Gold Frenzy

Limit Up! --> Website | Substack | YouTube

Overnight

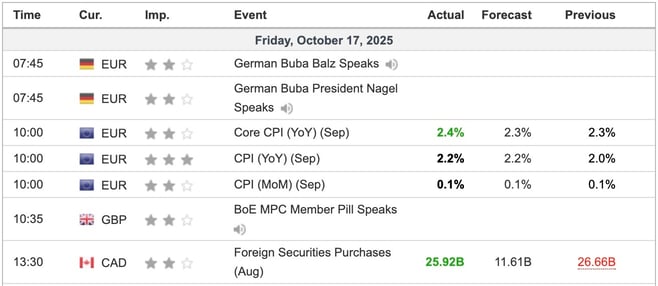

Economic Indicators Released Friday

Caution for the ECB as inflation ticks up again. Markets didn't care of course as everyone was watching the parabolic rise in Gold and Silver. That ended with a trainwreck close.

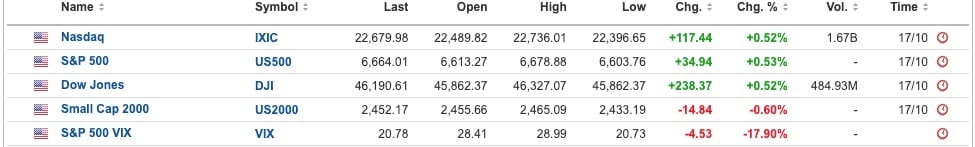

Equities did their usual bounce.

Breaking

Wall Street banks regain ground after global rout on credit worries [Reuters]

Moody’s says the banking system, private credit markets are sound despite worries over bad loans [CNBC]

Precious Metals / Commodities

The Gold frenzy hit a brick wall on Friday evening, price having got up to 4,380 at one stage. A consolidation, maybe for many months, is needed here as price is way ahead of itself. Read more

Whereas Gold price acceleration has slowed, Silver in is reverse, with a very ugly close on Friday. Not much follow through this morning but no relentless buying. Read more

With no US data and the entire world talking about Silver leasing rates, Spot Brent was pretty quiet. Having said that, the backdrop of credit market problems, regional US banks in trouble, CRE haircuts should have kept the markets trending downwards. Read more

Bitcoin (& Crypto)

A good break from the FUD but a lot of work to do on the upside. Trend resistance 110.1k, pivot tops at 115.8k and 117.9k all need to be conquered, along with consolidation above the minor downtrend at 115.8k. Read more

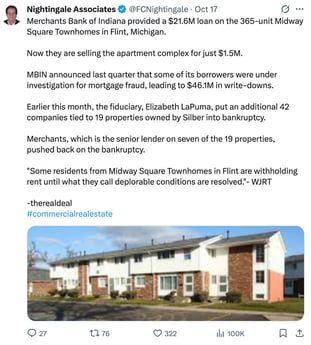

CRE / Autos / Banks / Private Equity

|

|

|

Doom and gloom abounds as credit markets start to crack, with auto loans being the focus. Moodys telling us everything was OK was just what we needed to confirm that everything wasn't, in fact, OK.

United States

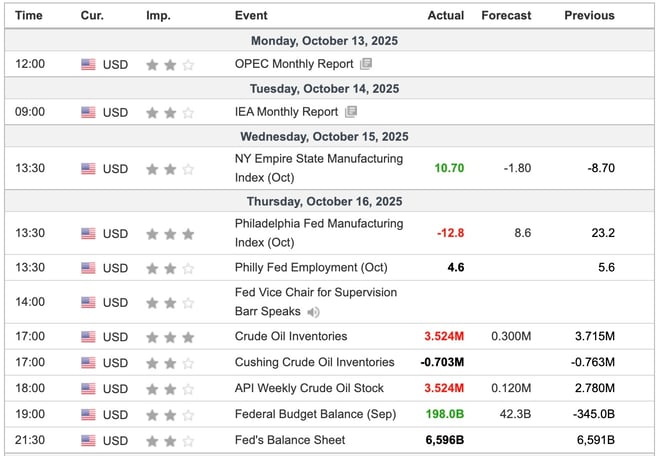

US Economic Indicators

Nothing to talk about data-wise of course but 10 year rates continued to drop as everyone is now expecting multiple rate cuts this year.

