Limit Up! 11 December 2025

Limit Up! --> Website | Substack | YouTube

Overnight

Economic Indicators Released Overnight

China's CPI and PPI date went unnoticed as the FED hogged the limelight, and there was a glimmer of hope as YoY CPI came in at 0.7%, higher than expected and driven by recovering food prices. But deflation has really got a hold.

The FED delivered 25bps cuts as expected but the markets were blindsided by just how dovish the presser was. And the message is clear: rates are going lower and we'll do our bit to bail out the Federal Government. I hope that Powell, on retirement in May, doesn't look back at this presser as contaminating his legacy.

Meanwhile over the border Canada held rates with an upbeat assessment of Canada's economy that is not justified. Nothing really here

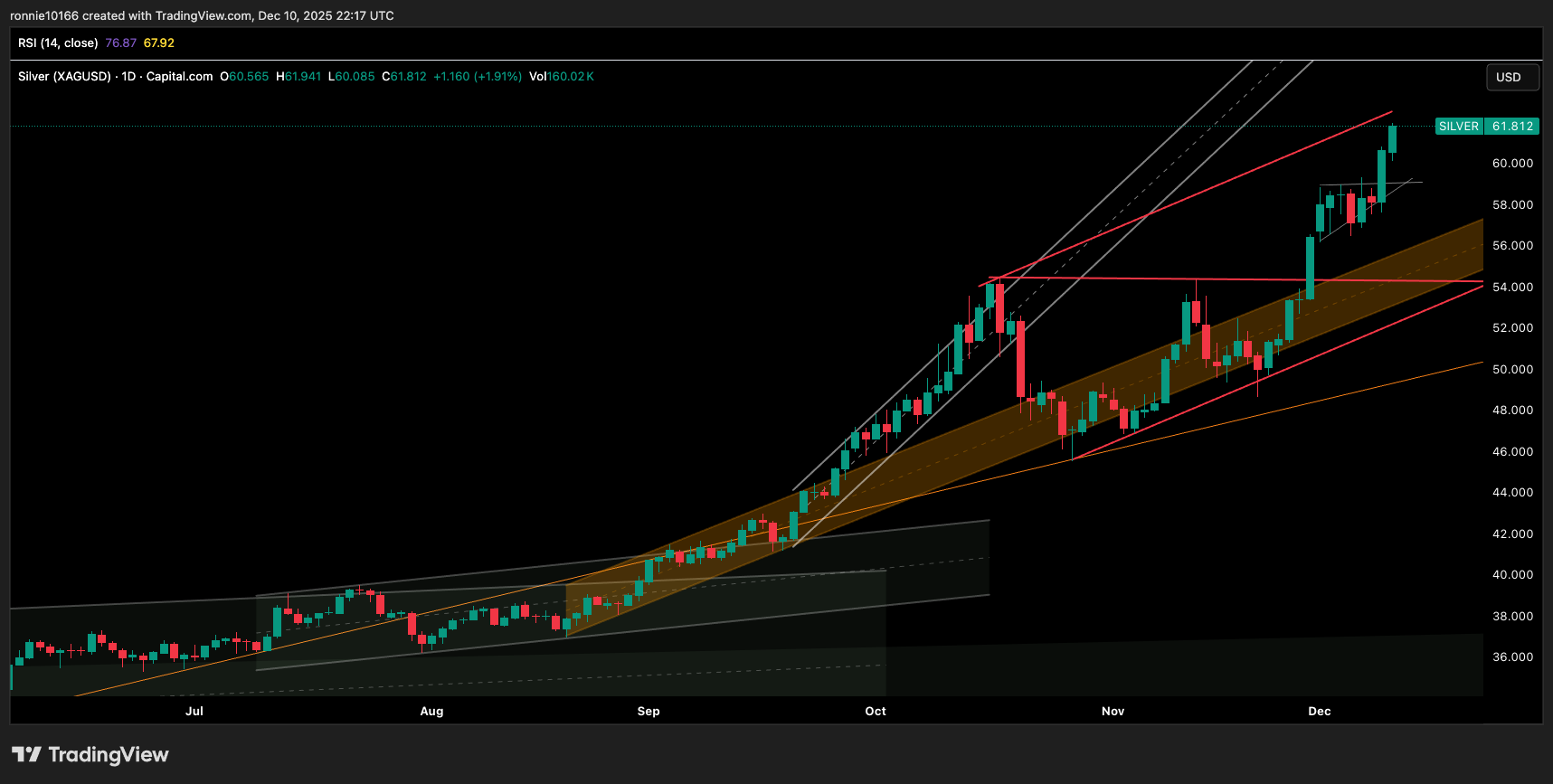

Equities loved it, Bitcoin did briefly and Gold, Silver surged.

