Limit Up! 2 December 2025

Limit Up! --> Website | Substack | YouTube

Overnight

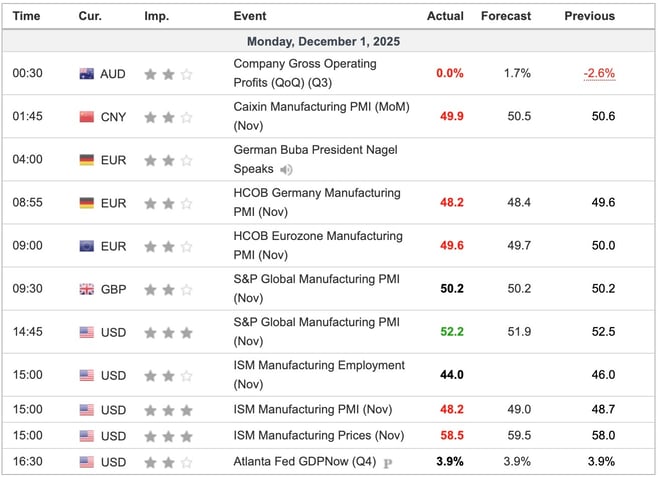

Economic Indicators Released Overnight

A day of PMIs and pretty much all of them were worse than expected. Added to Chinese manufacturing PMI which has contracted for the last 9 months. So the mood was negative with JGBs taking the limelight away from Silver.

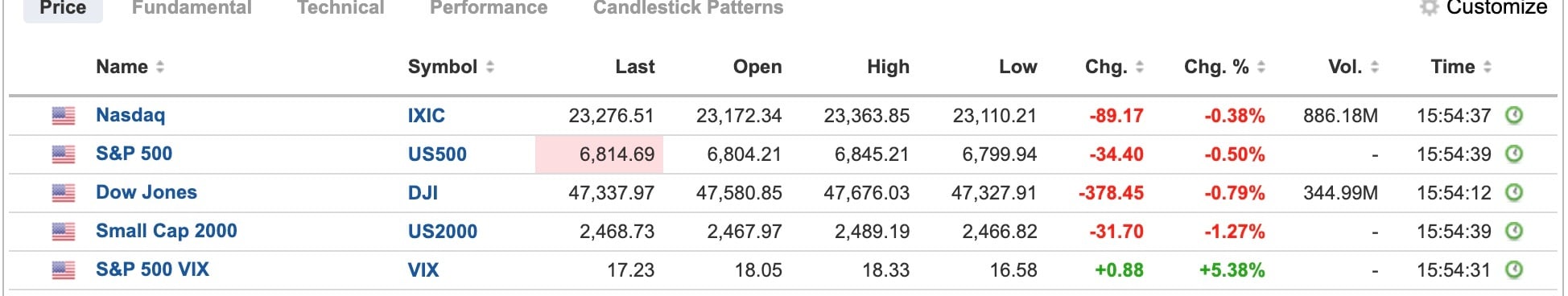

The return from Thanksgiving was in clear juxtaposition to the slow drift up of risk assets last week.

US Equities

Breaking

Global bonds slide after hawkish Bank of Japan comments [FT]

Chinese airlines slash over 900 Japan-bound flights amid Taiwan tensions [Nikkei]

