Clarity

Recent Market Moves in Retrospect

Last week was a quiet week with few important economic releases, and also Thanksgiving in US. Let's use the market insanity downtime to focus on how we went from almost into the abyss to the best Goldilocks situation possible.

In retrospect there were only a few important points

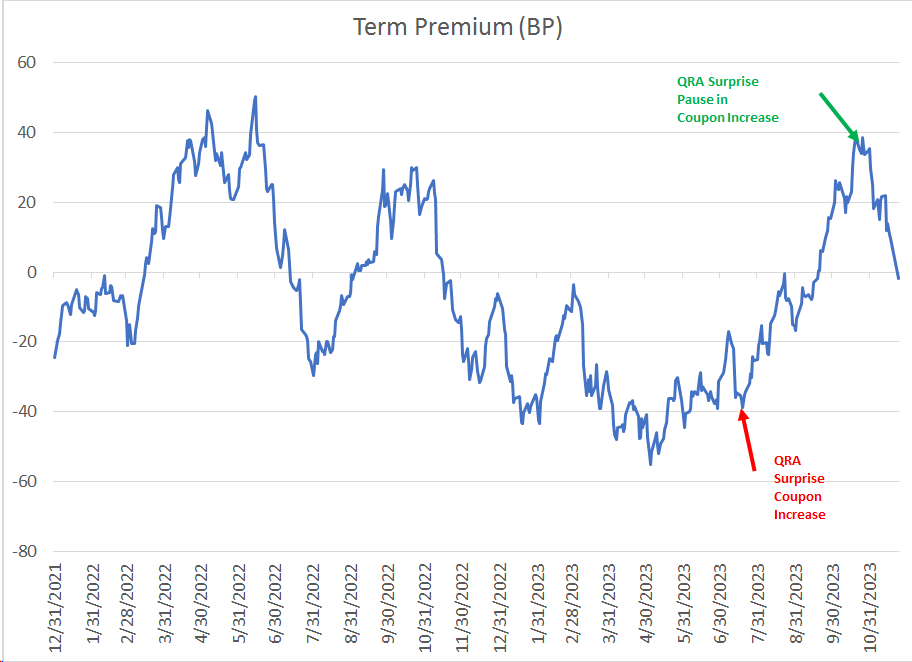

- Bond market in a big sell off

- US Treasury plans big auction of coupons ( long dated bonds )

- FED holds rates but Powell gives strangely dovish presser

- Primary Dealers advise Treasury it's going to be a bloodbath

- Treasury cancels coupons auction

- Powell walks back presser, back to higher for longer as usual

All markets caught short and produces insane rally in bonds and stocks. Simultaneously !!

Andy Constan on X "Honestly I don't understand how anyone can miss the clear signal. Instead those who did miss it are late to bring up net liquidity. Even worse is the takes that explain the bond rally in conflict with the stock rally or visa versa. It was the QRA folks."

Yes the big drop in the reverse repo had everyone following a red herring. And a drop in the reverse repo doesn't equal the FED adding liquidity, it's less liquidity to have to mop up.

We're all going to have to become US Treasury results experts.

Despite the noise it's still all about US Debt, and issuance of even more debt.

