It's Arrived

Limit Up! --> Website | Substack | YouTube

Overnight

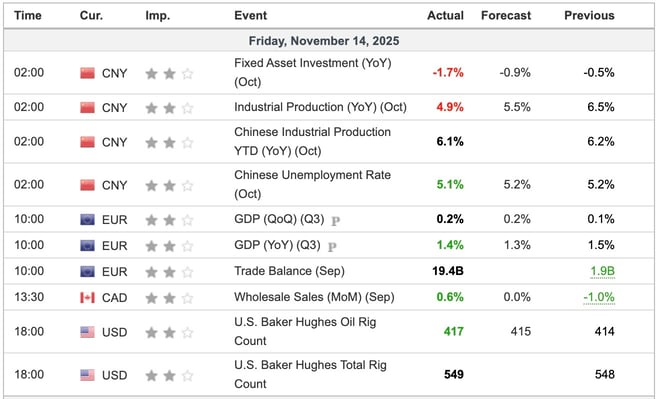

Friday's Economic Indicators

- Bid-to-cover ratio: 2.29 (below the average of 2.38 over the prior 10 auctions, signalling weaker demand).

- Tail: 1 basis point (high yield exceeded the when-issued level of 4.684%).

- Bidder breakdown (competitive bids): Indirect bidders (often foreign) took 71% ($17.71 billion accepted out of $19.57 billion tendered), direct bidders took 14.5% ($3.62 billion accepted out of $5.95 billion tendered), and primary dealers took the remaining 14.5% ($3.62 billion accepted out of $31.79 billion tendered).

- Noncompetitive tenders: $53.59 million accepted.

- Allotted at high: 23.04%.

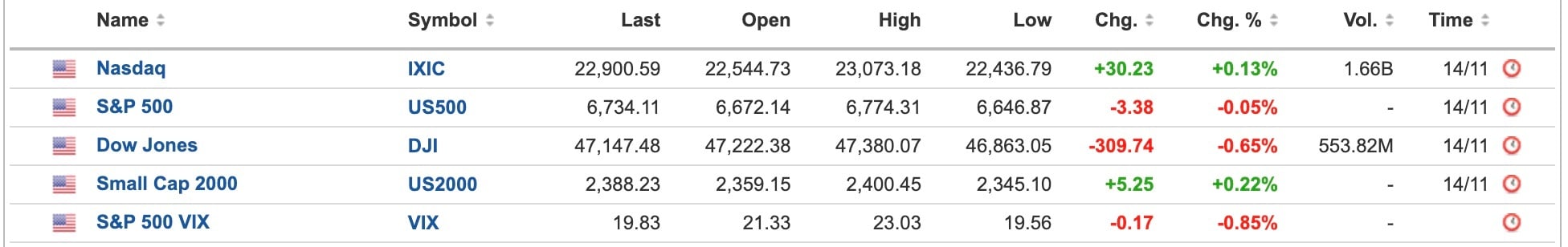

US Equities

Breaking

Fed's Logan: Would be hard to support December rate cut [Reuters]

Oracle bonds sell off as AI investment fuels investor concerns [Reuters]

China’s secretive gold purchases help fuel record rally [FT]

China’s Economy Stumbles After Unprecedented Slump in Investment [Bloomberg]

Japan considering stimulus package sized around 17 trln yen, Nikkei says [investing.com]

Former Fed Official Violated Trading Rules, Disclosures Show [NY Times]

Janet Yellen: The US Is ‘In Danger of Becoming a Banana Republic’ [Bloomberg]

Precious Metals / Commodities

A decent bounce that was met with resistance. Consolidation is needed for the bull market to continue, and that may last 3 to 6 months. If we get down to 3,500 it really would be Xmas.

Almost tagged the all time high last week but ended a lot lower. Like Gold consolidation is needed, but Silver will be the one breaking higher first.

Oil in a holding pattern and Brent holding $60 is key. Topside can break with geopolitics but economic weakness should see price a lot lower. Bitcoin is leading with liquidity issues. Lets see if oil can lead economy down with it.

Bitcoin (& Crypto)

A big breakdown in Bitcoin signals that liquidity is low (that's not M2) and risk assets will follow. The FED seems to be about to address this but in reality they're way behind the curve as usual.