Chart shows price currently in a bull flag but that could be negated if yield drops to 3.60%.

US 10 Year Government Bond Yield Monthly

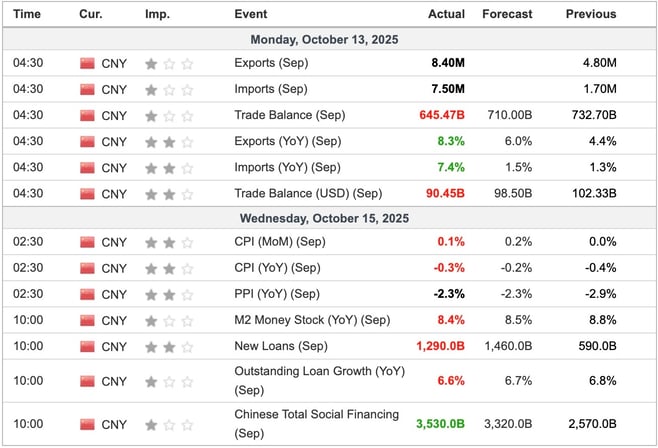

China

China Economic Indicators

China 10 Year Government Bond Yield Monthly

Exports and imports surge as prices continue to decline. China is in trouble and trying to trade it's way out.

10 year yields look to have bottomed out and may start rising again. This would not appear to be because of the economy growing, but more likely related to credit risk.

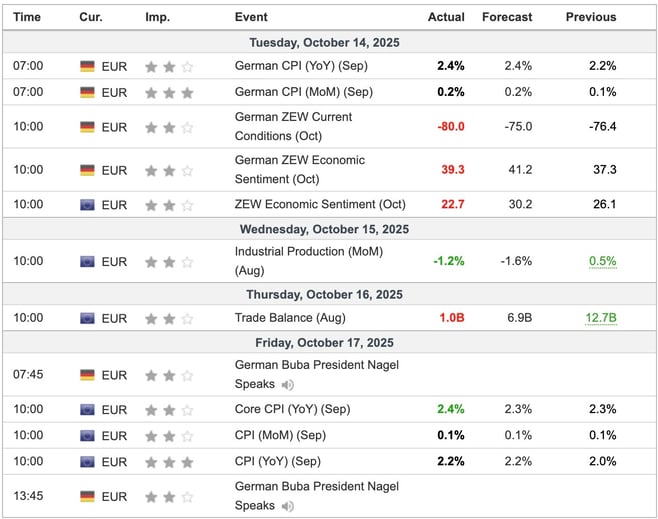

Europe

EU Economic Indicators

CPI may have come down but it's now stuck above target. With the US about to cut rates drastically, the implications for the EURO are clear. And if short rates can't come down then long rates will surely push higher. Another bull flag.

Germany 10 Year Government Bond Yield Monthly

United Kingdom

UK Economic Indicators

Wages prices are definitely confronting for the Bank of England/UK government.

And those yields look poised to break higher.

UK 10 Year Government Bond Yield Monthly

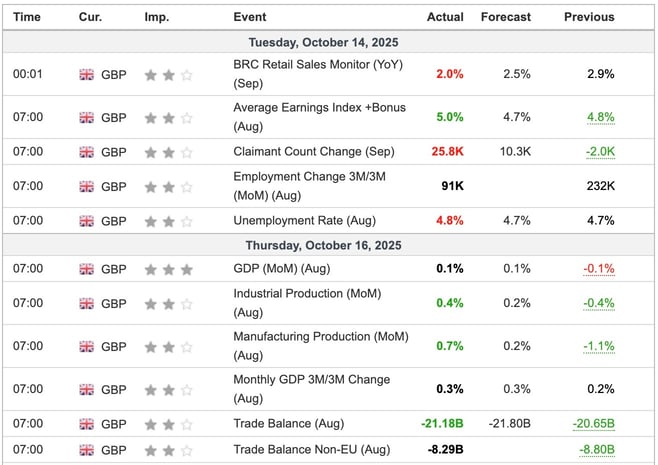

Canada

Canada Economic Indicators

Canada 10 Year Government Bond Yield Monthly

Only in Canada, maybe the US, do rates look as though they might drop. The extended bull flag is being challenged.