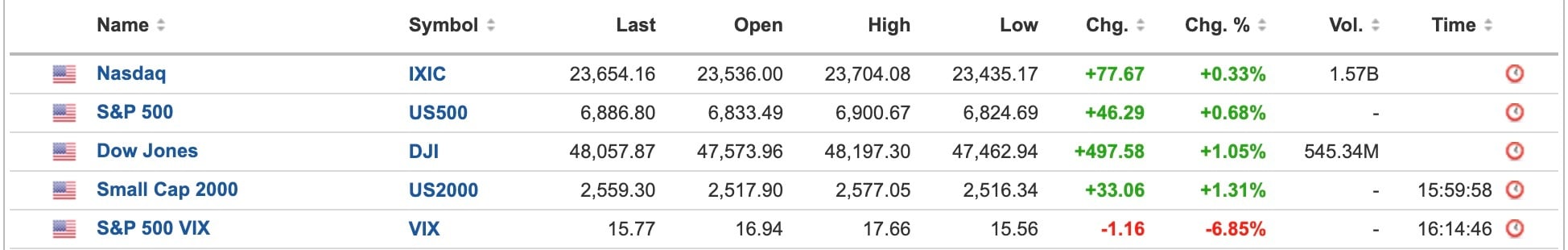

US Equities

Breaking

Fed cuts rates to three-year low after fractious meeting [FT]

Japan denies report it rebuffed EU's plea to join Russian asset plans [Reuters]

Commodities

Silver still rising and now approaching trend resistance around 62.00. The break of the bull flag gives us support at 59.00 down to 56.20. As investors absorb the message in Powell’s presser today, the move to non sovereign bearer assets will only increase. Read more

Foreign Exchange

Powell’s surprising dovish presser drove the USD lower across the board, but as yet hasn’t followed through. It’s at minor support at 98.20 right now, and a loss of 97.70 could see the start of a move back to the double bottom at 95.80. Read more

Equities

Price tagged the pivot line as the DJIA becomes the benchmark trend assessment tool for risk assets. Price needs a big green candle, and confirmation, to break equities higher and to start a new trend upwards. Read more