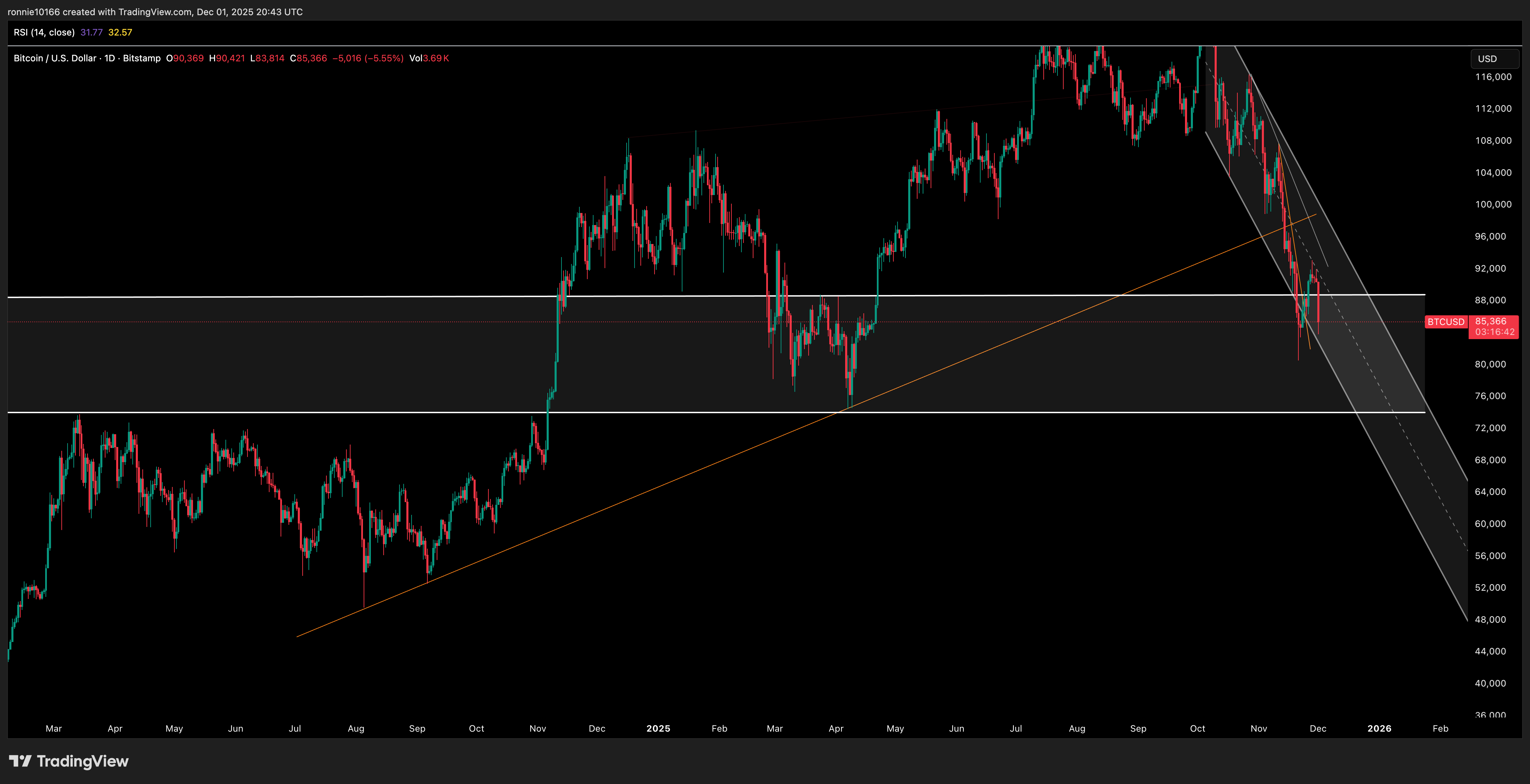

Bitcoin

We’re seeing some good sellers: sovereigns, funds - long term investors, liquidate their Bitcoin and it looks like they’re buying Silver. It not just X telling us that, it’s the BTC price action and the number of substantial buyers of physical metals. Read more

