Risk Off

Links

Daily LinkedIn | Weekly LinkedIn | Next event | Check out the website

Overnight

University of Michigan Consumer Expectations March 2025

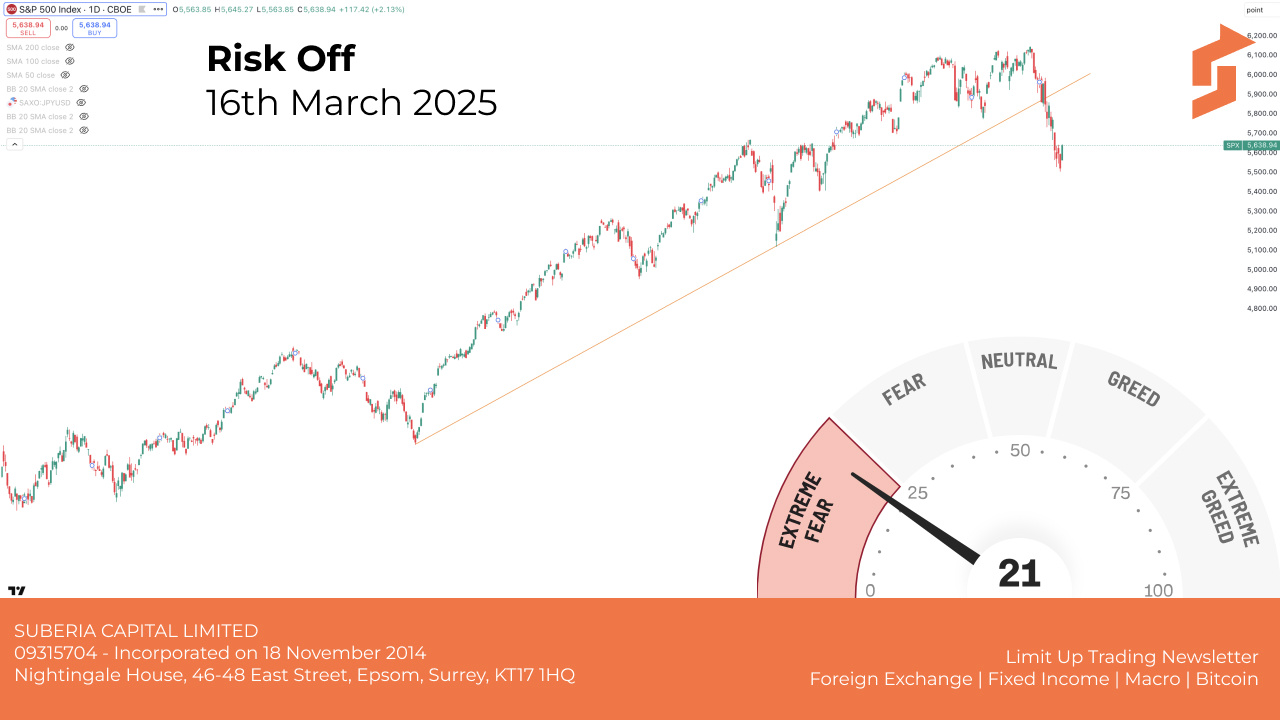

Above is the CNN Fear & Greed Index [CNN]

Markets are risk-off and so is the US consumer, confidence down but inflation expectations higher.

The S&P500 is only 10% off the all time high which normally wouldn't worry markets, but this time is different. Retail investors are fully long. It's a reflection of younger generations with money to invest, home ownership is not possible, and armed by Revolut and Robinhood, they can simply flick any excess funds into fractional ownership of listed shares.

The mantra that "why save when you can invest" is empowering while markets go up, but it's definitely not when markets go down. Central banks have destroyed savers in the last twenty years by keeping rates lower than inflation. And when everybody is in, markets will always go the direction of maximum pain,

Breaking

‘Buy Canada’ Pressure Builds on $1.6 Trillion in Pension Pot [Bloomberg]

U.S. Judge Finds China Liable for Covid Missteps, Imposes $24 Billion Penalty [NY Times]

US Senate passes bill to avert shutdown, House Democrats turn on Schumer

Precious Metals

Gold from 2,000 to 3,000 in a year is really just a reminder that the purchasing power of the USD has had a 33% decline in just one year.

That's astonishing.

