Limit Up! 17 October 2025

Limit Up! --> Website | Substack | YouTube

Overnight

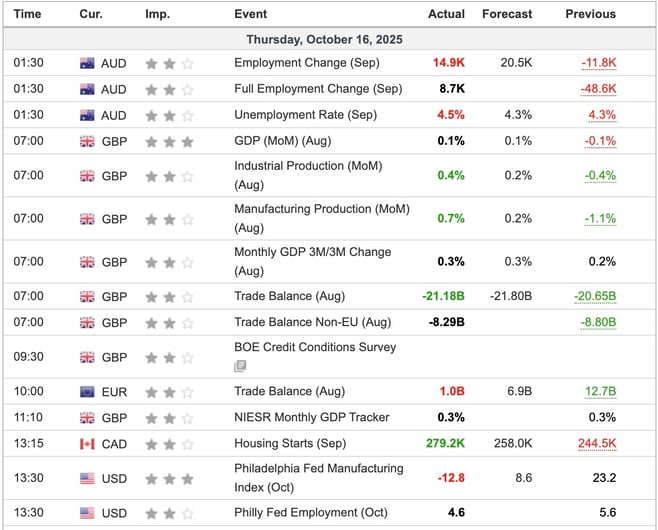

Economic Indicators Released Overnight

A big jump in the Australian Unemployment Rate surprised FX traders, keeping AUD/USD below the 15 year downtrend in the face of a weaker USD. Otherwise Philly Fed disappointed and UK numbers better than expected.

US Govt still shut.

Gold and Silver surged higher yet again, while equities stalled and Bitcoin is thumped yet again. USD and bond yields were lower.

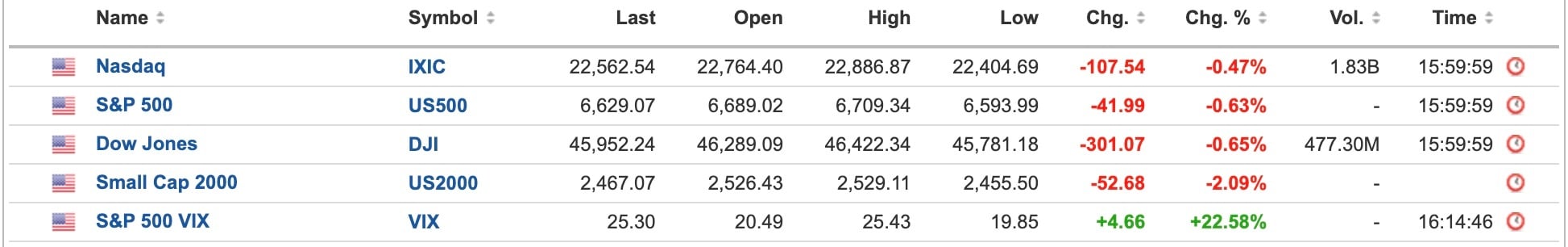

US Equities

Breaking

Fed's Waller on board for an October rate cut, as Miran again presses for aggressive easing [Reuters]

On The Verge Of A Funding Crisis: Fed's Emergency Liquidity Facility Unexpectedly Soars Most Since COVID [Zerohedge]

Barclays warns UK faces gilt market challenges ahead of Budget [investing.com]

