Limit Up! 30 October 2025

Limit Up! --> Website | Substack | YouTube

Overnight

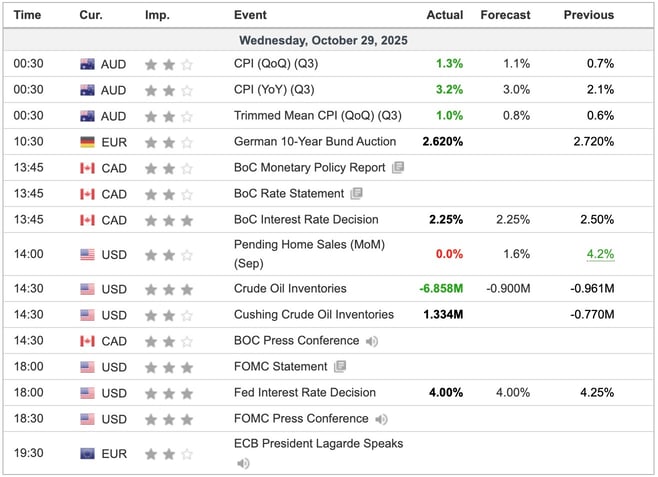

Economic Indicators Released Overnight

Terrible inflation numbers in Australia seems to have derailed the RBA's eternal desire to cut rates. A spike in inflation in Canada this month didn't stop the BoC cutting yesterday, or the FED who have no data to depend on.

The concerted lowering of rates by central banks may be viewed as a concerted policy error. Only time will tell. Read more

Fed chair Powell losing grip as rate cut decision shows division [investing.com]

Fed trims US rates by quarter point but casts doubt on December cut [FT]

Bank of Canada cuts key interest rate to 2.25% [CBC]

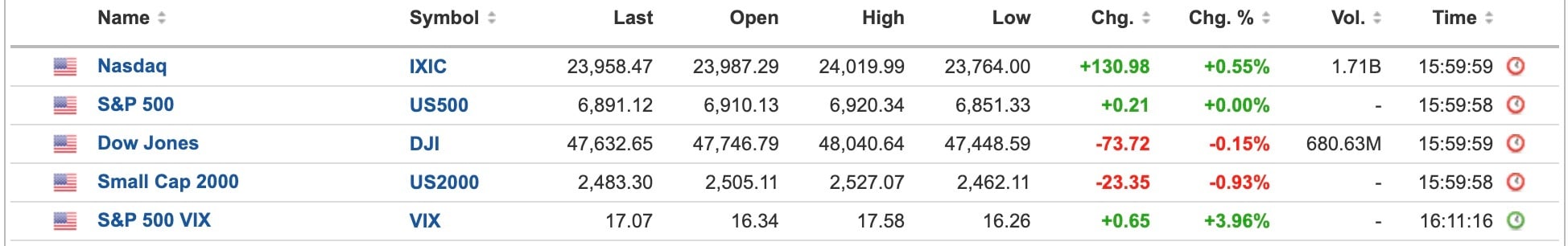

US Equities were unfazed.

Breaking

S&P 500 gives up gains after Fed’s Powell cools bets on December rate cut [investing.com]

Trump Uses Government-Investing Push to Boost Nuclear Industry [Yahoo! Finance]

Bitcoin

Bitcoin continues to trade poorly with any rally getting quickly sold into. Price tagged our tentative uptrend support. This price action 4 years ago would have been an 80% drawdown but we’re still 100k plus. Read more

Foreign Exchange

The USD jumped as Powell was not as bullish as markets thought he might be. Price has increased 3% since the last rate cut, a similar thing happening to yields. Read more

Equities

S&P spiked lower on Powell but recovered nicely. We couldn’t close the first gap at 6,845 and leave a wick underneath. Read more

Bonds

10 year yields rise 10bps as Powell announces 25bps cut. We’ve seen this movie before. At this rate Trump will force Fed Funds to 1% and 10 years will be at 6%. At least the banks would love it. Read more.

US 10 Year Government Bond Yield Daily

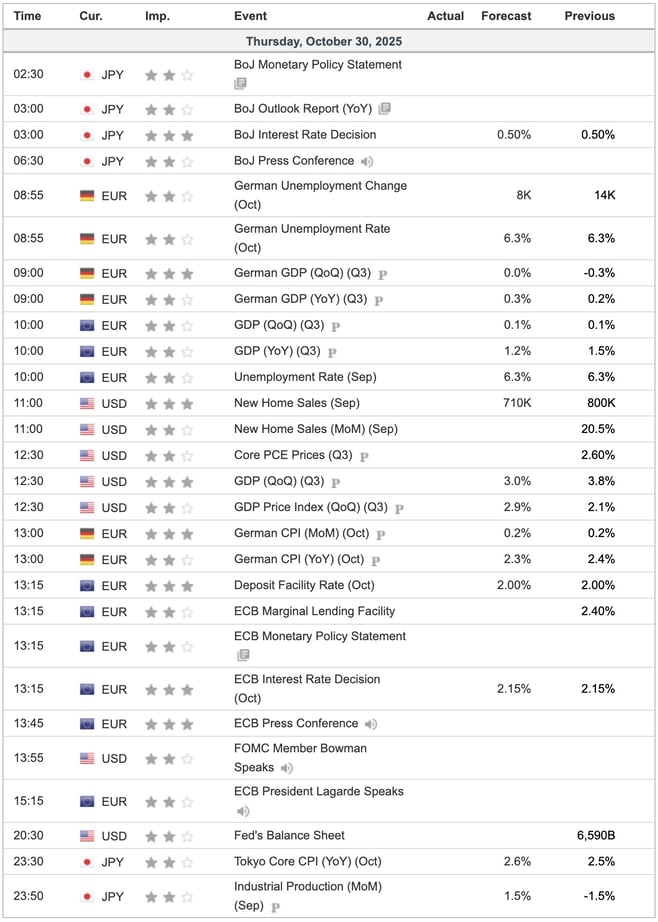

Economic Indicators Today

Ian Reynolds

Ian Reynolds

.jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(47).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(5).jpg)

-1.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(30)-1.jpg)