Chaos in Japan

The YEN carry trade in back on as hedge funds and other nasty speculators pile into US tech stocks by borrowing in YEN.

And why not? FED still hasn't cut and BoJ can't hike. There's only one winner

USD / YEN Daily

USD / YEN recovers as does the Nikkei 225.

Nikkei 225 Monthly

Breaking

US Considers a Rare Antitrust Move: Breaking Up Google [Bloomberg]

New Zealand delivers first rate cut in over 4 years and flags more easing [Reuters]

People leave New Zealand in record numbers as economy bites [Reuters]

In Focus

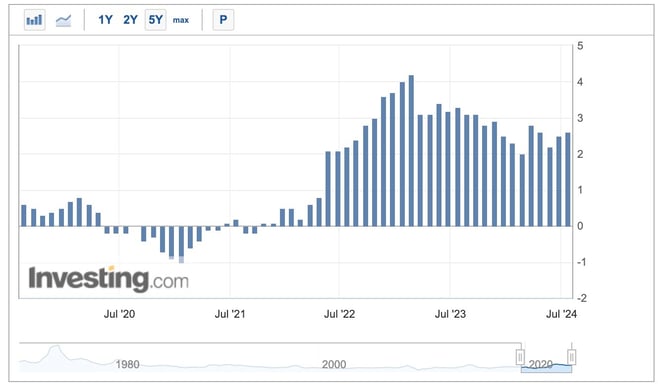

China

Source: Trading Economics

Banks and other fixed-income investors are buying long-date government bonds because the economy is struggling and better alternatives don’t exist. The stock market is at the same price as 15/20 years ago. Real estate continues to collapse and capital is leaving the country.

Foreign Investors Pull Record Amount of Money From China[Bloomberg]

China Regulators Tell Some Rural Banks to Renege on Bond Trades [Bloomberg]

The PBoC and others are trying not to repeat the experience of the western central banks, that is a bubble in bonds where yields go to zero, stoking inflation and where having to hike rates kills everyone.

And they're really bungling it. Now SMEs are collapsing and massive steel producers are sounding the alarm bell.

World’s Biggest Steel Producer Warns of ‘Severe’ Industry Crisis [Bloomberg]

Multinationals sound alarm over weak demand in China [Bloomberg]

Foreclosures Rise in China as Homeowners Struggle to Repay Mortgages [Caixin Global]

China House Prices, Unemployment Rate July 2024

Luckily the YEN is hogging all the focus in currencies, which has allowed the PBoC to fix the YUAN lower.

Japan

Another day another Prime Minister. And Ueda summoned to parliament to discuss the rate hike mess.

Japan Set for Yet Another New Leader as PM Kishida Steps Aside [Bloomberg]

Japan parliament asks central bank governor Ueda to discuss rate hike [Reuters]

Japan PPI July 2024

Japan GDP Q2 2024

Japan Industrial Production June 2024

US Economy

This week's PPI (lower) and CPI (lower if you look really hard) were offset but a strong retails sales number. With massive discounting at stores currently and the anecdotal evidence of the Walmart report that number of customers grew as those more affluent had to trade down, those retails sales number take on more significance.

Top Fed official ‘open’ to September rate cut as inflation cools [FT]

Trucking industry shows signs of life after long downturn in US [FT]

US PPI July 2024

US CPI July 2024

US Initial Jobless Claims , Retail Sales July 2024

US Housing Starts July2024

How the US Treasury Will Fund the Next $20 Trillion in Debt [Bloomberg]

In The Background

CRE / Banks / CLOs

|

|

|

UBS to Close Legacy Real Estate Fund on Office Market Woes [Bloomberg]

Canada

The duel real estate crises in the US and Canada are coming to a head. And that's residential not commercial.![]()

Canada Building Permits June 2024

Real Estate Insolvencies to Surpass Global Financial Crisis Levels" {Globe & Mail]

Europe

EU Industrial Production June 2024

United Kingdom

Britain likely to lose nearly one in six millionaires by 2028, report says [Reuters]

UK Unemployment June 2024

UK CPI /PPI July 2024

The UK is coming into focus now as it battles the economic effect of leaving Europe and the impact of massive migration. Look for problems to escalate but whereas other countries will lose control, many years of the IRA, strikes and the likes leaves the British public with a stiff upper lip.

Australia

Stalemate in Australia as the infighting continues. RBA vs Government now joined by corporate regulator suing the stock exchange. The only thing of joy was the breakdancing Aussie olympian.

Stop telling us what to do with interest rates: RBA deputy[AFR]

What's Next ?

Very light of numbers next week. Crypto and stock markets will indicate when the easing cycle starts.

The Jackson Hole FED meeting will be the defining moment for Chair Powell as he'll be leaving soon. He's done his time and he desperately wants to leave with his reputation intact. Imagine having to set monetary policy against the fiscal insanity of Trump or Harris. At least everyone used to be able to blame COVID.

This Week's Important Economic Indicators [London time]

![This Week's Important Economic Indicators [London time]](https://vip.suberia.capital/hs-fs/hubfs/indicators%2019082024.jpg?width=658&height=393&name=indicators%2019082024.jpg)

Ian Reynolds

Ian Reynolds