Xmas is 75,000k

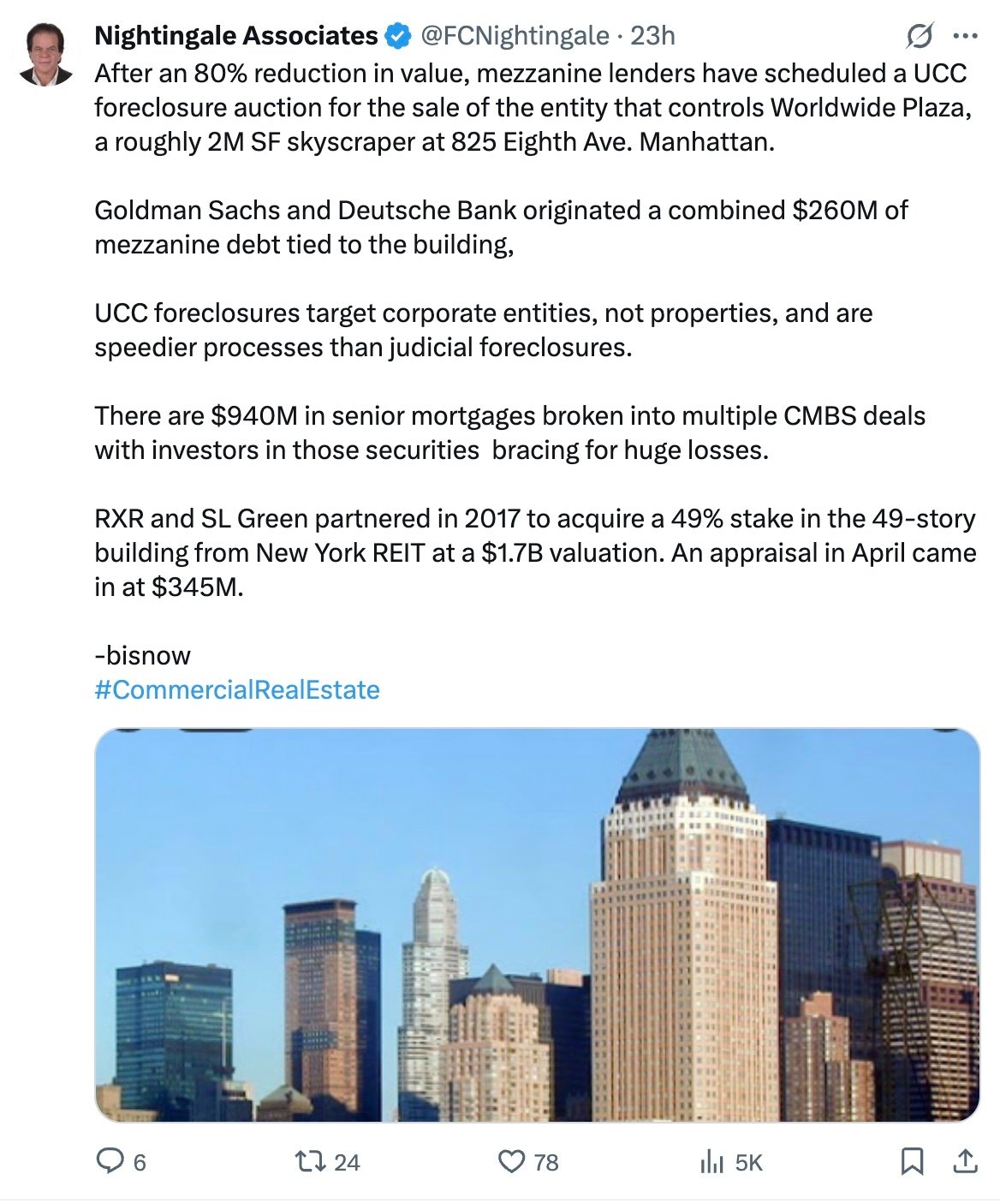

CRE / Banks / CLOs

|

|

|

The CRE game is coming to the surface. Look out below!

United States

US Economic Indicators

No data, of course, and a poor auctions, looks like Treasury can't kick the can down the road any longer. They have done well to contain contagion but the insane issuance has to have impact at some stage. 10 year yields under Trump, after vertical red line below, have only gone slightly lower. That wasn't the game plan. Now the FED has to save the day. And they're in disarray.

