Tariff Tsunami

Podcasts | Daily LinkedIn | Weekly LinkedIn | Check out the website

Overnight

Economic Indicators Released Overnight

With the US on holiday, economic data was sparse on Friday, only positive household spending in Japan and still negative year on year input prices in Europe to report.

The Invest America Act just cleared Congress—every U.S. child gets a $1K S&P 500 starter account at birth. 70M kids gaining a stake in America’s growth next year when the program starts.

Overview of the Invest America Act

-

$1,000 Seed Investment: Every U.S. citizen born after July 4, 2026, would receive a $1,000 federal contribution into a tax-advantaged investment account at birth.

-

Annual Contribution Limits: Family and friends could contribute up to $5,000 annually to these accounts, with the limit adjusted for inflation after 2026.

-

Investment Options: Funds would be invested in mutual funds or exchange-traded funds tracking the S&P 500 index, promoting long-term growth.

-

Withdrawal Conditions: Withdrawals are permitted only after the beneficiary turns 18, except for qualified rollovers. Distributions would be taxed at the capital gains rate.

-

Projected Growth: With consistent contributions and an estimated 7% annual return, the account could grow substantially by the time the beneficiary reaches adulthood.

Breaking

50K ANCIENT BITCOINS JUST MOVED. The Internet is awash with rumours of whales selling, Roger Ver cashing out, the greatest heist in history or whatever. Certainly typical of the consolidation before a parabolic run, is the passing of old Bitcoins from old to new hodlers. It's almost a tradition.

Trump calls on US central bank head to quit immediately [BBC]

Several countries, including longtime allies like Australia, Canada, and the U.K., are now warning their citizens about traveling to the United States. Multiple Countries Just Issued Travel Warnings for the U.S [Yahoo! News]

Tariff Tsunami

As of July 4, 2025, President Donald Trump's 90-day global tariff pause is set to expire on July 9, with no extension planned. The administration intends to implement "reciprocal" tariffs ranging from 10% to 70% on nations lacking trade agreements with the U.S., starting August 1. Countries like Cambodia, Laos, and Madagascar are among the initial targets.

While partial agreements have been reached with the UK, China, and Vietnam, major economies such as the EU and Japan remain without finalised deals. The EU has deemed it "impossible" to conclude a comprehensive trade agreement by the July 9 deadline.

How trade tensions are really affecting the global economy [FT]

Japan Finally Admits Its Carmakers Have Been Paying All Trump Tariff Costs As Trade Talks Collapse [Zerohedge]

Full EU-US trade deal ‘impossible’ before deadline, says Ursula von der Leyen [FT]

Precious Metals / Commodities

Monthly Gold chart is beautiful to behold. 2 months of consolidation then bumping off support.

Americans cash out on gold coins as Asian investors bulk up [Business Times]

Bitcoin (& Crypto)

Back to support on whatever is happening with those 50,000 Bitcoins. Doesn't matter, just wait for the break higher.

White House Says Gold Reserves May Be Used to Purchase Bitcoin [Yahoo! Finance]

Ripple applies for US national bank charter as crypto eyes next frontier [Reuters]

CRE / Banks / CLOs

|

|

|

Hearing rumours of large scale distress from Freddie Mac financed dwellings.

United States

China

China Economic Indicators

China PMIs pretty much as expected and rumours are circulating that long bonds due to be issued in September by local government entities are now coming ASAP. Certainly the 15 year downtrend in long yields has a bit more to go.

China 30 Year Government Bond Yield Monthly

Japan

Japan Economic Indicators

Japan's economy is all over the place.

Big move in USD/YEN coming. Off the back of EURO/USD strength?

USD/YEN Monthly

Europe

EU Economic Indicators

All steady in Europe as regulators now asking if the EURO is too strong. First time they've been able to say that for 20 years.

EUR/USD Monthly

United Kingdom

UK Economic Indicators

UK economy is treading water as the Labour Govt struggles to survive after showing absolutely no knowledge of economics or accounting. Gilt yields now back to when the Pound was kicked out of the European Exchange Rate Mechanism.

UK 30 Year Government Bond Yield Monthly

Investor fright over Reeves’ tears shows fragility of UK finances [FT]

Canada

Canada Economic Indicators

Quiet week data wise from Canada but again currency topping out against the USD.

USD/CAD Monthly

Australia

Australia Economic Indicators

Really poor trade balance reflects the Australian Govt's inability to achieve anything or convince anybody that they know what they're doing. Chalmers will be glad that it's Rachel Reeves that is holding the limelight at the moment.

The Aussie Dollar right up at the 15 year downtrend against the USD.

Federal borrowing to top states as $1 trillion debt milestone looms [AFR]

Nation’s largest green hydrogen project axed [The Australian]

Is the US alliance real or just friends with benefits? [The Australian]

Interesting

What's Next?

10 and 30 year US auctions will take the focus after tariffs play out. RBA meeting on Tuesday should deliver 25bps as discussed at the previous meeting.

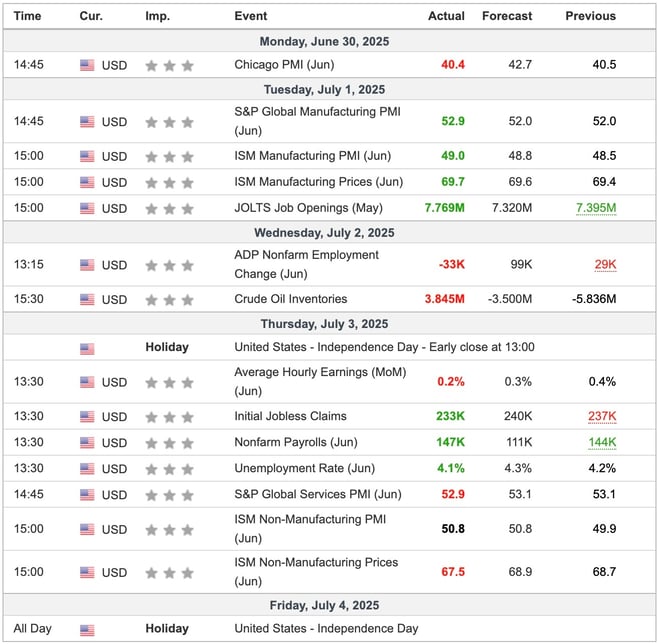

This Week's Important Economic Indicators [London time]

![This Week's Important Economic Indicators [London time]](https://vip.suberia.capital/hs-fs/hubfs/06072025/indicators-1.jpg?width=658&height=332&name=indicators-1.jpg)

Ian Reynolds

Ian Reynolds