Limit Up! 21 October 2025

Limit Up! --> Website | Substack | YouTube

Overnight

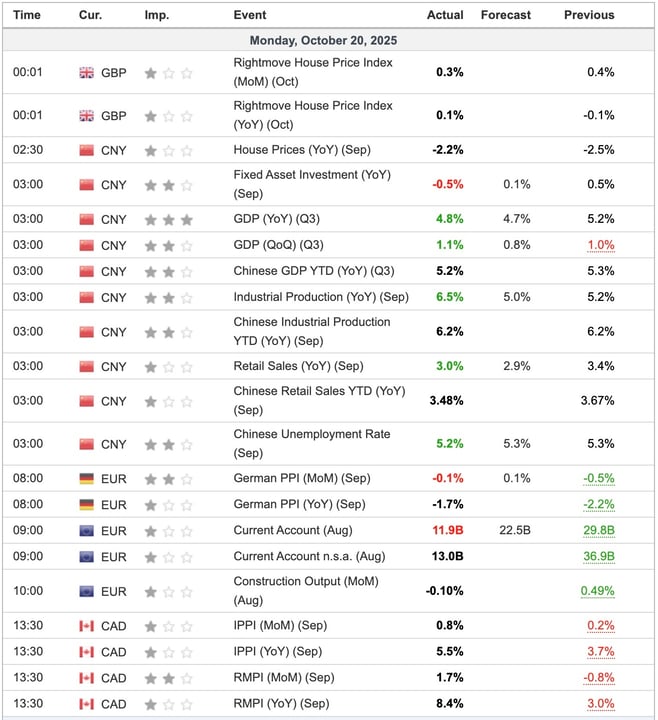

Economic Indicators Released Overnight

Some data finally but not from the US. In China the stronger Industrial Production supports yesterday's strongly higher trade numbers but the rest of the data tells us that spinning the wheels quicker doesn't work in quicksand.

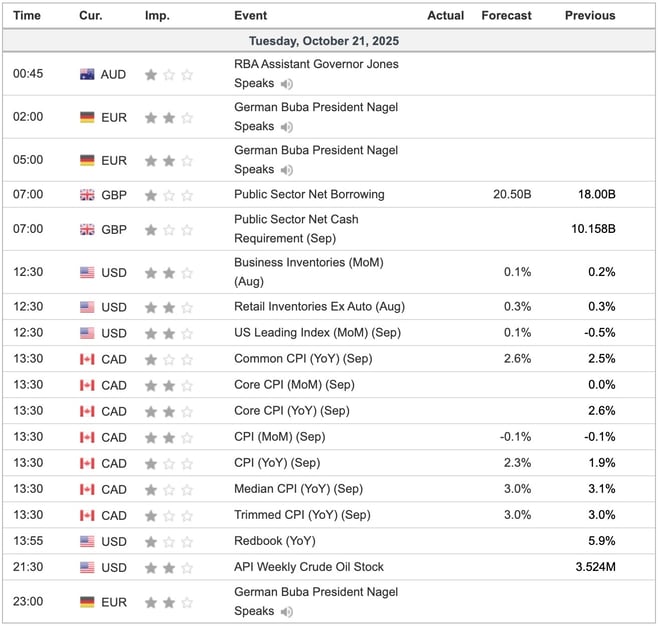

Those industrial and resource price increases in Canada aren't a good look, let's see where CPI comes in later today.

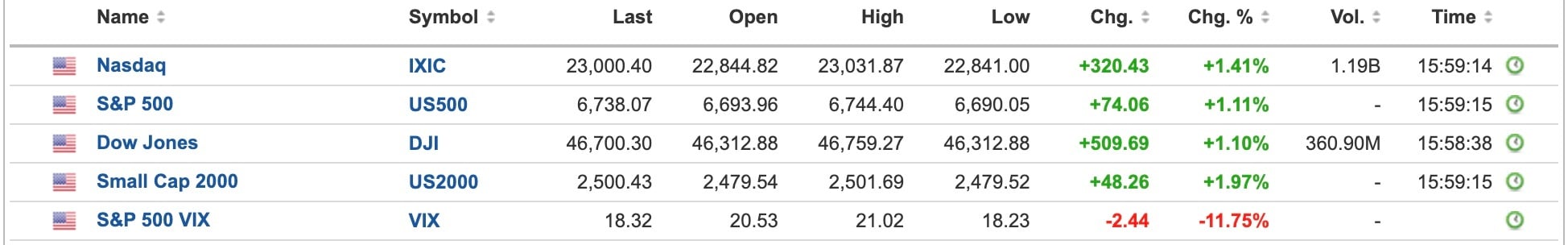

The buy all hard assets trade continues with equities surging and Vix going lower

US Equities

Breaking

PrimaLend creditors consider bankruptcy push as payments stall - Bloomberg [investing.com]

Albanese and Trump commit to $13b in critical minerals projects [AFR]

Europeans rush to Zelenskyy’s defence after tense Trump meeting [FT]

JPMorgan warns First Brands fallout driving up banks’ funding costs [FT]

S&P 500 Climbs 1% as Earnings Kick Into High Gear [Bloomberg]

Amazon Outage Still Hampers AWS Service as Recovery Drags On [Bloomberg]

Bitcoin

Social media telling us sell Gold, Buy Bitcoin is the cool asset switch but it’s not true. BTC and Gold both rallied hard yesterday. It’s a non-credit trade. Read more

Commodities

Gold springs back, without Silver following, as FOMO hits globally. Technically we still need to confirm above 4,380 for a big surge higher. Those long wicks pushing off the top of the trend channel suggest a much higher price is coming soon. Read more

Foreign Exchange

Supported by a bounce in the DXY, USD/YEN’s downward trajectory has been reversed, for now a least. Zooming out if the USD is bottoming, and that’s not clear yet, and the new Japanese Prime Minister is going to pursue a more stimulatory fiscal policy, then USD/YEN should be a one way bet higher. Read more

Equities

The beginning of earnings season gave price a boost yesterday and we’re back to resistance at 6,740. The bigger tech stocks release earnings next week so we may well consolidate under resistance until we have more data. Read more

More on Substack

Economic Indicators Today

Ian Reynolds

Ian Reynolds

.jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(54).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(86).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(83).jpg)