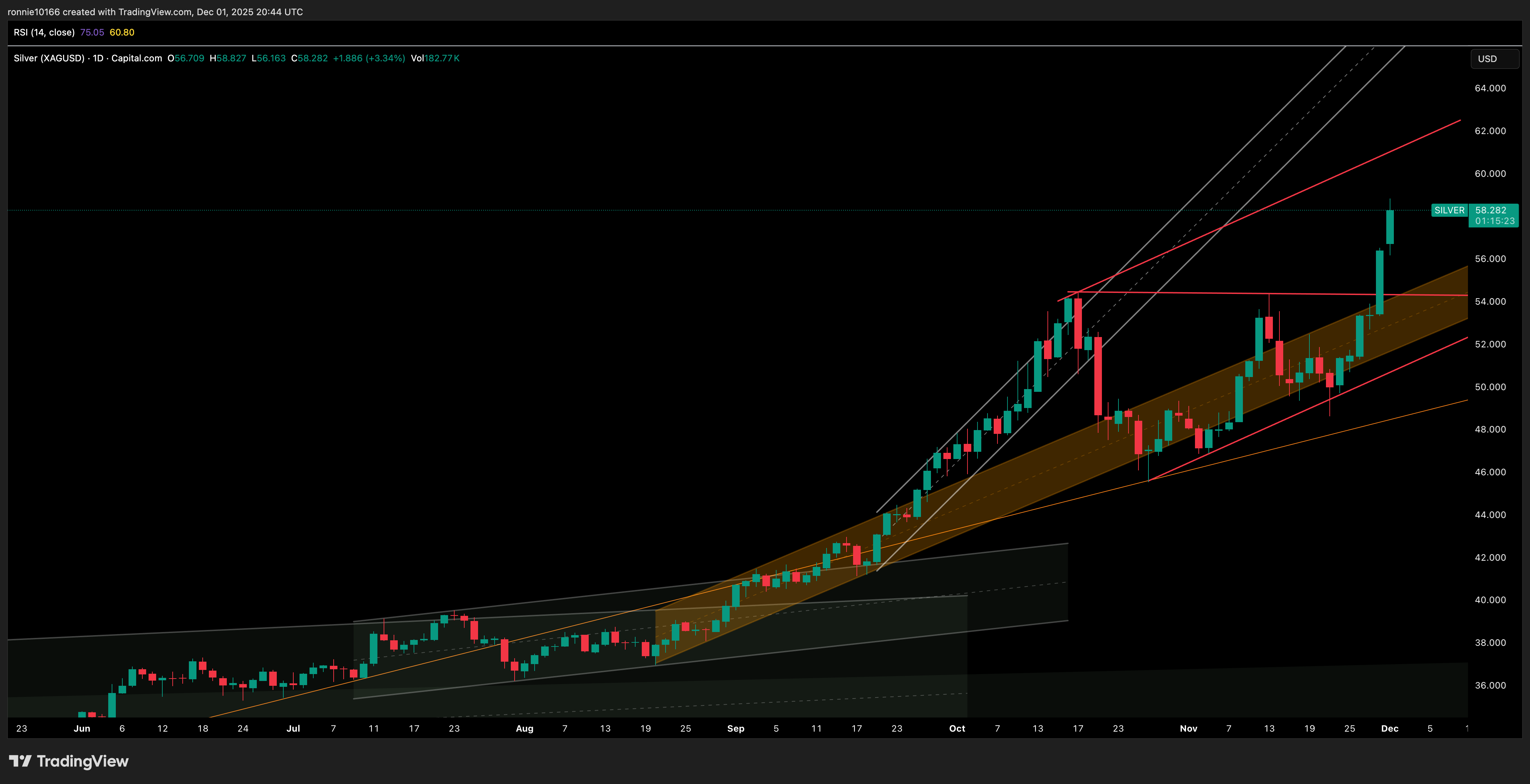

Commodities

Conspiracy theories abound, from sabotage at the CME to the ghost of Bunker Hunt! All good fun, especially as Silver confirms the break over 54.40 and hits an all time high at 58.80. Read more

Foreign Exchange

Japanese 10 year yield hits 1.88% - not seen since 2008. And X goes mad with Japan bringing the global financial system down and BoJ pre-warning us that they’re going to hike rates on 19 December. Read more

Bonds

UST10 tagged the trend support at 3.97% as we suggested it would, and then spiked higher. Clear targets above at 4.18% and 4.20% before a big sell-off in price to yield 4.30%. Read more

US 10 Year Government Bond Yield Daily

Economic Indicators Today

Ian Reynolds

Ian Reynolds

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(38).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(58).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(55).jpg)