Limit Up! 17th June 2025

Podcasts | Daily LinkedIn | Weekly LinkedIn | Check out the website

Overnight

The G7 meeting discussions were entirely geopolitical

Middle East & Iran–Israel Conflict

-

The G7 issued a joint statement firmly supporting Israel’s right to self‑defence, identified Iran as a source of regional instability, and insisted Iran must never obtain nuclear weapons .

-

Leaders called for urgent de-escalation, including pushing for a ceasefire in Gaza, and pledged to collaborate on stability in global energy markets.

-

U.S. President Trump departed the summit early to address the crisis directly, underlining the G7’s regional focus and his administration’s strong pro‑Israel stance

Trump says everyone should immediately evacuate Tehran [Reuters]

Twenty-Year Bond Auction Attracts Above Average Demand [RTT News]

A solid day for US stock markets

US Equities

Breaking

A Battered Iran Signals It Wants to De-Escalate Hostilities With Israel and Negotiate [Wall St Journal]

Bitcoin

BTC continues to grind higher, with some big buyers publicly in the headlights.

Commodities

The weekly chart on Brent offers a good view. Close this week above $79.00 to confirm the trend higher, or below $68.00 to establish 2 candles of bull trap, or more chop.

Foreign Exchange

Continued strength of the Loonie vs the USD possibly reflecting reallocation of capital, as EUR/CAD is a horizontal line when the chop is taken away.

USD/CAD Daily

Bonds

And maybe rising Canadian yields are attracting that capital.

Canada 10 Year Government Bond Yield Daily

Equities

The NASDAQ still can't break out of the bull flag.

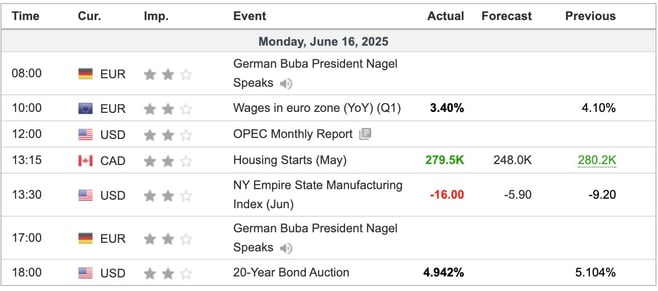

Economic Indicators Today

Ian Reynolds

Ian Reynolds

.jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(36).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(37).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(14).jpg)