DOW JONES INDUSTRIAL AVERAGE Daily

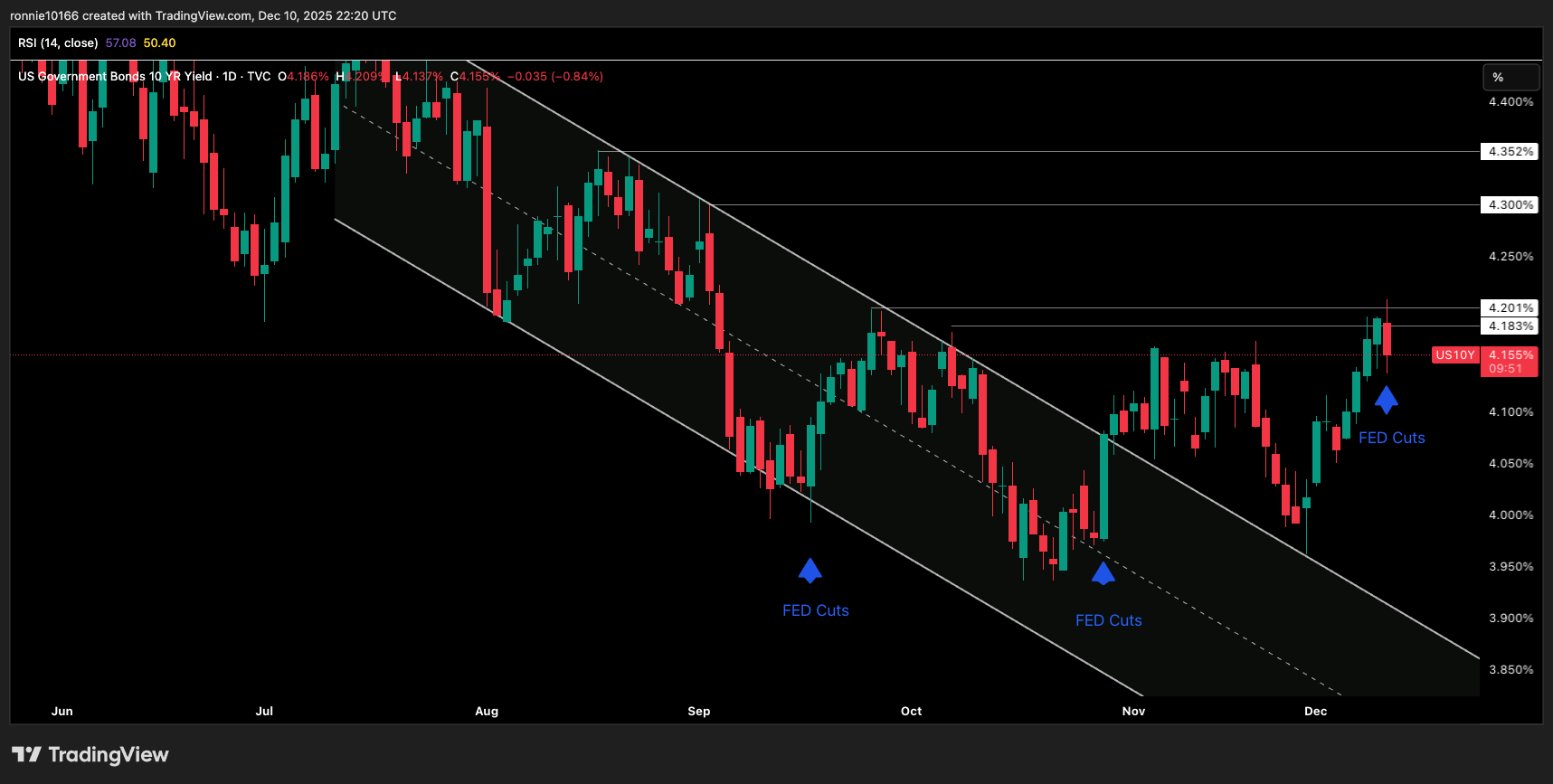

Bonds

A brief rally on the news. Since yield returned to the scene of the crime on 28 November, the only way has been up. The charts are quite clear: below 3.96% and bonds will rally hard and above 4.20% bonds will fall out of bed. Read more

US 10 Year Government Bond Yield Daily

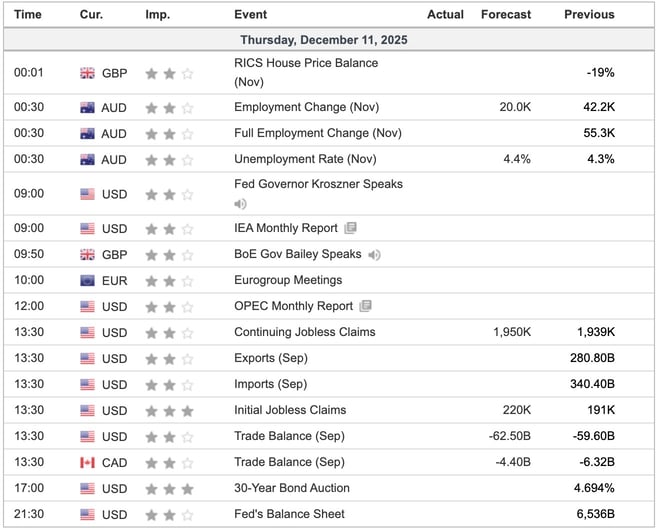

Economic Indicators Today

Ian Reynolds

Ian Reynolds

.jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(13).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(83).jpg)