Limit Up! 8 December 2025

Limit Up! --> Website | Substack | YouTube

Overnight

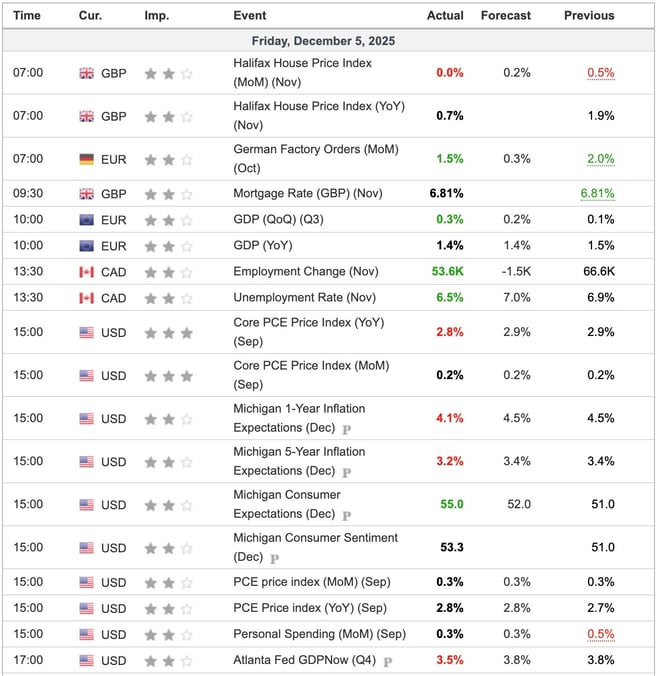

Economic Indicators Released Friday

No matter, markets drifted for a lot of Fridays session, as the Silver fight at $60.00 drew all the attention.

RBA tomorrow and the FED Wednesday will have markets on their toes, but if it all goes as it almost certainly will, the run down before Xmas begins.

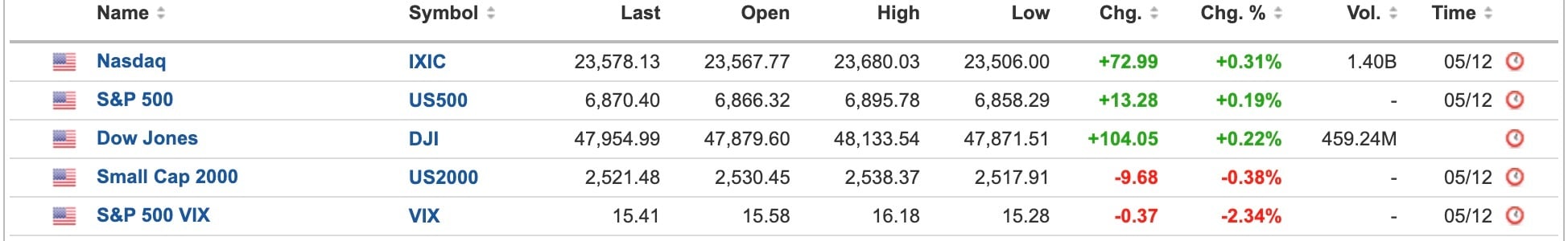

US Equities

Breaking

Fed expected to cut rates despite deep divisions over US economic outlook [FT]