GOLD / USD Monthly

Bitcoin (& Crypto)

BTC continues to try to build a bottom without hitting technical support at 75,000. Plenty of institutions, states and countries waiting to buy - currently on the sideline.

BITCOIN / USD Daily

Russian central bank proposes wealthy individuals be allowed to invest in crypto [Reuters]

CRE / Banks / CLOs

|

|

|

|

United States

US Economic Indicators

Current inflation worries were pushed aside after CPI and PPI this week but what about the effects of tariffs? Trump loves President McKinley's tariff strategy where there was no income tax so the country lived off tariffs. This was in the1890s.

Immediately there is income tax in the US so it's hard to imagine that the US consumer, currently not confident and expecting inflation to push higher, can pay the extra costs. Especially as credit cards and auto loans are maxed out already and with high delinquency rates.

The idea is to create a domestic market to replace the imports, firstly that takes time and secondly it takes investment.

It won't take much to convince markets that tariffs are going to kill the economy.

Especially as markets know that The Great Depression was caused by tariffs.

US Considers Emergency Powers to Restart Closed Coal Plants [Bloomberg]

China

China Economic Indicators

Rumours of cuts to the bank reserve ratio on Friday are so far unconfirmed. Giving banks more ability to lend to citizens of a country experiencing deflation, seem unlikely to make much difference. I know the Govt owns the banks, but surely banks don't lend to people unlikely to give them their money back.

The steep drop in bond yields is now bouncing

China 10 Year Government Bond Yield Monthly

As China’s Birth Rate Drops, Pampered Pets Reap the Benefits [Bloomberg]

Why China Is Struggling to Escape a Cycle of Deflation [Bloomberg]

Japan

Japan Economic Indicators

With GDP at a solid 2-3% and the same numbers for inflation, yields have to go up and the currency has to strengthen.

10 year yield at 1.5% could easily double or maybe treble.

Would that cause the most indebted nation on earth to default? Clearly the BoJ / MoF won't let that happen. Maybe it won't be up to them.

Japan 10 Year Government Bond Yield Daily

Europe

Germany Economic Indicators

A messy week in the EU with an amazing number of speakers reflecting the huge change impacting Europe and the UK.

Trump is Making Europe Great Again and a European only war seems the likely outcome. Although German debt yields have jumped higher, markets don't really believe yet that the US has run off yet but when they do, a lot of repricing will happen.

The European Commission plans to take €10 trillion of citizens' savings for EU defence

Europe has all it needs to take the lead in the competitiveness race.

— Ursula von der Leyen (@vonderleyen) March 10, 2025

This month, the @EU_Commission will unveil the 🇪🇺 Savings & Investments Union.

We'll turn private savings into much needed investment.

And we'll work with our institutional partners to get it off the ground pic.twitter.com/rtd0UqCeut

Portugal rules out buying F-35s because of Trump [Politico]

Volkswagen open to building military equipment for German army [Yahoo! News]

United Kingdom

UK Economic Indicators

GDP and industrial production lower is no surprise. What does the UK make industrially these days?

The PM is spending money like crazy. Billions into Ukraine and billions into rebuilding the economy. Trouble is where is the money going to come from and what interest rate will it be at?

Cable is our favourite chart at the moment

GBP / USD Daily

Starmer Sees £45 Billion Savings in UK Push Into Digital, AI [Bloomberg]

Canada

Canada Economic Indicators

A final rate cut and wait and see was the BoC Governor's thinking this week. The country is waiting for Trump's verdict and much as markets like Mark Carney, he's too late to the game to make any difference.

The Loonie is marking time too.

USD / CAD Daily

Canada’s New Prime Minister Carney Plots Visit to France, UK [Bloomberg]

Australia

Australia Economic Indicators

Nothing much from economic releases but the OECD Household Dashboard is sobering

Interesting

What's Next ?

It central bank week. FED and BoJ is delicious, and BoE Thursday.

If we can get the Fort Knox audit and Epstein papers released on Wednesday, we'd be able to make a movie about this coming week.

Who said there are decades when nothing happens and weeks when decades happen? Lenin.

This Week's Important Economic Indicators [London time]

![This Week's Important Economic Indicators [London time]](https://vip.suberia.capital/hs-fs/hubfs/16032025/indicators.jpg?width=658&height=475&name=indicators.jpg)

Ian Reynolds

Ian Reynolds

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(17).jpg)