US 10 Year Government Bond Yield Daily

China

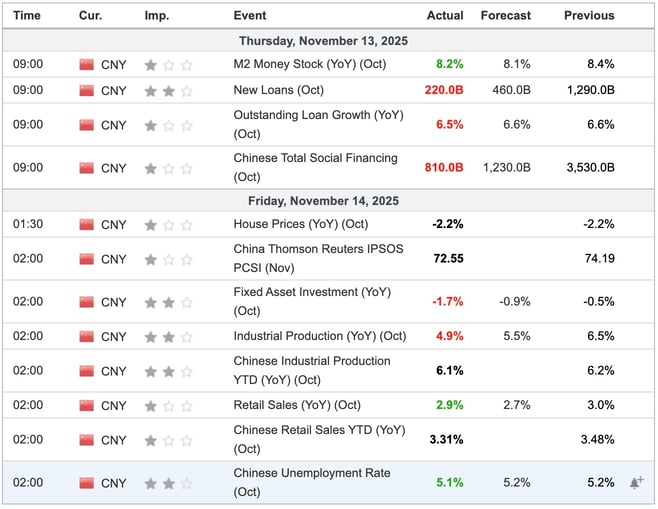

China Economic Indicators

China 10 Year Government Bond Yield Daily

The Chinese economy is grinding lower. Unbelievably house prices are still falling after 4 years. And 10 year rates are bottoming.

Europe

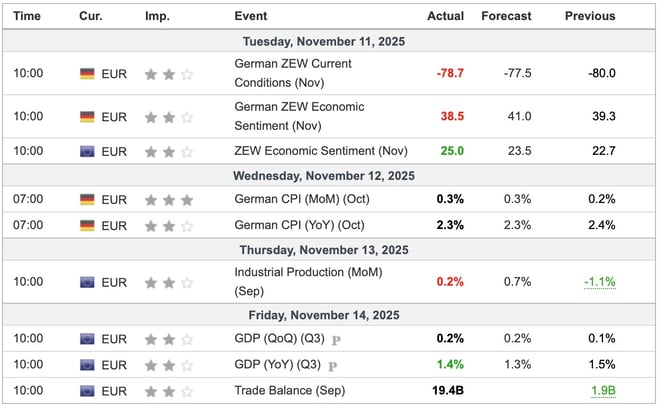

EU Economic Indicators

Not much activity happening in the EU either, as the recent uptick in Industrial Production, seems to be subsiding.

