Limit Up! 1st August 2025

Daily LinkedIn | Weekly LinkedIn | Bitcoin for Business

Overnight

A whole host of economic data released overnight including stronger than expected Australian Retail Sales, weaker than expected Chinese Manufacturing PMI and inline German CPI but the market was blown away with the monthly US PCE coming in hot.

US Economic Indicators Released Overnight

Yesterday's US Q1 GDP at 3% annualised (even if it was skewed by tariffs) was in stark contrast with Canada where the economy has stagnated.

Canada GDP June 2025

Iran suddenly appeared in the headlines again as Bessent said more sanction being applied

Equities firmly on the back foot back, and despite stellar performances by Meta and Microsoft, now that the upward momentum has faded, bringing risk assets down hard.

Breaking

US Treasury keeps notes, bonds auction sizes steady, increases debt buybacks [Reuters]

BOJ keeps interest rates flat, but flags rate hikes on rising inflation, GDP [investing.com]

Trump puts 50% tariffs on Brazil and copper, eliminates a tax loophole and hints at new deals [CNN]

Bitcoin

Yesterday's strong recovery was overturned by the PCE data as rate cut hopes fade

Commodities

Gold hanging in there as a stronger USD takes off the shine.

Foreign Exchange

A clear rejection of the channel and confirmation of the breakdown.

Equities

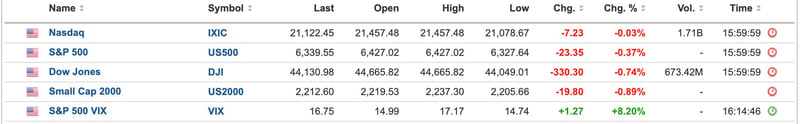

S&P tries to go higher, dragged up by NASDAQ but had a weak close. A break of 6,250 support would see price a lot lower.

Interesting

Has Gaza tested the limits of Donald Trump’s support for Benjamin Netanyahu? [FT]

Economic Indicators Today

Ian Reynolds

Ian Reynolds

.jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(64).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(17).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(74).jpg)