Precious Metals / Commodities

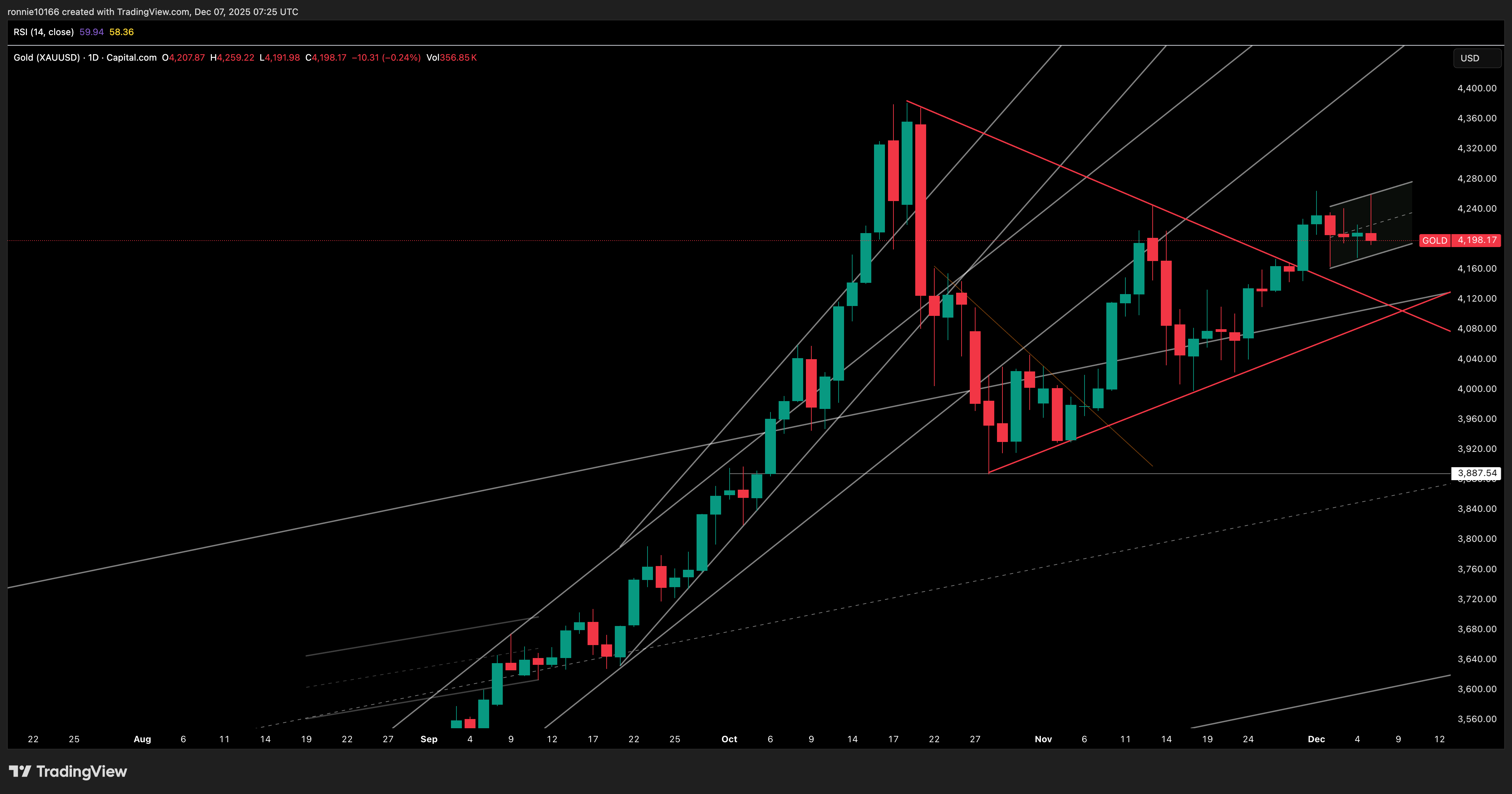

We were expecting a stronger push towards the all time high at 4,380 but we’re consolidating again, price remaining neutral as Silver’s upwards force keeps it there. Read more