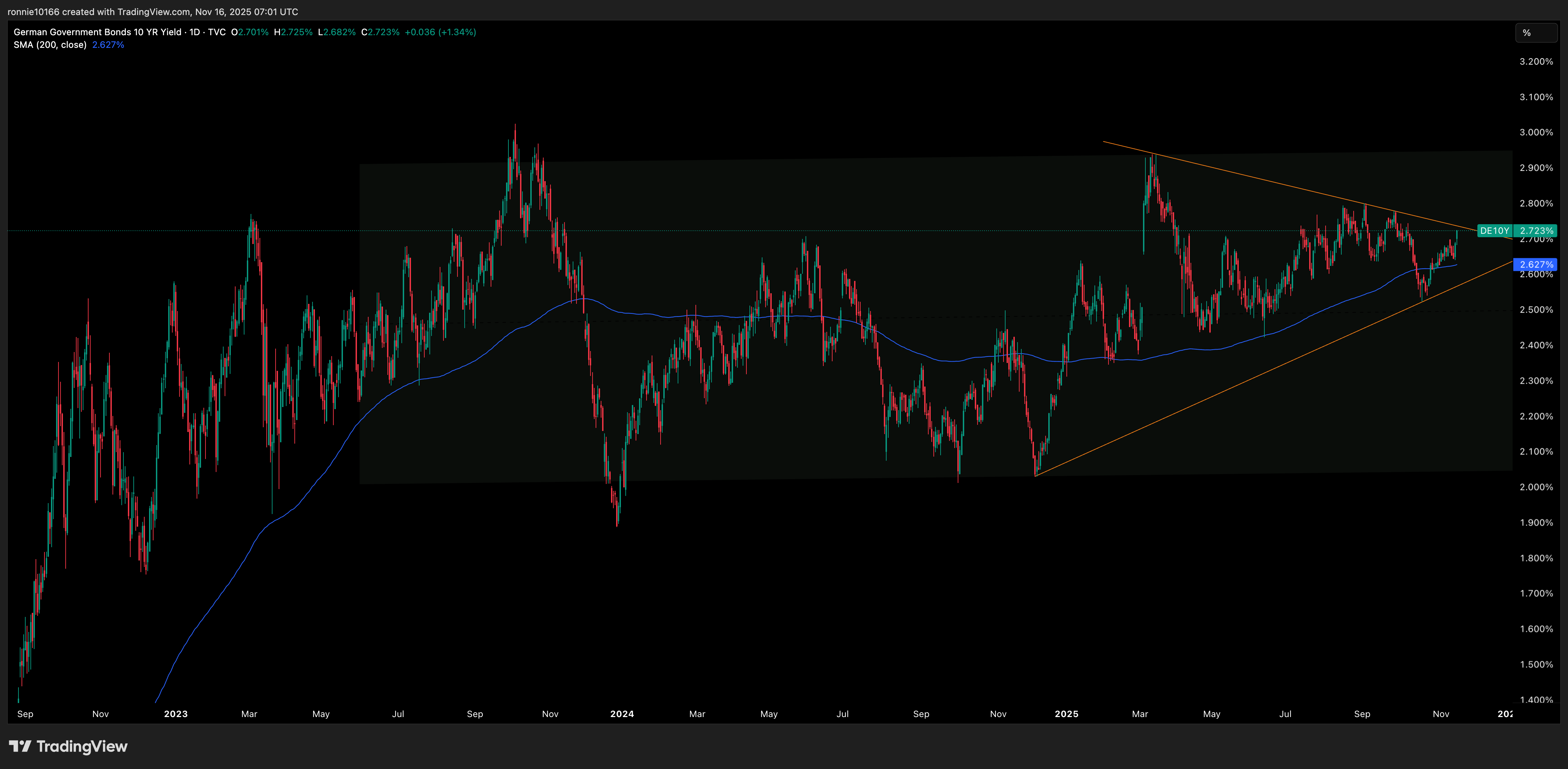

The wedge pattern is really tight now, in 10 year yields, and it's going to go big one way or another.

