Limit Up! 5 November 2025

Limit Up! --> Website | Substack | YouTube

Overnight

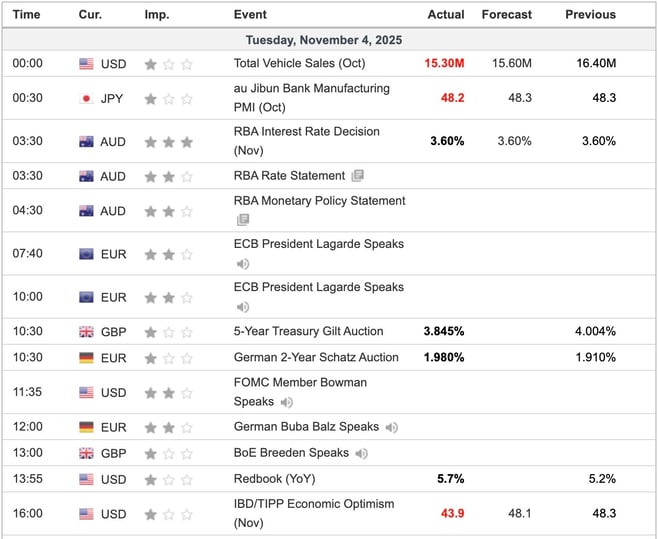

Economic Indicators Released Overnight

Economics totally in the background with only the RBA hold of any interest.

RBA holds official interest rate at 3.6% while warning of rising house prices and rents [The Guardian]

Statement by the Monetary Policy Board: Monetary Policy Decision [RBA]

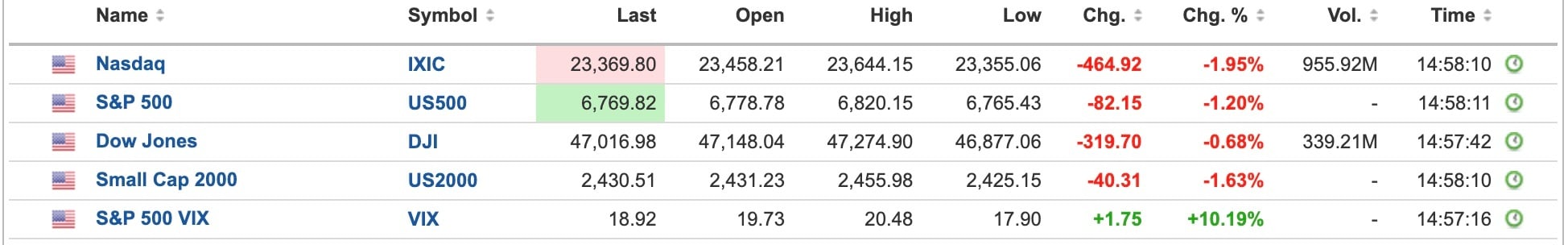

US Equities fell but it wasn't a rout. Yet.

Breaking

S&P 500 falls after Wall Street CEOs warn on valuations [investing.com]

Katayama Warns on Currency After Yen Hits Fresh 8-Month Low [Bloomberg]