Australia

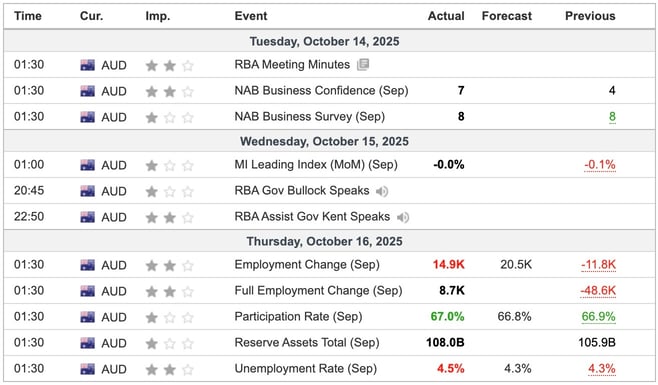

Australia Economic Indicators

Locals were shocked at the jump in the Unemployment Rate. The economy is stagnant, inflation is stubbornly high, and now jobs are cracking.

Japan

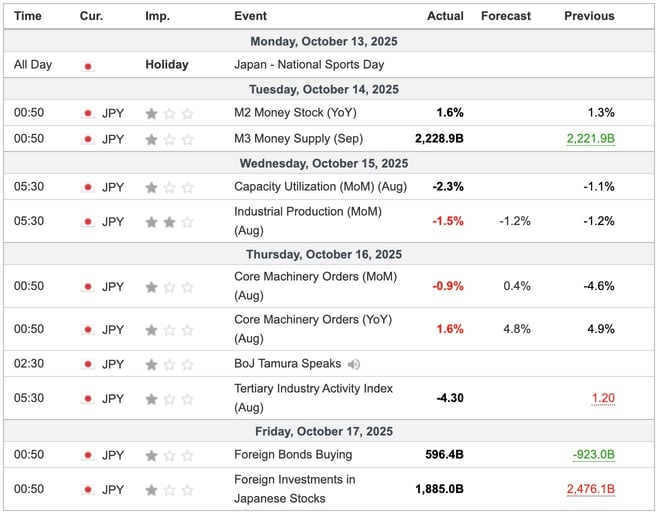

Japan Economic Indicators

\

\

Japan 10 Year Government Bond Yield Monthly

The Japanese economy is slowing, and inflation is not rising any more. But rates are too low and still rising parabolically.

What's Next?

No central banks this week and US CPI maybe on Friday. Markets are firmly focused on precious metals but the undercurrent of credit risk in the US is set to steal the focus.

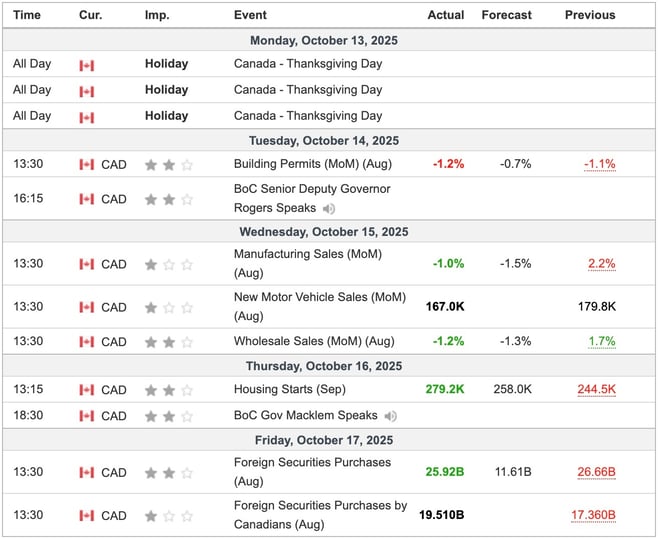

This Week's Important Economic Indicators [London time]

![This Week's Important Economic Indicators [London time]](https://vip.suberia.capital/hs-fs/hubfs/20102025/indicators2.jpg?width=658&height=442&name=indicators2.jpg)

Ian Reynolds

Ian Reynolds

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(36).jpg)