Limit Up! 16th July 2025

Podcasts | Daily LinkedIn | Weekly LinkedIn | Check out the website

Overnight

China GDP June 2025

Markets looking at China again

-

Q2 2025 GDP grew 5.2% YoY (vs. 5.4% in Q1; forecast ~5.1%)

-

QoQ growth was +1.1%, beating +0.9% estimates

-

Industrial output surged (+6.8%), led by high-tech manufacturing

-

Exports strong, helping offset external trade headwinds

-

Retail sales weak (+4.8%), and property investment sharply down

US, Canada CPI June 2025

What looks like a pretty consensus CPI report, hit market sentiment. The headline YoY was the key as 2.4% rose to 2.7% with energy prices and base effects contributing to the rise.

US inflation reaches 2.7% as Trump tariffs hit [FT]

The lack of inflation progress added to the long end bond sell-off and everything fell apart from the NASDAQ.

The first crypto bill failed to pass through the House, adding to the gloomy sentiment.

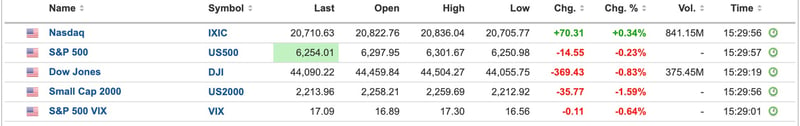

US Equities

Breaking

Bitcoin

BTC crashed through the daily Bollinger Bands but finds support at yesterday's resistance on the weekly chart.

Commodities

Silver and Gold pull back even though markets go risk off.

Bonds

Bond yields rise globally led by the benchmark US 10 year, clearly bouncing from long term support. Above 4.65% alarms, and stops, will be going off.

US 10 Year Government Bond Yield Daily

Foreign Exchange

DXY spikes finally. Above 98.95 will be interesting for all markets.

Equities

Tesla regains the trend as equity markets narrow with the NASDAQ being the only index winner today.

TESLA Daily

Interesting

Agencies Issue Joint Statement on Risk-Management Considerations For Crypto-Asset Safekeeping [OCC]

A stronger partnership - that’s our response to changing trade relationships, economic volatility and threats to our security. We’ll keep working closely together as we deliver on a new partnership.

Prime Minister Carney speaks with President of the European Commission Ursula von der Leyen [Yahoo! Finance

Economic Indicators Today

Ian Reynolds

Ian Reynolds

.jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(32).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(56).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(55).jpg)