Intense Scrutiny

Podcasts | Daily LinkedIn | Weekly LinkedIn | Bitcoin for Business

Overnight

The event we have been watching for years, and for once, a surprise. Markets having at one stage priced in 3 cuts before the end of the year, then back to 2 then 1 as Powell keeps telling us he's happy with rates where they are. And now he's hinting that he is going to cut.

Isn't he? If he is, why is he?

Federal Reserve Chair Jerome Powell delivered his final Jackson Hole speech on August 22, 2025, at the Kansas City Fed’s annual economic symposium, titled “Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy.” Here’s a summary of the key points:

- Economic Outlook and Monetary Policy: Powell highlighted the U.S. economy’s resilience amid significant policy changes. The labour market remains near maximum employment, with the unemployment rate at 4.3%, still low historically but up from early 2023. Inflation has declined significantly from post-pandemic highs but remains above the Fed’s 2% target, with consumer prices at 2.7% and core prices at 3.1% in July 2025. He noted a “shifting balance of risks,” with rising concerns about employment weakening, suggesting conditions “may warrant” interest rate cuts, potentially starting at the September 2025 FOMC meeting. However, he emphasised a cautious, data-dependent approach, avoiding a firm commitment to rate cuts due to uncertainties like tariffs’ impact on inflation.

- Monetary Policy Framework Review: Powell announced updates to the Fed’s monetary policy framework, revised every five years. The 2020 framework, which introduced flexible average inflation targeting to tolerate higher inflation after periods of low inflation, was reconsidered. Powell indicated a retreat from this approach due to the 2021–2022 inflation surge, emphasising a return to preemptive action to control inflation while still supporting employment. The revised framework aims to better handle volatile inflation and supply shocks, enhancing communication about forecasts and uncertainties, including potential changes to the Summary of Economic Projections’ “dot plot.”

- Labor Market and Inflation Balance: Powell stressed the Fed’s dual mandate of stable prices and maximum employment, noting the labour market has cooled from its overheated state in 2022. Job vacancies have normalised, and unemployment rises are driven by slower hiring rather than layoffs. He expressed concern about further labour market cooling, prioritising its stability while acknowledging tariffs’ visible but potentially short-lived inflationary effects.

- Political Context and Fed Independence: The speech occurred amid significant political pressure from the Trump administration, including calls for rate cuts and attacks on Fed officials like Governor Lisa Cook. Powell reiterated the Fed’s commitment to data-driven decisions, unaffected by political demands, to maintain its independence.

US Equities

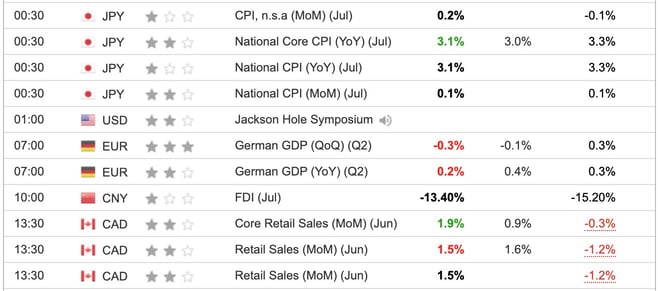

- Japanese inflation continues to tick lower

- Shock German GDP as collapse of Industrial Production leads to recession

- Surprisingly high Canadian Retail Sales and across all sectors

Economic Indicators Released Overnight

Breaking

Xi Warns Unpaid Bills to Companies Could Damage Trust in Beijing [Bloomberg]

US to take 10% equity stake in Intel, in Trump's latest corporate move [Reuters]

From $50 billion to bust, investors count cost of Evergrande's market tryst [Reuters]

Intense Scrutiny

After a year of intense scrutiny, Powell delivered his final Jackson Hole address. Normally a complete non-event, this year there is more than just the hint at rate cuts.

It's not just Powell under scrutiny. The whole board is under scrutiny.

On 8th August, Adriana D. Kugler suddenly quit. Now Federal Reserve Governor Lisa Cook is the latest figure targeted by the Trump administration over claims of mortgage fraud.

