Limit Up! 12th August 2025

Daily LinkedIn | Weekly LinkedIn | Bitcoin for Business | Latest Limit Up! Podcast Now Live

Overnight

With only yet more very short bill issuance to deal with and CPI later today, markets were bearish, particularly Gold and Silver.

Bitcoin had a blast higher running stops but ended poorly.

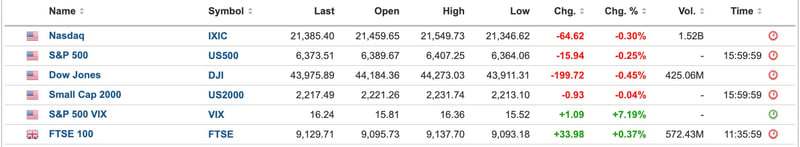

US Equities

Breaking

RBI Said to Have Sold at Least $5 Billion to Boost Rupee [Bloomberg]

Bitcoin

Definitely looking like a bearish close on BTC with a double shooting star top. Looking to go back to $112k for support.

Commodities

Gold and Silver did eventually pull back after tariffs were ruled out. Wedge has to break soon.

Trump says gold imports will not face US tariffs [FT]

Foreign Exchange

Cable looking to roll over as bear flag but that's a steep slope. USD needs to put in a higher low to confirm.

Equities

NASDAQ hanging above post COVID channel. Definite loss of momentum. Yet again hopes of US interest rate cuts buoying markets.

Bonds

Re-imaging the post COVID structure of US 10 year yields. It's a battle between soft yield curve control by Treasury and market having to digest so much issuance. Result: going nowhere at the moment.

US 10 Year Government Bond Yield Daily

Interesting

Economic Indicators Today

Ian Reynolds

Ian Reynolds

.jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(74).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(32).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(56).jpg)