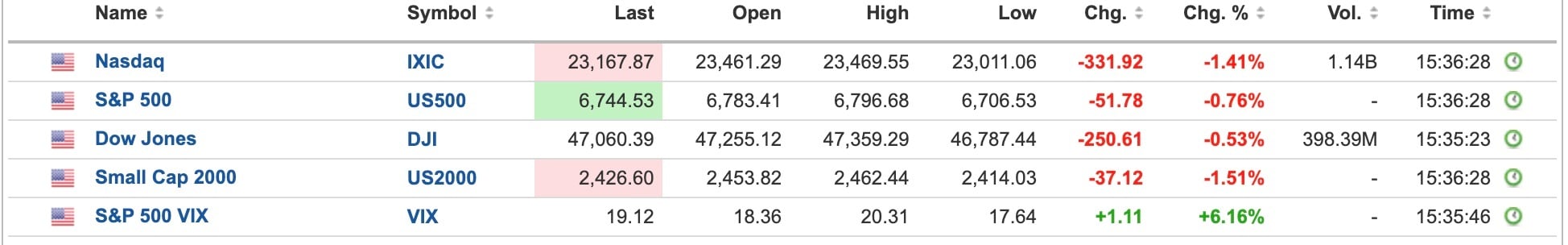

Chip, AI and tech stocks in general had a bad day, and the question is: does this mark the top?

A dovish hold by the Bank of England was pretty much the only economic event but yesterday was a pivotal moment for markets.

US Equities

Breaking

US Household Debt Hits Record $18.6 Trillion As Student Loan Defaults Explode [Zerohedge]

Elon Musk Wins $1 Trillion Tesla Payday [NY Times]

Milei defies calls to float Argentine peso freely [FT]

