Limit Up! 10 December 2025

Limit Up! --> Website | Substack | YouTube

Overnight

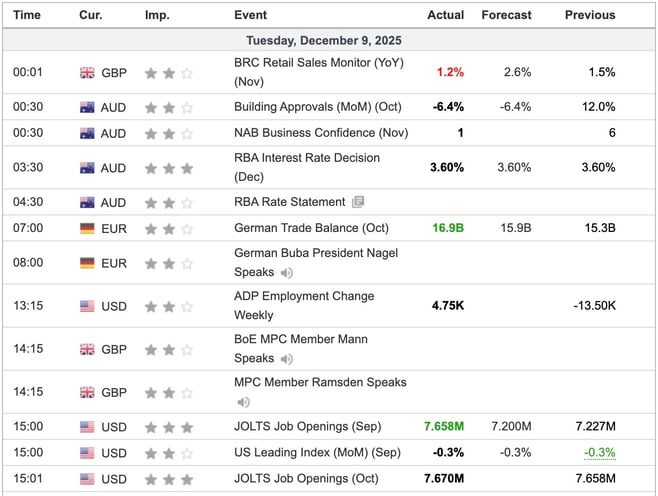

Economic Indicators Released Overnight

A big increase in job openings cements 25bps cut by the FED tonight but what about the presser? Never will a FED Chair's words be more scrutinised.

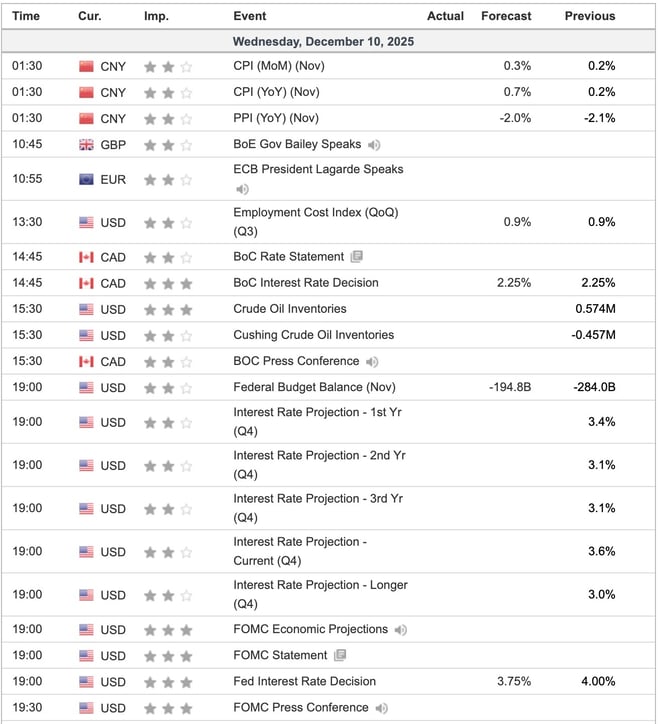

Everyone, including us, forgot that it's the Bank of Canada's monetary policy meeting today as well and their announcement will precede the FED's. Expect another cut and it'll be another policy error. It's US interest rates that need to go lower.

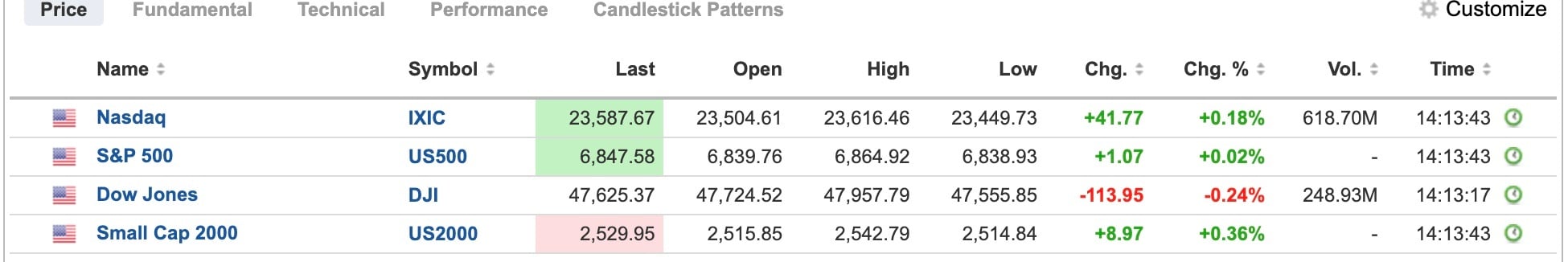

Markets had a good day with Silver spiking, BTC doing well and USD/YEN now the release valve for Japan.

US Equities

Breaking

Trump on brink as Europe plans 'nuclear option' if US sells out Ukraine [Express]

Macron Calls for ECB Monetary Policy Approach Rethink [Yahoo! Finance]

Bitcoin

BTC is headed to it’s date with destiny at 96.5k where it will meet the strong downtrend resistance, and then the pivot line at 99.00k. Read more

Commodities

Silver took out 60.00 and is now headed to trend resistance at 62.20. Price is not overbought on the daily but is on the weekly and monthly. Read more

Foreign Exchange

With 10 year yield approaching 2% and potential YCC or similar a possibility, the release valve has become the YEN. Price popped overnight with immediate target of 158.00 to 158.70, double top and trend resistance. Read more

Bonds

Yesterday’s RBA decision to hold rates steady was no surprise, but Michelle Bullock’s presser spoke of no conversations about rate cuts, rate cuts are off the table. She’s preparing the market for a hike in the new year unless inflation inexplicably disappears. Read more

Australia 2 Year Government Bond Yield Daily

Economic Indicators Today

Ian Reynolds

Ian Reynolds

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(17).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(57).jpg)