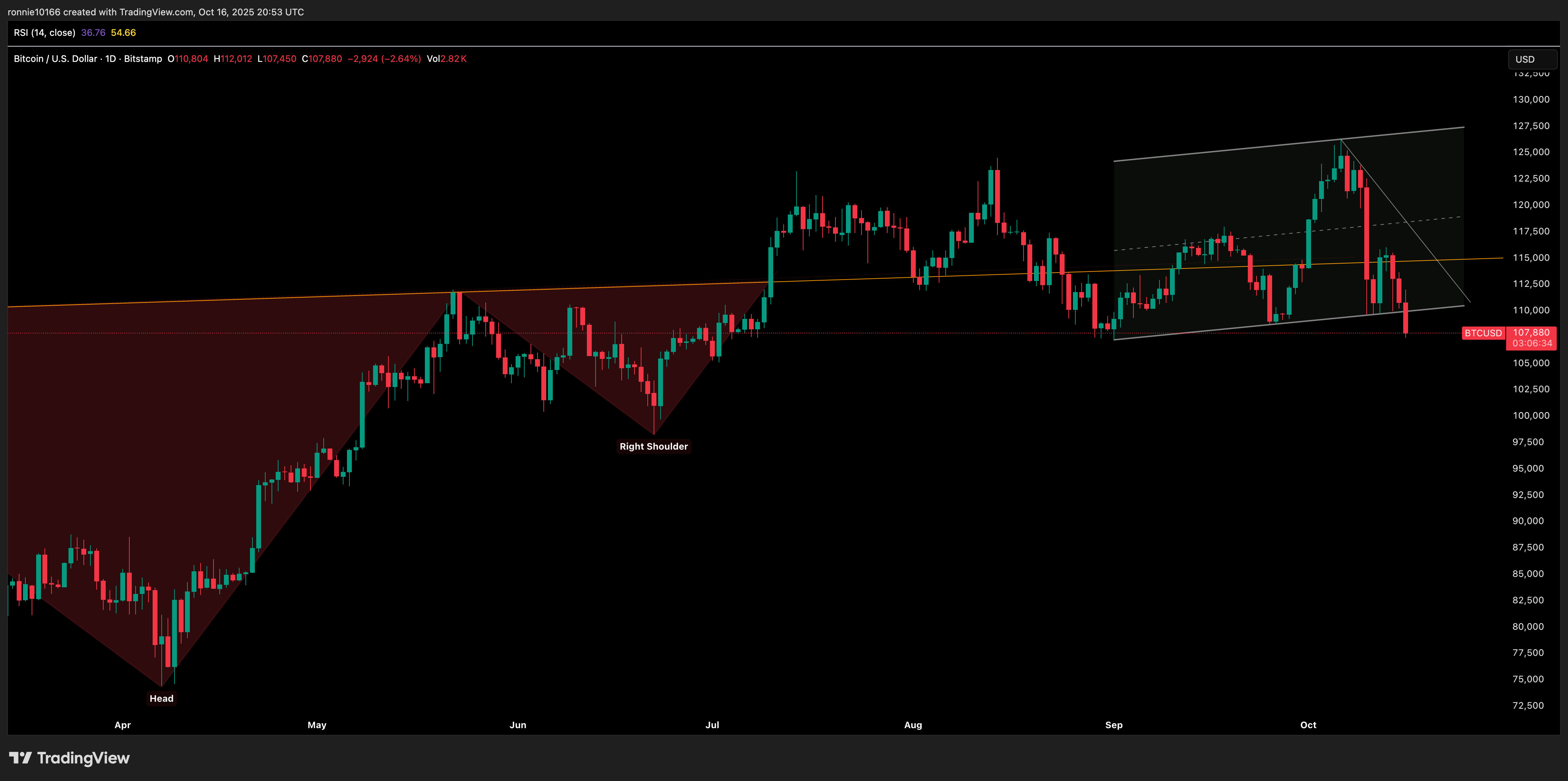

Bitcoin

The chances of a test of 100k are growing as price action is really poor. We couldn’t get above 116k and now 3 solid down days could lead to 7 solid down days. Read more

Commodities

Price has taken out support at 62.70 and now looks to 59.10. Nice place to move your stop down is above 64.25, as we approach the clear air pocket below 58.70. Read more

