Limit Up! 24 October 2025

Limit Up! --> Website | Substack | YouTube

Overnight

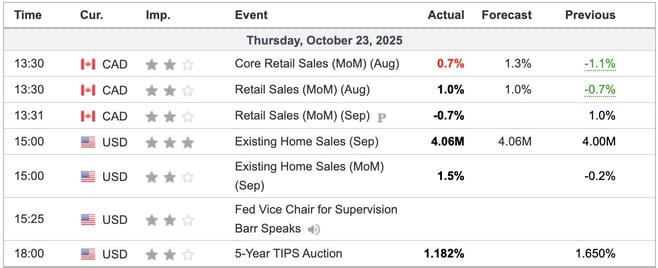

Economic Indicators Released Overnight

Retail sales rebounded strongly, rising 1.0% month-over-month (m/m) to C$70.4 billion, beating expectations and recovering from July's 0.8% decline. Growth was driven by:

Motor vehicle and parts dealers: +1.8% (new cars up 2.3%).

-

- Clothing and accessories: +3.2%.

- General merchandise: +2.4%.

- Core sales (excluding autos and gas): +1.1% m/m.

- September 2025 Advance Estimate: Sales are projected to fall 0.7% m/m, based on partial survey responses (48.4% of companies). This preliminary figure is subject to revision in the full November release.

In the US Existing Home Sales showed a strong rebound.

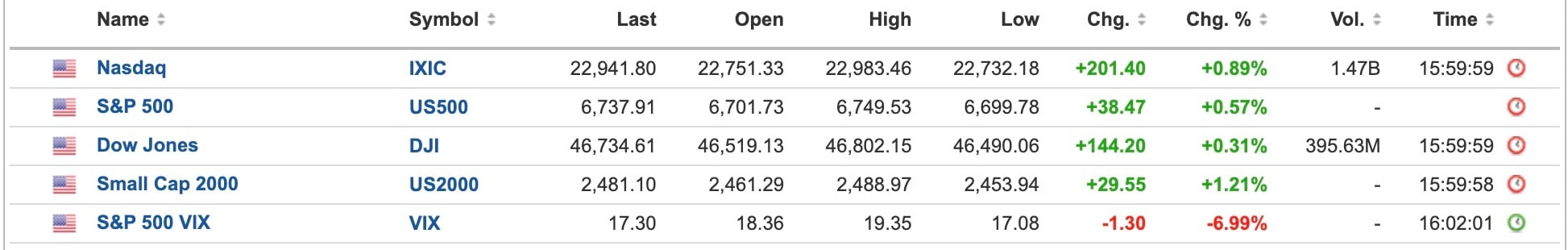

Equities confounded the doomsayers with a nice rally.

US Equities

Breaking

Exclusive: China state oil majors suspend Russian oil buys due to sanctions, sources say [Reuters]

Bank of America Warns of Forced Stocks Selling If Credit Problems Persist [Bloomberg]

Bitcoin

As Gold and Silver fever takes a break, all eyes are are on Bitcoin again. Price can’t get above the short-term downtrend at 111.5k so it’s near now. Equally to the downside, despite the appalling price action, we still haven’t closed below 106.5k. Read more

Commodities

Double trouble pushing oil prices higher suddenly. The US buying a million barrels for the strategic reserve front ran sanctions on Russian oil companies. Price has spiked to the breakdown from the rectangle at 66.10. Read more

Foreign Exchange

Price closed higher than trend resistance at 152.40. Now we look to see confirmation tomorrow and can declare a trend. Below 150.35 negates. With DXY stable and AUD/USD undecided this could be the trend that finally washes out the YEN carry trade and, as such, will get interesting. Read more

Equities

The world keeps ending for all those talking heads, but price keeps rising. This is building into an epic short squeeze possibility. Read more

More on Substack

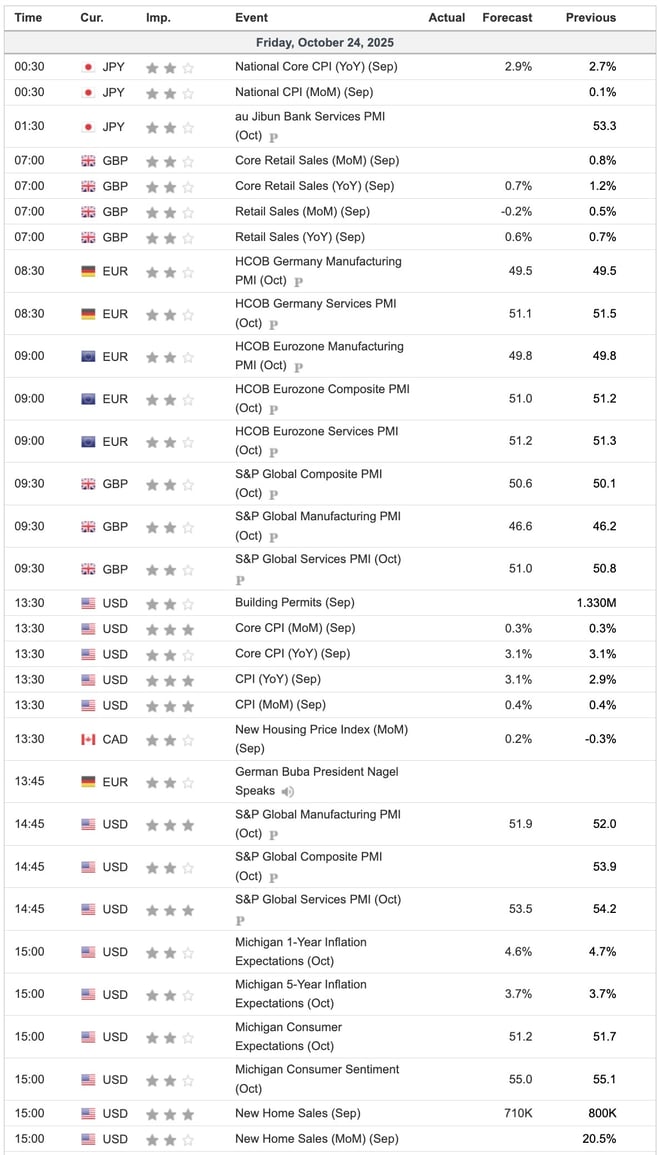

Economic Indicators Today

Ian Reynolds

Ian Reynolds

.jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(58).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(89).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(83).jpg)