Limit Up! 3 December 2025

Limit Up! --> Website | Substack | YouTube

Overnight

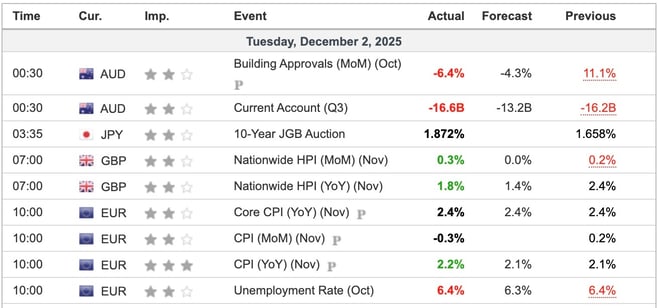

Economic Indicators Released Overnight

EU CPI came in slightly higher than expected but nothing to worry about.

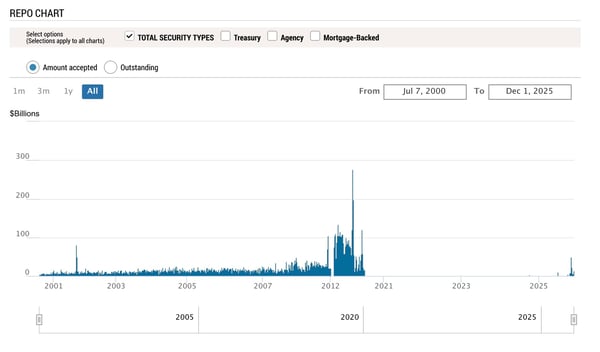

Better to worry about the FED's Standing Repo Facility. We ignored the end of October higher short rates and increased Repo usage. However it does now appear to be becoming a consistent feature.

So the doomers will have been disappointed by the Japanese auction and also by equities bouncing back.

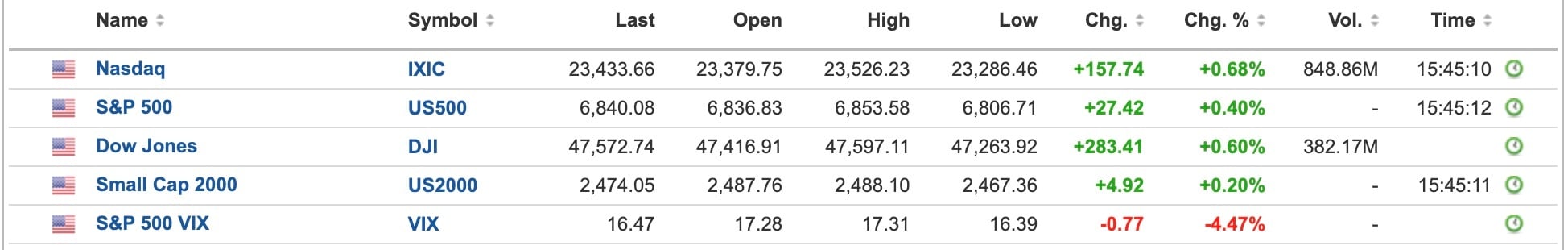

US Equities

Breaking

Did A German Court Just Shatter One Of The Biden Era's Biggest Lies [Zerohedge]

Bitcoin

Back to 91k as 2 months of FUD starts to subside. At 126k it seemed very different. “Price will never go below 100k again” was said so many times. So what’s changed? Read more

Commodities

What looked like a down day yesterday turned into a positive day as price heads to the inevitable $62.00 at trend resistance. Read more

Equities

The Dow Jones cuts out all the noise and shows us what’s going on with US equites. Read more