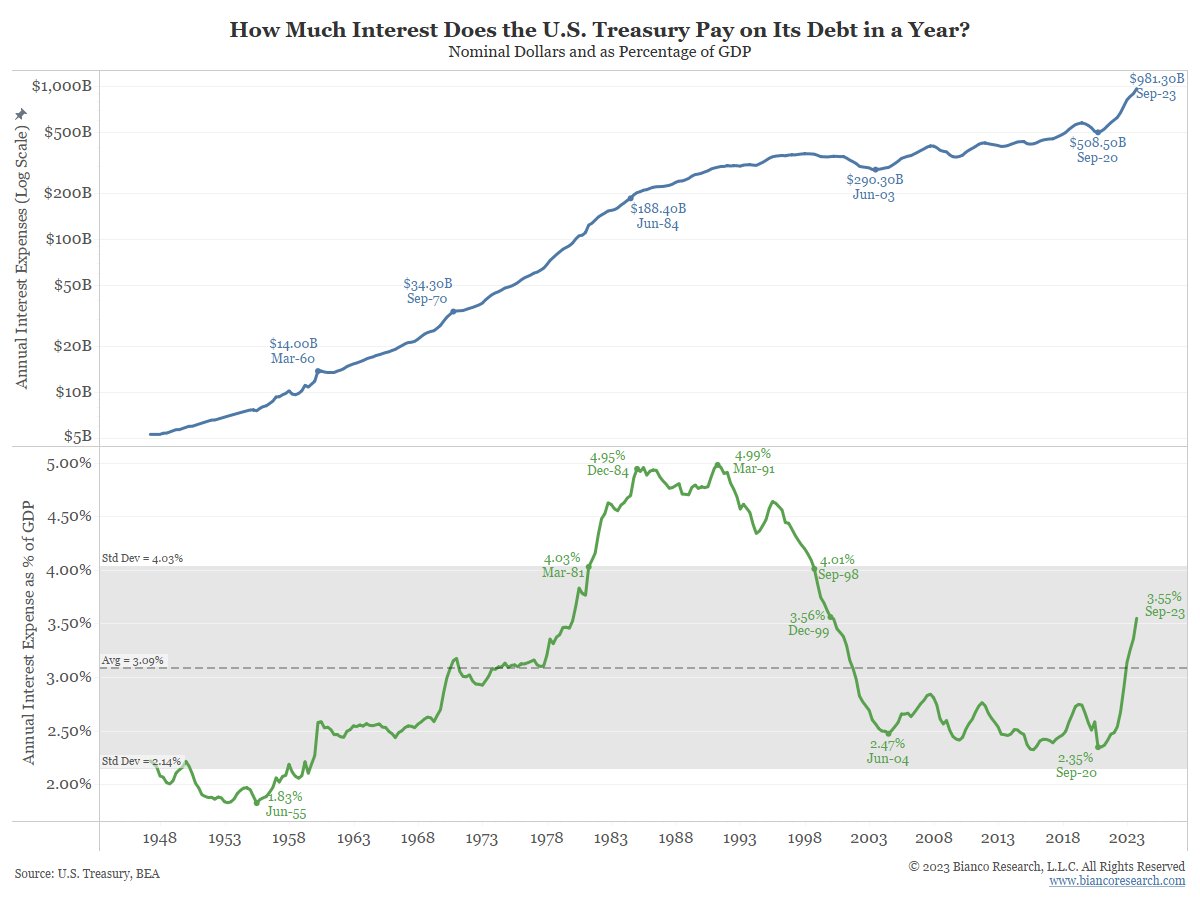

Talking about US debt here's Jim Bianco, also on X and this is really interesting

This makes a lot of sense. For all the talk of debt interest as percentage of GDP, it's clear that the US Government thinks it can still get away with the situation, and if Jim's correct, borrow their way out of it.

It's a risky strategy but possibly the only strategy they have. Powell and the Primary Dealers have made this clear to them.

The Sam Altman / OpenAI Board saga is entertaining a whole load of people, especially the end-of-the-world algorithm.

AI is creating a lot of froth in tech stocks, which are the only stocks holding up US stock markets. To a huge extent.

New technologies cause massive booms and busts. Currently not one AI company can charge for it's service.

Beware the inevitable crash - not saying it won't rise again though.

US Initial Jobless Claims came in unexpectedly low.

While the University of Michigan survey suggests inflation expectations in the US becoming entrenched.

In The Background

China

WHO statement on reported clusters of respiratory illness in children in northern China [WHO]

Whilst all this frenzy is happening, Gold and Silver seems ready to break out, Gold to all time highs. Bitcoin is still in play with the ETF and Halving in the immediate focus.

Gold looking to break to all time highs.

Silver on verge of breakout and big move higher

Bitcoin resilient in the face of the Binance takedown.

In Case You Missed It

Argentina's Milei says shutting central bank 'non-negotiable' [Reuters]

YoY German PPI craters

Japan CPI ticked lower

Germany still in recession.

Australia

The Economist last week found Australia had the most entrenched inflation of 10 large advanced economies. “In Australia, our worst performer, the labour market is on fire,” it wrote.

Nowhere is the divide between fiscal and monetary policy so obvious as in Australia

It's a bad look

Anthony Albanese insists inflation is a global phenomenon, RBA boss saying it's homegrown [ABC]

Australia’s inflation problem is ‘homegrown’, Bullock warns [AFR]

(However ) “a more substantial monetary policy tightening is the right response to inflation that results from aggregate demand exceeding the economy’s potential to meet that demand.”

Michele Bullock has warned 4 per cent wage rises cannot be sustained without higher productivity, as the central bank flags the possibility of another rate rise.

Iron ore hits nine-month high on new China stimulus [AFR]

This Week's Important Economic Indicators [London time]

![This Week's Important Economic Indicators [London time]](https://vip.suberia.capital/hs-fs/hubfs/image-png-Nov-25-2023-05-24-09-9865-AM.png?width=1328&height=1190&name=image-png-Nov-25-2023-05-24-09-9865-AM.png)

Ian Reynolds

Ian Reynolds