When the last interest rate decision was made, Fed Vice Chair for Supervision Michelle Bowman and Governor Christopher Waller both voted against the decision to leave the benchmark interest rate unchanged, favouring instead a quarter-percentage-point reduction to guard against further weakening of the job market. This was the first time the whole board hadn't agreed the decision since 1993

Non-voting members were also getting into the action

Cleveland Fed President Beth Hammack: Divisions Grow Inside Fed Ahead of Decision on September Rate Cut [Wall St Journal]

Ex FED members also: Bullard says Fed can cut rates 100 bps into 2026, expects September cut [investing.com]

As the US Treasury thrashes around trying to raise revenue, doing OK with tariffs but a drop in the ocean, but failing abysmally in trying to cut costs, the urgency to cut rates to save on interest payments, is becoming all-consuming. A Gold revaluation is becoming more likely with co-opting stablecoins (not even in the dictionary yet) to support US treasuries still a pipe dream.

Something has to give and it could be the FED. Could this be the end of it's chequered history.

It's up to the following academics to get their ship in order and lead by example. The markets could make this very ugly if the FED loses investors' trust.

The FOMC consists of 12 voting members: seven Federal Reserve Board Governors, the New York Fed President, and four rotating regional Fed Bank Presidents. The regional presidents rotate annually, with the 2025 voting members confirmed as New York, Chicago, Boston, St. Louis, and Kansas City, per the Federal Reserve’s rotation schedule.

- Jerome Powell (Chair)

- Appointed By: Donald Trump (2018, reappointed 2022)

- Political Allegiance: Registered Republican, but viewed as politically independent.

- Hawk/Dove: Moderate/Centrist. Powell balances the Fed’s dual mandate (inflation control and employment). His Jackson Hole 2025 speech signalled openness to rate cuts, leaning slightly dovish.

- Christopher Waller

- Appointed By: Donald Trump (2020)

- Political Allegiance: Republican-leaning, former St. Louis Fed economist.

- Hawk/Dove: Hawkish. Supports tighter policy to control inflation but dissented in July 2025 for lower rates, showing some flexibility.

- Michelle Bowman

- Appointed By: Donald Trump (2018)

- Political Allegiance: Republican-leaning, banking background.

- Hawk/Dove: Hawkish. Dissented with Waller in July 2025, citing growth risks over premature rate cuts.

- Lisa Cook

- Appointed By: Joe Biden (2022)

- Political Allegiance: Democratic-leaning, academic economist.

- Hawk/Dove: Dovish. Prioritizes labor market strength, likely favoring lower rates.

- Adriana Kugler

- Appointed By: Joe Biden (2023)

- Political Allegiance: Democratic-leaning, labor economist.

- Hawk/Dove: Dovish. Focuses on employment, supporting accommodative policy.

- Philip Jefferson (Vice Chair)

- Appointed By: Joe Biden (2022)

- Political Allegiance: Democratic-leaning, academic background.

- Hawk/Dove: Dovish. Emphasises employment over strict inflation control.

- Michael Barr (Vice Chair for Supervision)

- Appointed By: Joe Biden (2022)

- Political Allegiance: Democratic-leaning, regulatory expertise.

- Hawk/Dove: Neutral. Balances inflation and employment but leans data-driven without strong hawk/dove bias.

- John Williams

- Appointed By: New York Fed Board of Directors (2018), approved by Board of Governors.

- Political Allegiance: Nonpartisan, career Fed economist.

- Hawk/Dove: Neutral. Data-driven, aligns with Powell’s cautious approach to rate changes.

- Austan Goolsbee (Chicago Fed)

- Appointed By: Chicago Fed Board (2022)

- Political Allegiance: Democratic-leaning, former Obama advisor.

- Hawk/Dove: Dovish. Strongly supports employment-focused policies and rate cuts.

- Susan Collins (Boston Fed)

- Appointed By: Boston Fed Board (2022)

- Political Allegiance: Nonpartisan, academic economist.

- Hawk/Dove: Slightly Dovish. Emphasizes price stability but notes labor market resilience, suggesting openness to looser policy.

- Alberto Musalem (St. Louis Fed)

- Appointed By: St. Louis Fed Board (2024)

- Political Allegiance: Nonpartisan, finance background.