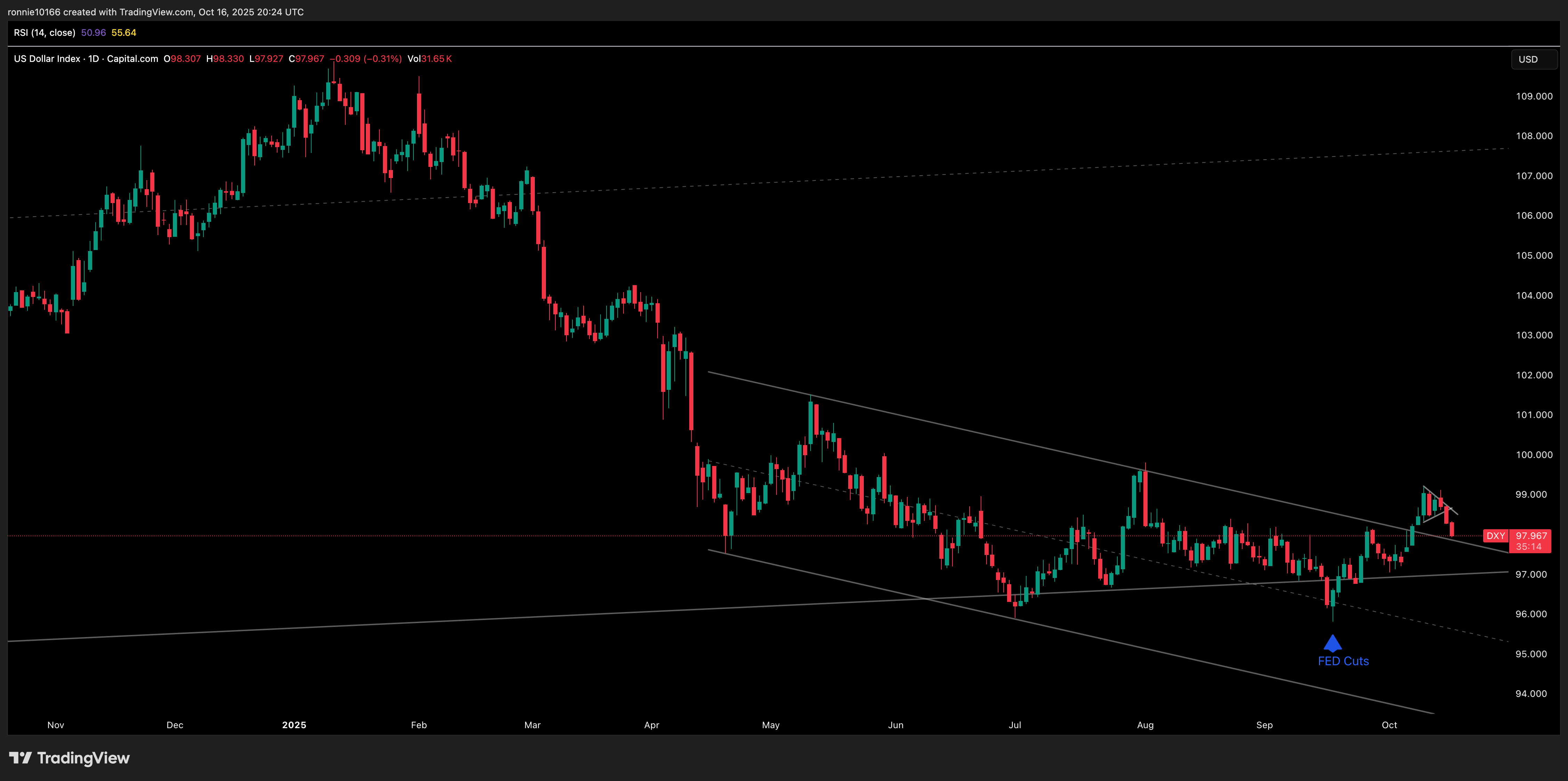

Foreign Exchange

Ok so the conclusion was break back lower towards the break of the downtrend at 97.85. 15 year support is at 96.80 today and price can’t seem to break away from it. Read more

Equities

Looks like the impulse to get back into the uptrend has failed, and a close below 6,630 would be bearish. Plenty of support if we go lower, but buyer beware below 6,210. Read more

More on Substack

USD/YEN Update 17 October 2025

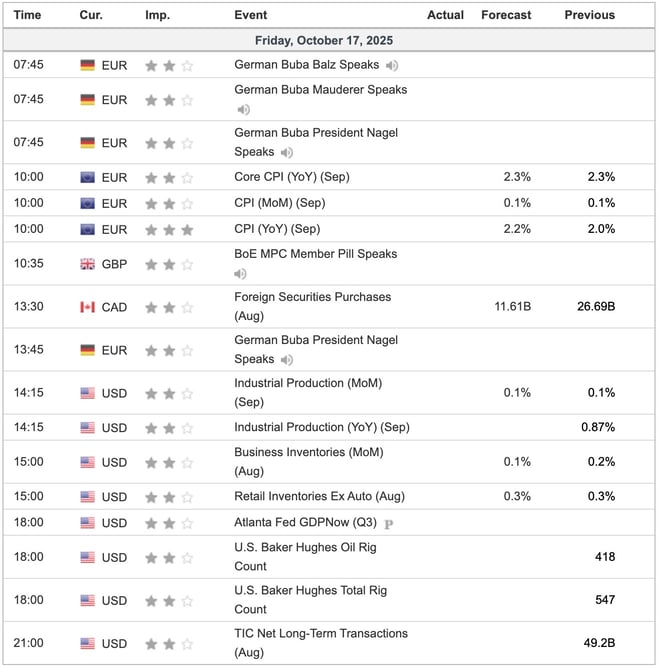

Economic Indicators Today

Ian Reynolds

Ian Reynolds

.jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(20).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(9).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(6).jpg)