Date With Destiny

Links

Daily LinkedIn | Weekly LinkedIn | Next event | Check out the website

Europe

The EU's time is up. They have done really well to weather misaligned fiscal and monetary policy, unelected leadership, the Greece crisis, numerous banking crises, Brexit, the Ukraine war and much more.

But they're out of time and now, friends.

No more support from the US or UK, the economic wrecks of former powerhouse Germany and the perennially weak France dragging them down and now politcal change splitting the union apart.

But their biggest problem is upon them right now

If Trump and Putin agree that war is over, what does the EU do? Declare war on Russia themselves? Continue to support Ukraine defending itself? Both seem unlikely as making a decision seems to be stuck at the 3rd sub-committee meeting. That's Mario Draghi saying that, and he should know.

How they're rueing their attitude to Brexit.

ECB Posts Record Loss Driven by Interest Bill for Past Policies

Italy’s Giorgia Meloni torn between supporting Ukraine and pleasing Donald Trump [FT]

Far-right AfD party wants Germany to leave the EU [DW]

Overnight

U.S. Michigan Consumer Expectations February 2025

Markets ended the week with a big sell off triggered by

- Michigan Survey adding to the narrative of the US consumer hitting the wall

- Chinese team finds new bat coronavirus that could infect humans via same route as Covid-19 [ South China Morning Post]

- Hackers steal more than $2b from crypto exchange Bybit [AFR]

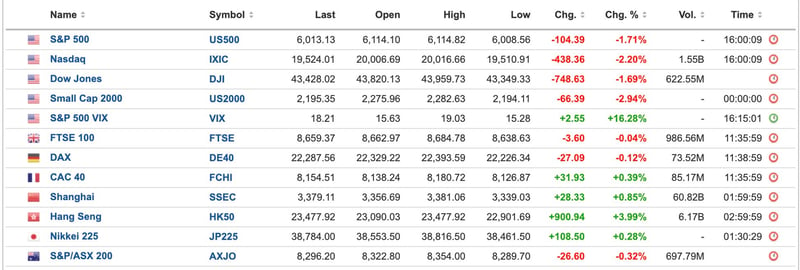

World Equities

Breaking

Bessent to Skip G-20 Finance Chiefs Gathering in South Africa [Bloomberg]

BRICS still discussing alternative payment platforms — Lavrov [Tass]

Gold

Everyone is talking about Gold for the first time in living memory and as that's the case, a big change in the global financial system is underway. Traders are calling for a retracement or at least a consolidation but looking at the monthly chart, it's difficult to get off the gravy train.

Gold / USD Monthly

Here's a great LinkedIn Post by Clive Thompson about a possible revaluation by the USD Treasury at a price that is top of the channel in March i.e. one of the few realistic proposals.

Bitcoin (& Crypto)

Still rangebound and expecting a big move when it breaks.

CRE / Banks / CLOs

|

|

|

The CRE crisis moves from valuation events to disposals.

United States

Markets are nervous that the US economy is on the brink. And there is a lot happening at government level to address structural trade deficits. But is the economy too compromised by the reckless spending of the Biden Administration.

The problem now that cutting the insane amount of government fraud and waste, although excellent, is also cutting GDP. And they need GDP growth to start inflating away the debt.

Trump (and Reagan before him) planning to slash corporation tax is easy to say, but the last thing they need is less income.

Corporate America is now over the Trump euphoria (lack of Biden euphoria) and definitely more cautious than even a month ago. Only Corporate America can save America now.

Treasuries Rise as Fed Minutes Reveal Discussion of Pausing Balance-Sheet Runoff [Bloomberg]

Trump loyalist Kash Patel confirmed as FBI director by the Senate [ABC]

Canada

Like the UK, retail sales and inflation higher.

Canada, of course, is waiting for tariff announcements but will they just bow to Trump?

This could be one of the last updates for the 51st state ?

China

Rates unchanged but house prices still falling rapidly, but at least some of those real estate developers have been wound up finally. Hanging on, hoping it will get better is never a good strategy and I think we'll now see a whole load of zombie companies disappear and the local government and banking systems restructured and refloated.

The Hang Seng seems to have got the message;

Hang Seng Daily

China’s Liquidity Crunch Extends Even as PBOC Injects Cash [Bloomberg]

Japan

Japan National Core CPI YoY January 2025

Japan has gone from inflation and rates too low to inflation and rates too high ! And now Ueda threatening yield curve control if rates spike!

This is a real demonstration of how Japan has lost control of it's own currency and capital markets. With the rest of the world in turmoil, this may pass unnoticed for now but I suspect that the day of reckoning (hyperinflation) is almost at hand.

BOJ chief signals readiness to increase bond buying if yield jumps [Reuters]

USD / YEN is back in play on the monthly chart and a potential head and shoulders top being formed within the uptrend channel. It's still got a lot of work to do to get the right shoulder at 144.00 but it could result in a move to 120.00.

USD / YEN Monthly

United Kingdom

Strong retails sales and employment reports but excessive wage inflation puts the UK in the best position in Europe. A disappointment that the budget surplus was less than expected but tax hikes for the rich never ends up with more tax revenue. I don't know how governments can keep rolling out this nonsense. The UK did exactly this in the 1970s and the rich (rock stars) went to live in France.

Australia

Australia Unemployment Rate January 2025

A good week economically for Australia as the RBA cut rates 25bps, a positive employment report and wage inflation under control.

But like the rest of the western world, weak leadership and a looming election casts doubts on the future.

And Australia's defence badly found out as China staged wargames 150 miles off Sydney.

Map Shows How China Staged Unprecedented War Games on Doorstep of US Allies [Newsweek]

Larry Fink says 30-year fixed rate mortgages could change Australia [AFR]

RBA’s Hauser Says Rate Pause Would Have Seen CPI Undershoot [Bloomberg]

What's Next ?

- Audit of Fort Knox

- End of Ukraine / Russia war

- US PCE data

Money printing is just around the corner with Canada and Japan talking about it already.

This Week's Important Economic Indicators [London time]

![This Week's Important Economic Indicators [London time]](https://vip.suberia.capital/hs-fs/hubfs/23022025/indicators.jpg?width=593&height=499&name=indicators.jpg)

Ian Reynolds

Ian Reynolds