- Hawk/Dove: Slightly Hawkish. Believes inflation risks outweigh labor market concerns, favoring cautious rate adjustments.

- Jeffrey Schmid (Kansas City Fed)

- Appointed By: Kansas City Fed Board (2023)

- Political Allegiance: Nonpartisan, banking and Fed experience.

- Hawk/Dove: Hawkish. Prefers holding rates steady to assess tariff impacts and inflation, avoiding large policy shifts.

Precious Metals / Commodities

We were expecting to break the wedge with Powell's speech but it's still going. 22nd September is where the lines converge.

What's not to like about the monthly Silver chart. Candles will be getting longer soon.

Beautiful bear flag forming in oil. Looking for a big move down as bigger than expected US interest rate cuts cause concern about it's economy.

SPOT BRENT Daily

Bitcoin (& Crypto)

BTC showing the way. A decent bounce but what was Powell really telling us?

CRE / Banks / CLOs

|

|

|

We're getting into the big haircuts now, and it's starting to hit mainstream news. Along with credit card defaults, car loans, student debts that have been ignored by markets, they will have their day soon.

United States

US Economic Indicators

Remarkably clear week of US data, all eyes on Powell with everyone, even some of the FOMC, disagreeing with him.

Treasuries rallied but not enough, given the signal. What happens when they do cut?

USD though , via DXY, broke and closed lower. We're right at 15 year support again.

China

China Economic Indicators

Not much here either, data or interest rate cuts.

Long end rates ticking up as the PBoC doesn't think short end needs cutting. Dangerous game to play. They don't want their currency appreciating just about now.

China 10 Year Government Bond Yield Daily

Japan

Japan Economic Indicators

Across the many measures of inflation, CPI going lower despite BoJ and MoF narrative that it's too high. Terrible trade numbers highlight how fragile the economy is. One day this week not a single JGB was traded. And that shows in the charts. 10 year rates trending higher.

Japan 10 Year Government Bond Yield Daily

Europe

EU Economic Indicators

German GDP lurches lower. The last interest rate cut raised 10 year rates 25bps. ECB will only cut again if FED does.

Germany 10 Year Government Bond Yield Daily

United Kingdom

UK Economic Indicators

As Bank of England predicted CPI rising towards 4% but they're cutting anyway. Markets already nervous about Reeves' ability to fund the country, let's hope The Old Lady doesn't lose it's credibility as well.

Even I'm surprised how the inverse heads and shoulders, that I added a week ago, is coming along.

Canada

Canada Economic Indicators

Inflation steady but still too high. Now strong retail sales defying narrative of housing crash. Trump/Carney are cooking up a deal. Let's see where that pushes price.

Canada to Drop Many Counter-Tariffs in Olive Branch to Trump [Bloomberg]

Air Canada to resume flights after pay deal struck with union [BBC]

Time for a Fib. Triple bottom and blow off top give us pretty good Fib levels to play with.

Australia

Australia Economic Indicators

All the talk in Australia is about the extreme amount of tax locals have to pay. Tax on tax on tax. Weak government and very low productivity, unaffordable housing and union activity. All adds up to 25 million (and counting) unhappy citizens. And did I mention highest immigration rate per capita?

Aussie heading back to the scene of the crime and that 15 year resistance still casting it's shadow.

AUD/USD Daily

Labor’s spending made RBA’s job harder: Lowe [AFR]

RBA forecast misses explain its data dependence [AFR]

Red tape ‘hairballs’ choking economic growth: Productivity tsar [AFR]

NZ’s house price crash - could it happen here? [News.com.au]

Chalmers flags super tax raid to fix ‘unfair’ system [AFR]

What's Next?

USD-CAD revision to trade deal in the pipe and monthly Core PCE in the US will be in focus.

When markets digest Powell's speech, the conclusion may not be about rate cuts, rather it could be about political appeasement.

Watch Bitcoin for direction and how that plays out in US equities.

This Week's Important Economic Indicators [London time]

![This Week's Important Economic Indicators [London time]](https://vip.suberia.capital/hs-fs/hubfs/24082025/indicators.jpg?width=658&height=480&name=indicators.jpg)

Ian Reynolds

Ian Reynolds

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(13).jpg)