Germany 10 Year Government Bond Yield Daily

United Kingdom

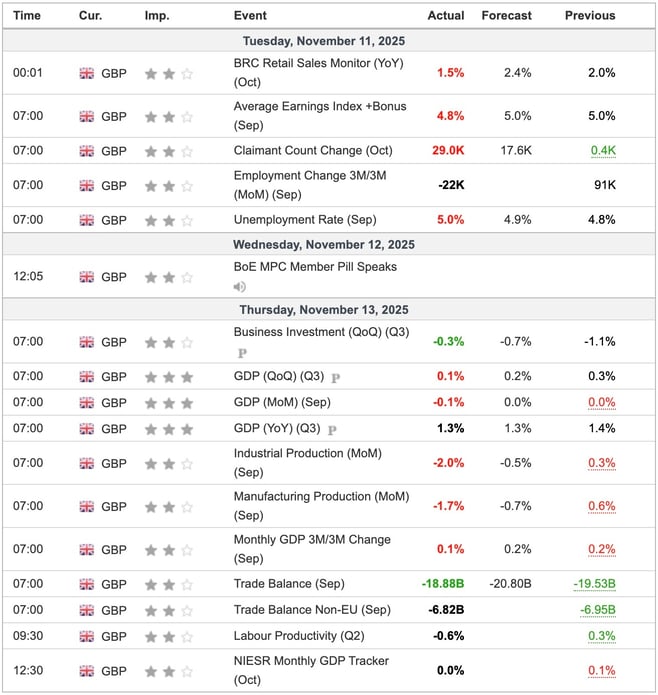

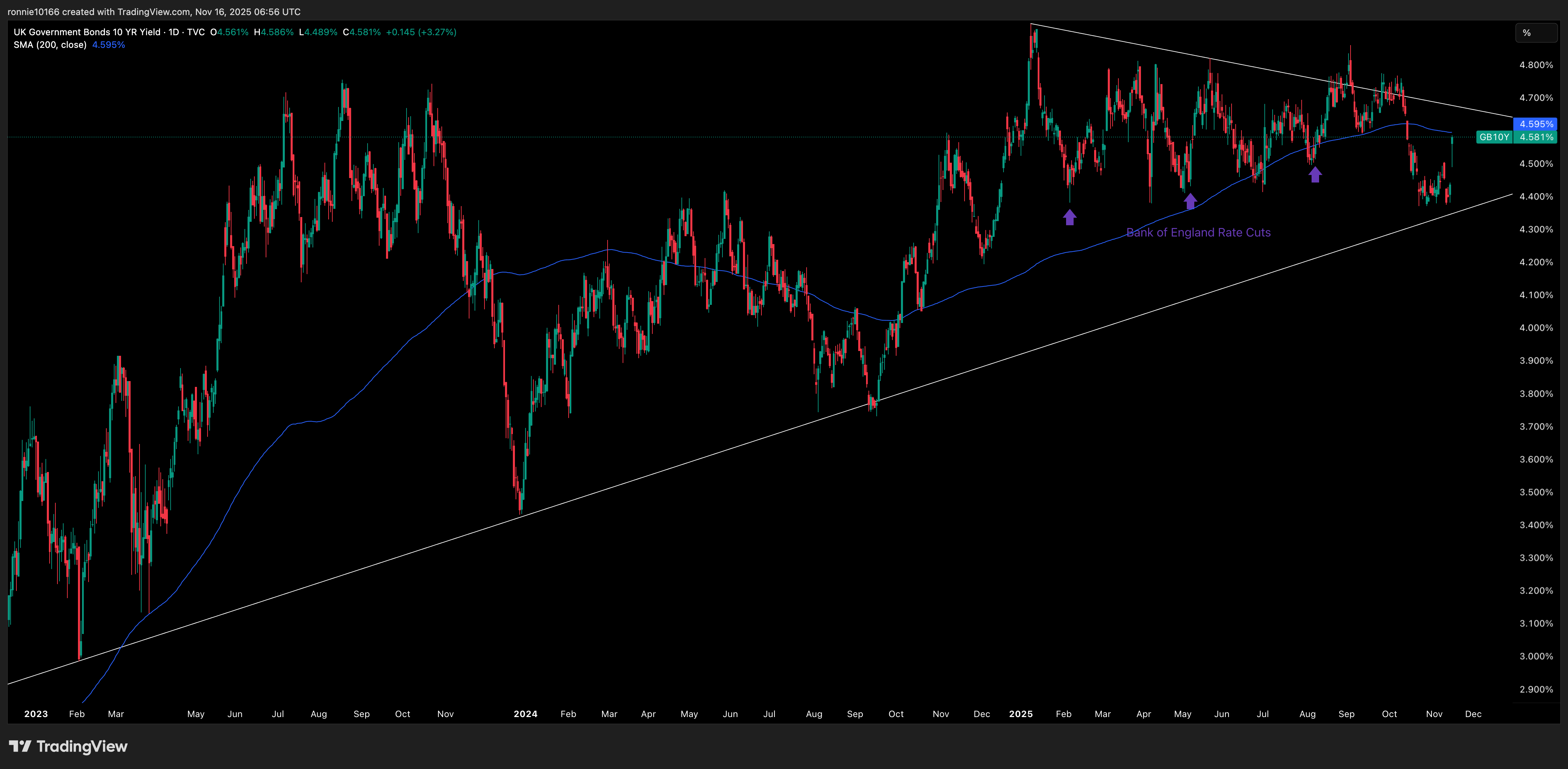

UK Economic Indicators

UK economy deeply in trouble now as the recent economic uptick recedes fast. The wedge is narrow here, too, and has tried to break higher twice already.

UK 10 Year Government Bond Yield Daily

Canada

Canada Economic Indicators

Little data this week, but the Canadian economy is in deep trouble, and relies on it's relationship with the US!

Break of the wedge less likely here, but will probably follow Europe's lead.