DOW JONES INDUSTRIAL AVERAGE Daily

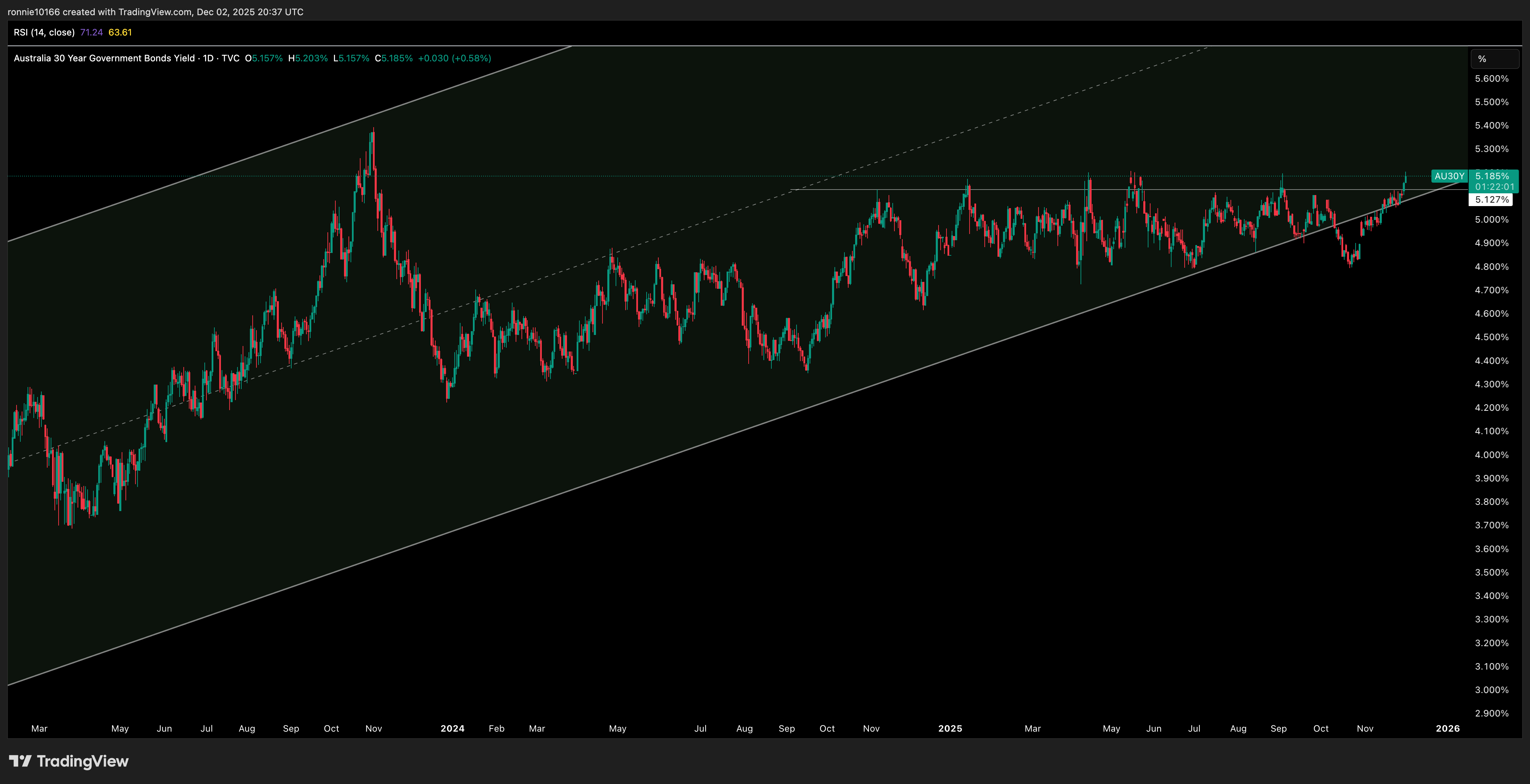

Bonds

Aussie rates are pushing up. The high in the 30 year since COVID is 5.40% as above. Now is the fifth effort to push above 5.20%. The backdrop isn’t good. Inflation way higher than target is pushing the RBA to reassess their model. That really is flying blind. Read more

Australia 30 Year Government Bond Yield Daily

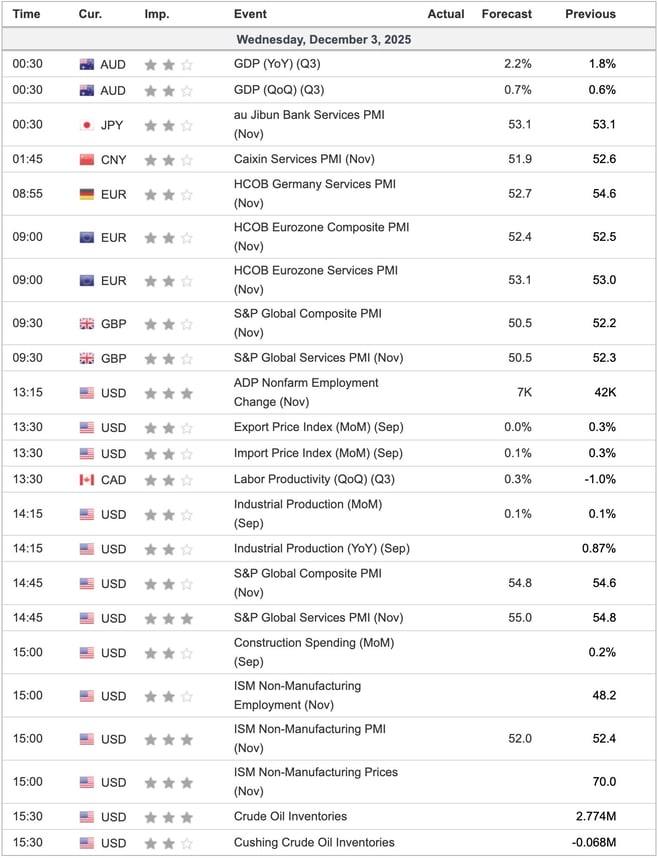

Economic Indicators Today

Ian Reynolds

Ian Reynolds