Limit Up! 4 December 2025

Limit Up! --> Website | Substack | YouTube

Overnight

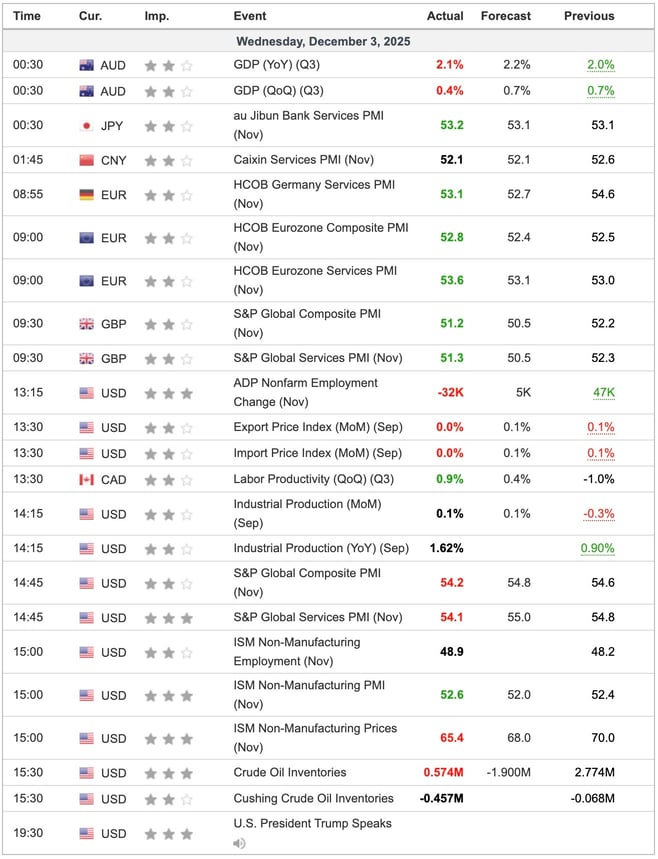

Economic Indicators Released Overnight

Australia's GDP was sufficiently high, along with much too high CPI, to make a rate hike a statistical probability on Tuesday. US ADP was negative and with October's Nonfarm Payroll cancelled, this is the number the FED will go with at the FOMC meeting on Wednesday. Added to zero import or export price increases (it's almost impossible for that to be so) and ISMs and PMI negative, the chances of a rate cut are tending to 100%. Markets are bullish but cautious. Silver reached another all time high, but the real mover was the USD, which apart from USD/YEN, moved lower.

US private employers shed 32,000 jobs in November [FT]

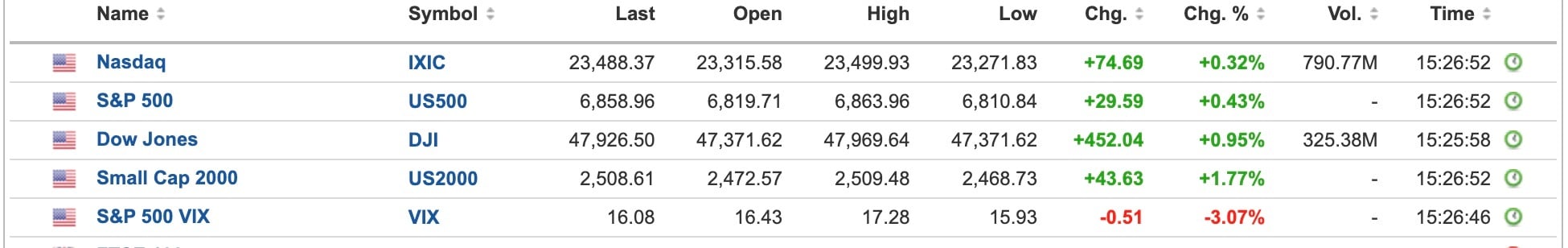

US Equities

Breaking

Bond investors warned US Treasury over picking Hassett as Fed chair [FT]

US retreat from its allies could hurt dollar's status, BoE's Mann says [Reuters]

Trump says he will nominate Fed chair in ‘early’ 2026 [FT]

The real reason inflation is high [Institute Public Affairs]. More than a quarter of all the Australian dollars in existence were created in the past five years.

Bitcoin

BTC had a good day yesterday but the wicks above are beginning to appear. Trend resistance is near at 94k, we nearly tagged it yesterday, and 99.5k higher up. Read more

Foreign Exchange

The double top at 100.00 is now pushing price to threaten support, firstly at 98.60, where price is now, and then down to 98.10 to 97.70. Read more

Equities

Last week’s good Thanksgiving bounce has run into strong resistance despite the lure of a US rate cut on Wednesday. Like Bitcoin we think that there could be an Xmas rally which will hit a lot of resistance, in this case around the all time highs. We’re nearly there. Read more

Bonds

The cash rate in Australia is 3.6%. Since the last cut on 12 August the 2 year yield has gone up 50bps, driven by significantly higher CPI. GDP came in yesterday at 2.1 YoY for Q3 which was strong enough to raise the question of a possible rate rise. Read more

Australia 2 Year Bond Yield Daily

Economic Indicators Today

Ian Reynolds

Ian Reynolds

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(82).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(17).jpg)

.jpg?width=352&name=11052025%20(1).jpg)