A Ray of Hope

Limit Up! --> Website | Substack | YouTube

Overnight

Economic Indicators Released Friday

EU Services PMIs were slightly lower and US Non-manufacturing PMIs mixed, was the best we could do with a day marked for Nonfarm Payroll action.

The result was very interesting. Without distracting data, currencies and bonds were dead, but Bitcoin, Gold and Silver surged and global stock markets hit all time highs.

US Equities

Breaking

Takaichi set to become Japan’s first female PM [AFR]

Trump tells Hamas to ‘move quickly’ on hostage deal during pause in Israeli bombardment [FT]

German economy ministry revises 2025 growth forecast up slightly to 0.2%, source says [Reuters]

Precious Metals / Commodities

Gold continues towards $4,000 despite early poor price action. We're getting near a local top around $4,000 though.

Equally for Silver, early selling was erased by a strong bid into the close at just under $48.

Brent confirmed below the rectangle as economic news and slightly positive geopolitical news pushed price lower.

Bitcoin (& Crypto)

Confirmed break out in Bitcoin but we're only into neutral territory at the all time highs.

CRE / Banks / CLOs

|

|

|

More big haircuts and lots of legal process going through still.

United States

US Economic Indicators

With the government shut, ADP gave us a clear sign that the job market is in trouble. With no other data available the FED will have to cut on the 29th, assuming government still shut.

Yields were pretty stable last week with the previous FED cut seemingly putting a floor beneath the 10 year at 4%.

US 10 Year Government Bond Yield Daily

China

China Economic Indicators

Slightly better than expected PMIs in China and a week's holiday is now upon us.

Stock markets are still rallying.

HANG SENG Daily

Europe

EU Economic Indicators

EUR/USD Daily

The expected rebound in the German economy just hasn't happened and it now looks like getting worse.

The Euro maintained the break from the bull flag but price needs to accelerate higher to keep the momentum up,

Canada

Canada Economic Indicators

A quiet week for Canada. 30 Year yields are consolidating before another drop.

Canada 30 Year Government Bond Yield Daily

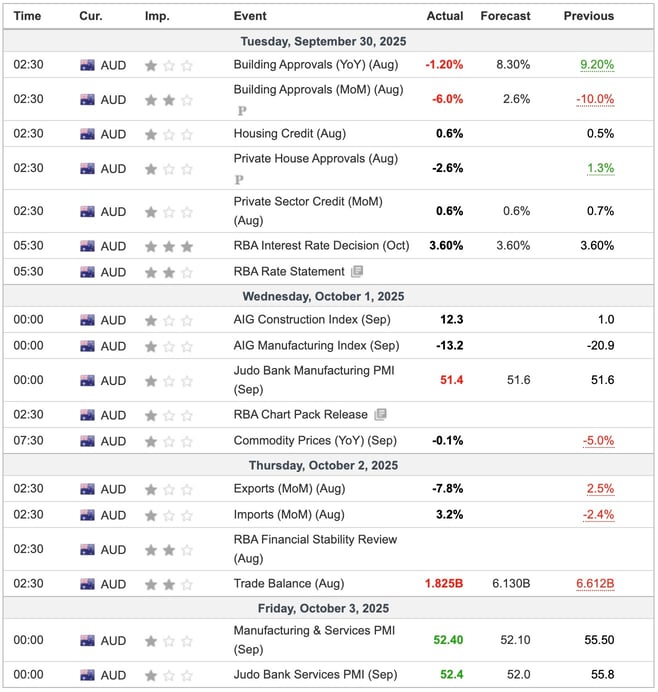

Australia

Australia Economic Indicators

US offers to buy stakes in Australian critical minerals companies [Reuters]

Rates held at 3.6% and a big drop in exports particularly Iron Ore.

Japan

Japan Economic Indicators

Really good news for Japan, as it's first female prime minister looks to make some positive, much-needed changes.

Needless to say the stock market cheered.

NIKKEI 225 Daily

What's Next?

Powell speaks on Thursday as part of the Federal Reserve's community bank conference agenda, so don't expect too much.

NFP etc pencilled in for next week if government reopens. Otherwise more of the same.

This Week's Important Economic Indicators [London time]

Ian Reynolds

Ian Reynolds

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(11).jpg)