Canada 10 Year Government Bond Yield Daily

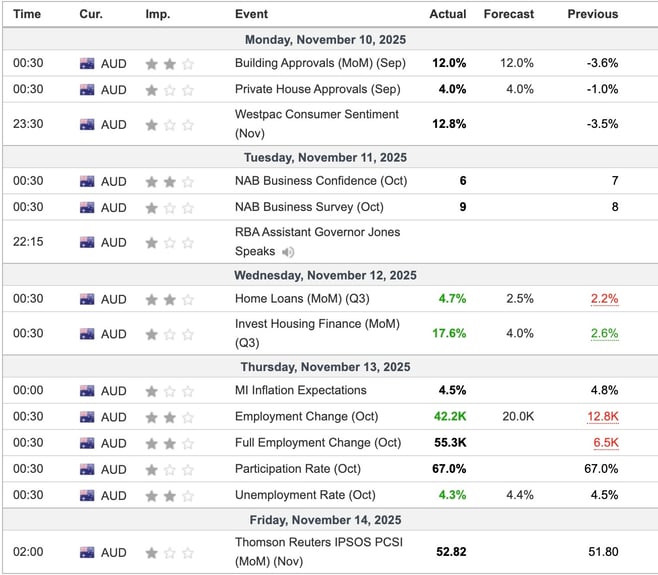

Australia

Australia Economic Indicators

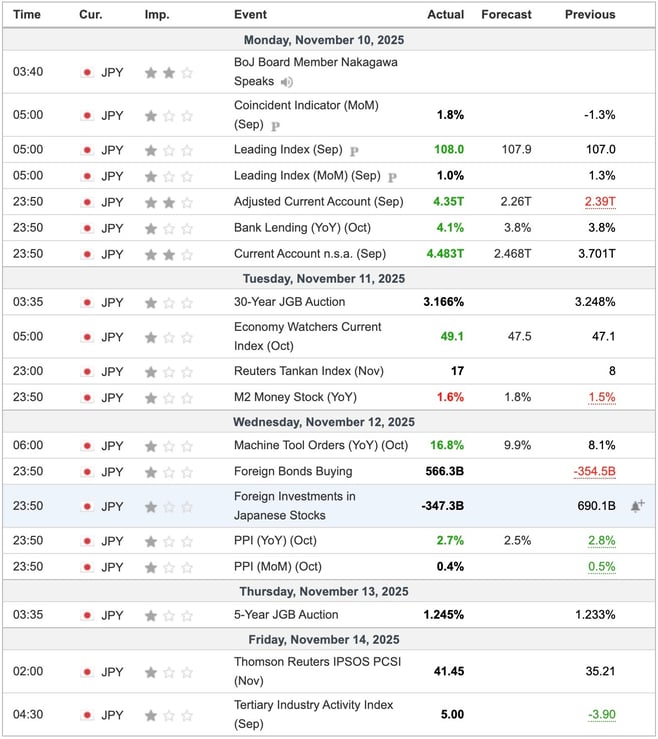

Japan

Japan Economic Indicators

Japan's GDP is out today, and will probably shown reasonable growth. Inflation is still above target but that's what Japan has needed for 40 years. As long as it's not too strong. Yields are rising and currency falling to get to an equilibrium. We may never see that equilibrium as other events play out.

Japan 10 Year Government Bond Yield Daily

What's Next?

Hopefully we''re start seeing US data but it will be months before they become in any way believable.

Trump is starting to wind back tariffs as the economy tanks. Will he even get to the Mid-terms?

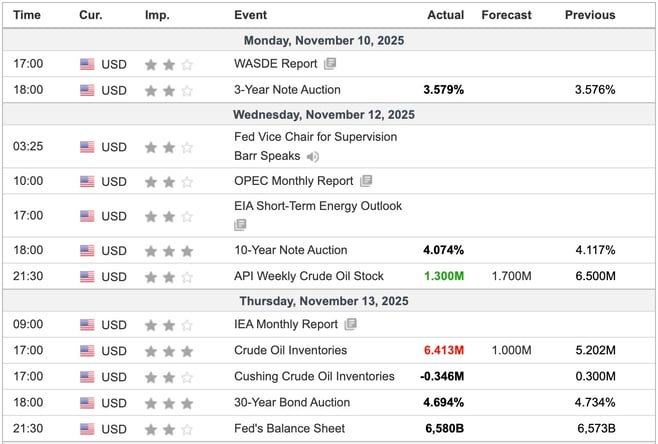

This Week's Important Economic Indicators [London time]

![This Week's Important Economic Indicators [London time]](https://vip.suberia.capital/hs-fs/hubfs/17112025/indicators.jpg?width=658&height=332&name=indicators.jpg)

Limit Up Podcast 10 November 2025

Ian Reynolds

Ian Reynolds