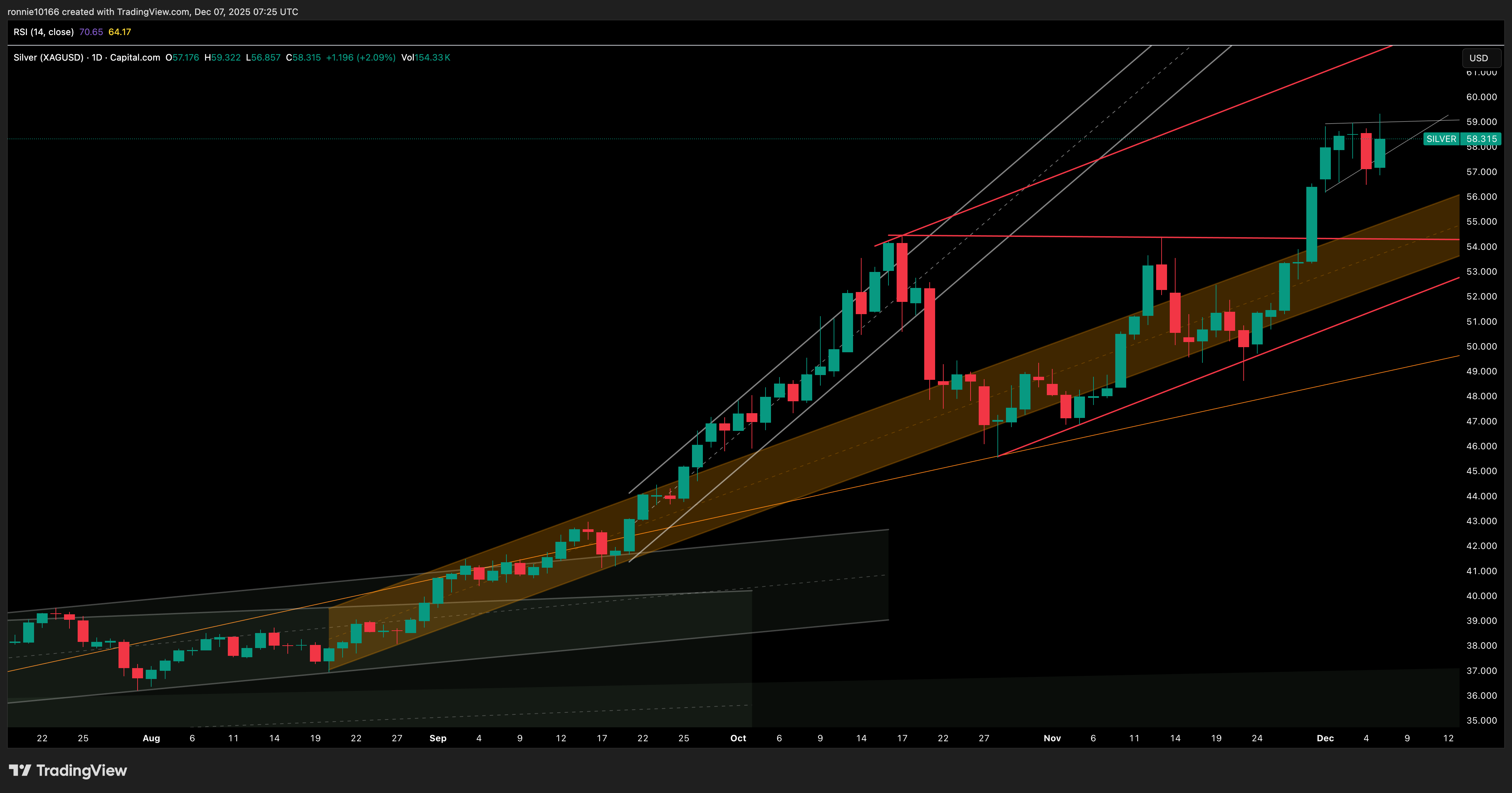

A new all time high yesterday at 59.30 as London bullion banks seem to have decided that 60.00 is the level to defend. Unlike Gold, the supply shortage is so acute that any long positions will be happy to run positions into year end. Read more

A clear break as Spot Brent heads back up to 67.10. Only a close below 61.60 negates, and even then there is strong support down to 60.20. Read more

Bitcoin (& Crypto)

A third attempt to breach the buy zone, down to 75k, looks to have bounced off support. There’s downtrend resistance right here at 91.5k and then price needs to get over 94.1k for a run at 96.5k, the big target. Read more

Country Updates

What's Next?

Apart from the FED and RBA, here comes NFP for November on Tuesday, followed by US Retail Sales and CPI. These numbers are not as important as the would have been with no government shutdown and without political interference.

This Week's Important Economic Indicators [London time]

![This Week's Important Economic Indicators [London time]](https://vip.suberia.capital/hs-fs/hubfs/08122025/indicators.jpg?width=658&height=696&name=indicators.jpg)

Limit Up Podcast 1 December 2025

Ian Reynolds

Ian Reynolds

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(66).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(86).jpg)