Commodities On Fire

Alert: Blinken Bombshell: "Ukraine Will Become A Member Of NATO" [Zerohedge]

Alert: Israel Warns Iran Of Massive Regional War If Directly Attacked [Zerohedge]

Alert: Russia used an advanced hypersonic missile for the first time in recent strike, Ukraine claims [CNN]

Breaking: Strong US labor market underpins economy in first quarter [Reuters]

We're also hearing rumours of US and Europeans troop being recalled.

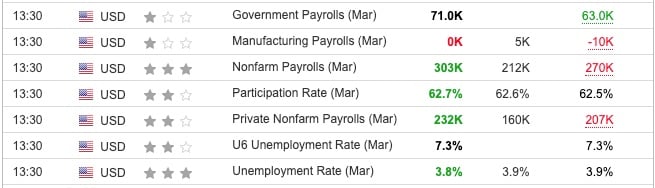

US Nonfarm Payroll March 2024

Much stronger than expected US employment numbers added fuel to the fire that no rate cuts are possible economically. The danger is that if Powell is forced to cut for election and US debt reasons, markets will start anticipating an inflationary bubble and long rates could rise significantly.

Fed Risks 70's Mistake If It Cuts Rates Too Soon, T. Rowe Says [Financial Post]

Flight to Commodities

Silver Monthly

Silver followed Gold, Copper, Cocoa and other commodities higher amidst reported hedge fund buying of physical Gold.

United States

A massive week in capital markets despite Monday being a holiday.

Tuesday brought us the ISM Purchasing Managers Index(s) showing a positive upward change. Although a leading indicator, it caught the markets off guard and suggested that those FED cuts may not be cutting after all.

US ISM PMIs March 2024

Tuesday also brought us something new. A small long dated treasury buy-back.

Click to see bigger image.

Looks like a test program for some sort of yield curve control.

Wednesday saw Powell speaking at Stanford University

Fed Chair Powell delivers remarks on the economic outlook at Stanford Business School

While his predecessor Alan Greenspan gave us a hint how this is going to play out, many years ago

Alan Greenspan gave away the game plan years ago.

— Financelot (@FinanceLancelot) April 5, 2024

US isn't going to default on its debt. They're going force everyone else to default on theirs by rates & Dollar shortages.

When everyone is forced to sell US Treasuries they'll buy them below face value.pic.twitter.com/pkUn9Wf1ww https://t.co/ptPaBHHZeW

And oil started surging, now up 26% this year

Wall Street Is Suddenly Sweating 5% Yields Again, Thanks to Oil’s Surge [Bloomberg]

Crude Oil WTI Futures - May 24 (CLK4)

And on Friday

What happened overnight? US rally wiped out by rate comment, oil spike

And Gold hit a new all-time high

Gold Daily

So we have inflationary pressures via oil and other commodity prices, wage increases, SaaS companies hiking subscriptions and much more, on top of crazy fiscal spending

$1.2 Trillion spending bill. Over 1,000 pages. Released at 2AM today. Just got approved now, 10 hours after. No one could possibly read it. They threw in everything but the kitchen sink.

— Gabor Gurbacs (@gaborgurbacs) March 22, 2024

Ladies & Gentlemen— This is democracy. What's the point of taxes if we can print trillions? pic.twitter.com/EOX5uwkLOz

In The Background

Are rate cuts more likely in Europe ?

Germany CPI March 2024

EU CPI March 2024

EU PPI February 2024

EU Retail Sales February 2024

Global bankruptcies

This factory contaminated the whole world. And you helped pay for it [Sydney Morning Herald]

Gold-backed currencies are back

Zimbabwe Replaces Battered Dollar With Unit Linked to Gold, FX

Commercial real estate

From the Financial Times article on banks and property-related debt: "Newmark, a real estate advisory and brokerage company, said the estimated $2tn of US commercial real estate debt maturing between this year and 2026 would have to be refinanced at much higher interest rates. According to US Mortgage Bankers Association data provided by Newmark, $929bn of commercial real estate debt will need to be repaid or refinanced this year alone." I suspect this issue will end up being less about funding -- there is a lot of cash on the sideline waiting to engage -- and more about price discovery, actual transactions, and the consequences for balance sheets that are yet to mark to market large holdings.

Bank of Korea Warns of Economic Hit if Property Slump Lasts n[Bloomberg]

Japan

Japan To Embark On An Era Of "Mass Foreign Immigration"

Australia

RBA Didn’t Consider Case to Raise Rates in March, Minutes Show

RBA's Kent: No change to current rundown of balance sheet [FX Street]

Australia to Switch to New System for Monetary Policy Implementation [Bloomberg]

Insolvencies grow as businesses bear the brunt of an economic ‘perfect storm’ [The Australian]

Australia Trade Balance February 2024

More of nothing in Australia as the economy slows, house prices still moving higher driven by immigration and inflation still elevated and much higher than the officially reported CPI numbers.

What's Next

Markets are not fully pricing in escalation of war, and are determined in hoping that the FED will cut interest rates.

Gold and Silver exploding higher tells us that some actors are taking evasive action.

Look for further rises in commodities amidst the geopolitical mess.

Wednesday's US CPI report is more likely to surprise on the high side than on the low side. PPI is on Thursday along with the ECB interest rate meeting and decision.

The result of Friday's 30 year US bond auction will be in close focus.

This Week's Important Economic Indicators [London time]

![This Week's Important Economic Indicators [London time]](https://vip.suberia.capital/hs-fs/hubfs/indicators-Apr-06-2024-05-31-56-4564-AM.jpg?width=800&height=582&name=indicators-Apr-06-2024-05-31-56-4564-AM.jpg)

Ian Reynolds

Ian Reynolds

-1.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(16)-1.jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(17).jpg)