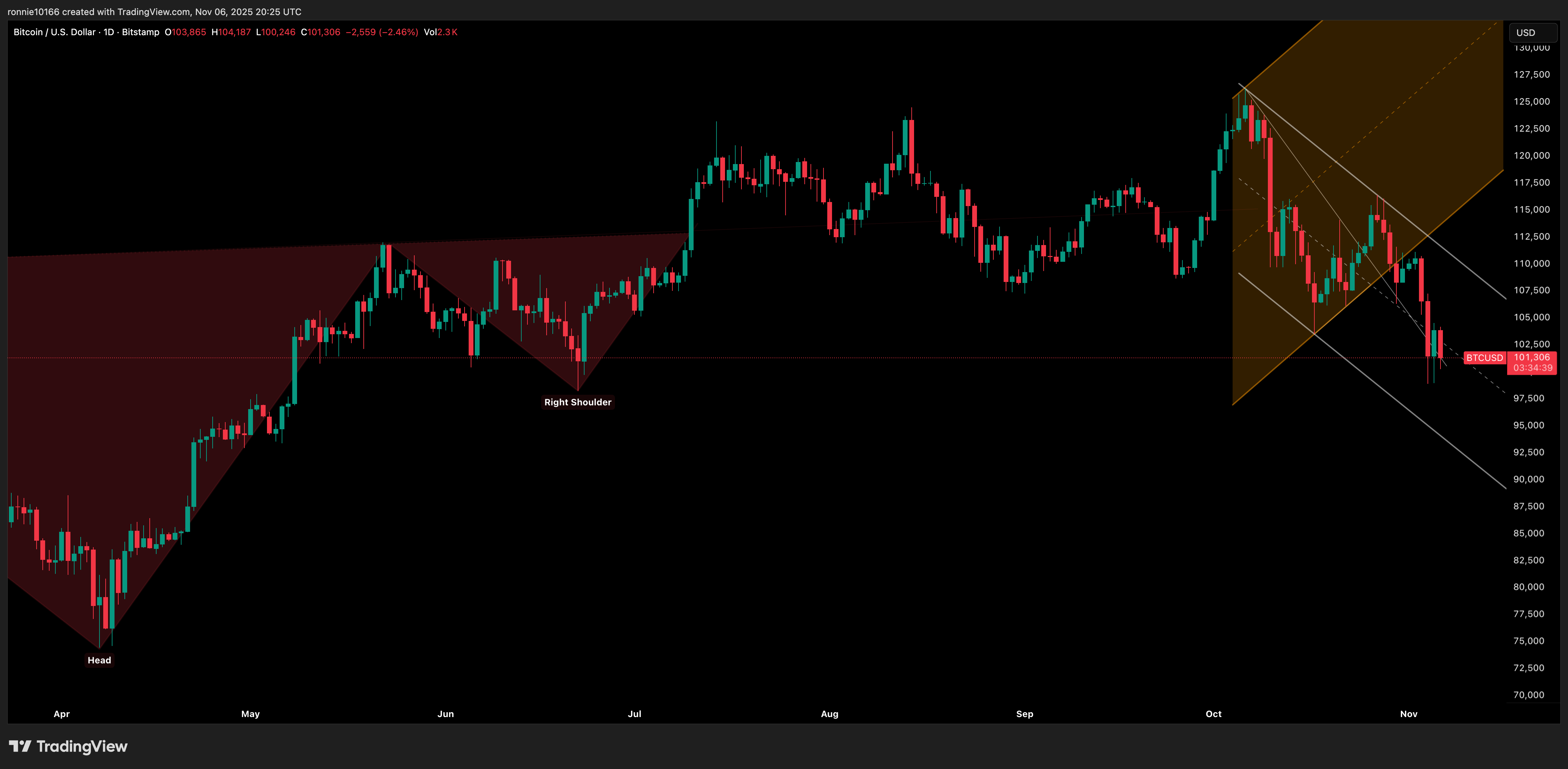

Bitcoin

An almost euphoric day yesterday as BTC bounced 1% after the 5% drop the previous day. If this was the bottom we’d expect as least another 2 attempts to get price below 100k, and that’s happening as we speak. Read more

Commodities

We hoped that yesterday would have given us a close in the channel but it didn’t. The momentum isn’t up therefore down is the only option. Read more

Foreign Exchange

Momentum has gone for now, and DXY lost a lot of ground yesterday after 5 up days. Up the stairs and down the elevator. The Ministry of Finance comments usually get markets to challenge them but it didn’t happen. Read more

Equities

The train never stops is about government printing money out of thin air. If OpenAI needs government support, they were testing the market, and Elon gets a $1T package, then clearly the value of money is disconnected from value. Read more

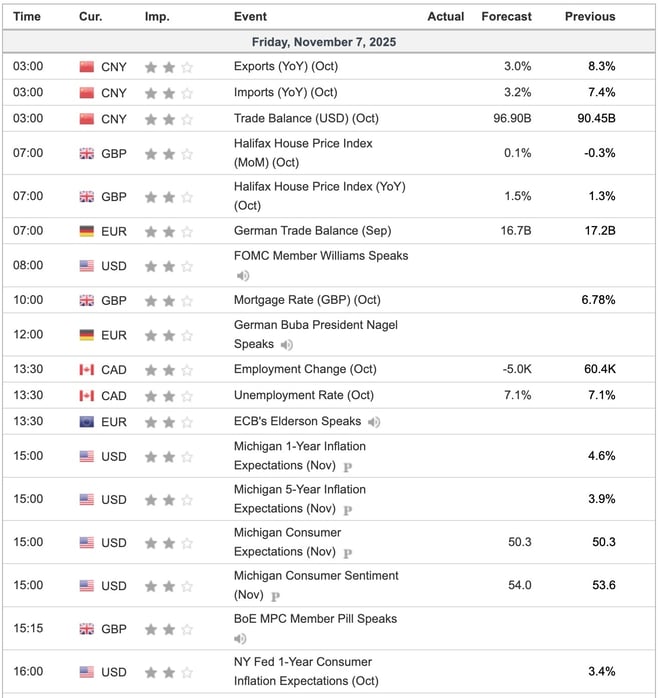

Economic Indicators Today

Ian Reynolds

Ian Reynolds

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(76).jpg)