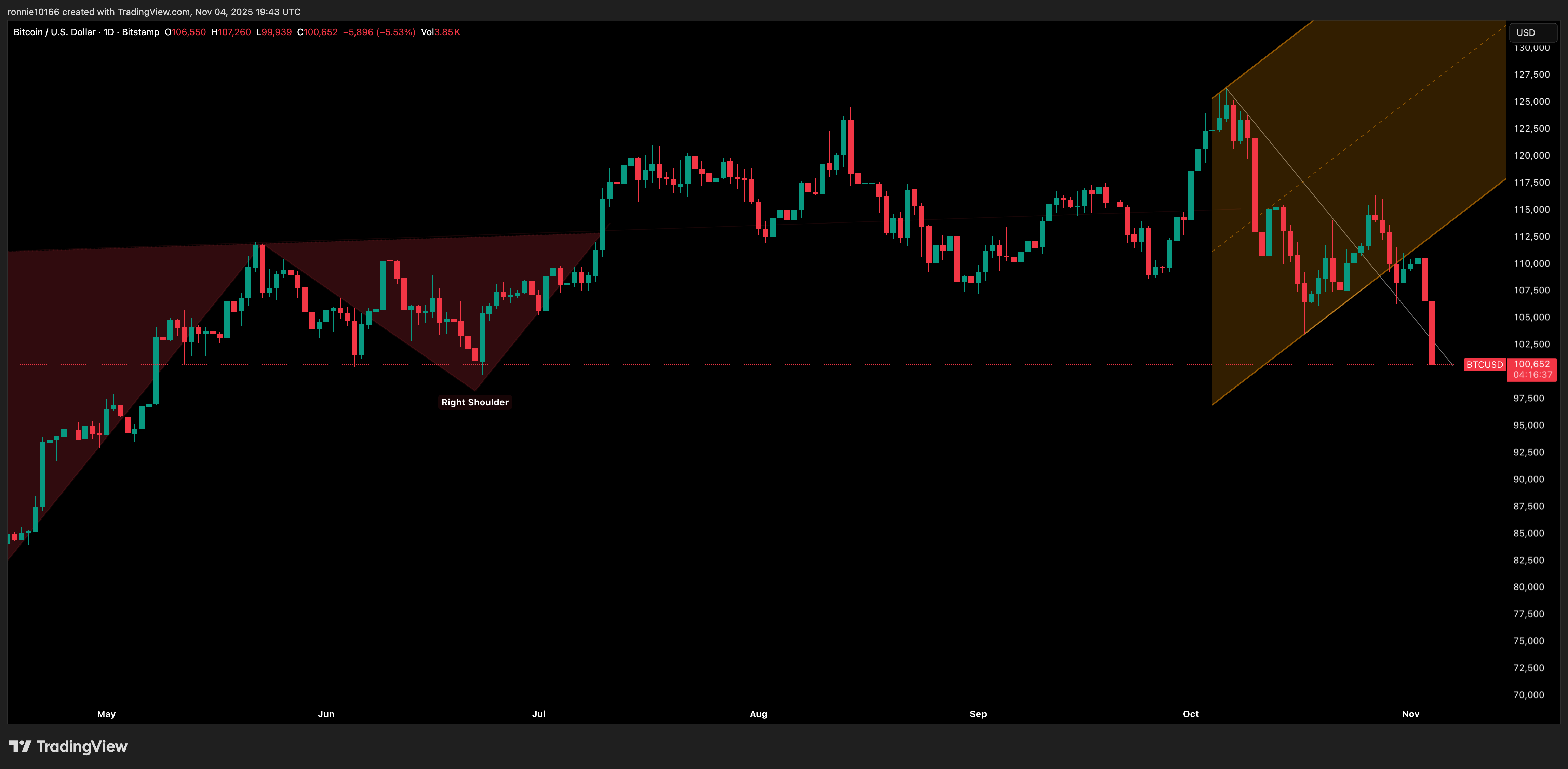

Bitcoin

Bitcoin leads global capital markets lower as credit markets and banking liquidity spook investors. The failed trend is a beautiful example of how price fails at key trend points. Look how price broke and then follows resistance up before collapsing. Read more

Commodities

Price breaks below another trend channel as market sentiment sours significantly. Let’s see where it closes today as a big snapback could happen if stock markets don’t keep going lower. Read more

Foreign Exchange

DXY continues to grind higher, now adding to the poor market sentiment. It’s at that first pivot point at 99.85 with more resistance at 101.50. If price confirms above 101.50, then we will be buying for a long-term trend taking DXY near 120.00. Read more

Equities

Sentiment has soured dramatically in the last few days as banks continue to use the FED’s Repo Facility, credit markets are breaking and the AI trade may have topped. That’s said, the fall wasn’t that big and we’d want price to confirm before reconsidering the trend higher. Read more

More on Substack

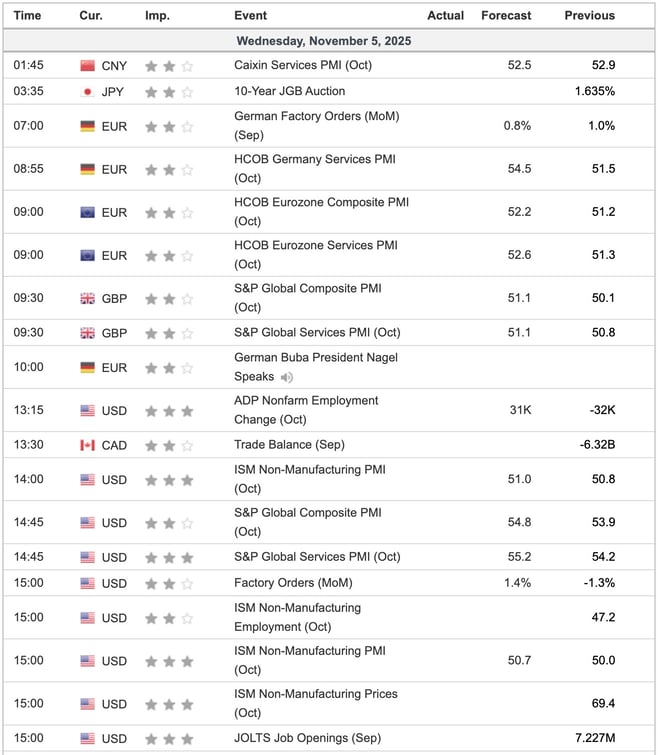

Economic Indicators Today

Ian Reynolds

Ian Reynolds

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(13).jpg)