Limit Up! 16 October 2025

Latest Podcast

Limit Up! --> Website | Substack | YouTube

Overnight

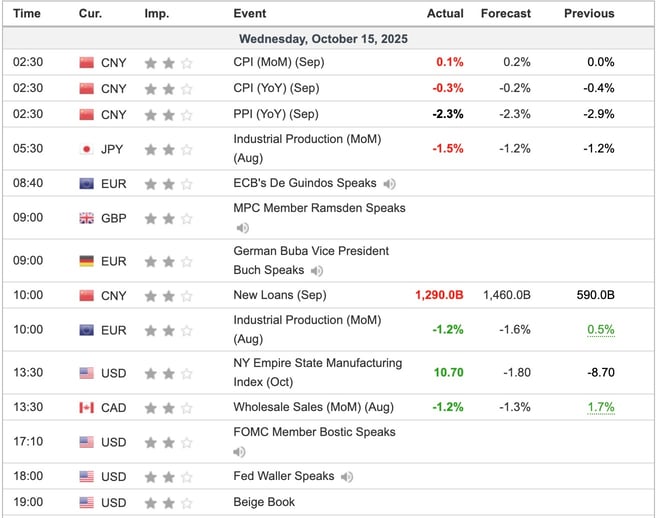

Economic Indicators Released Overnight

Latest FED's Beige Book shows little change from previous report

Markets were quiet, watching latest Trump nonsense. No wonder Gold and Silver are going mad.

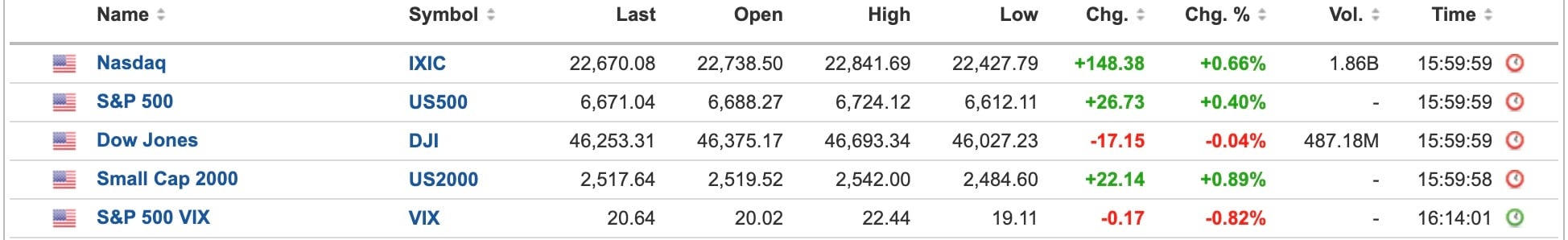

US Equities

Breaking

US regulators poised to offer capital relief to community banks, Bloomberg News reports [Reuters]

Trump needs emergency powers to protect US economy [NY Times]

US Treasury arranging fresh $20bn in debt market support for Argentina [FT]

S&P 500 ends higher after strong bank earnings, chip stocks rally [Reuters]

Bitcoin

BTC can’t get higher even if equities are rallying. FOMO has loose money pouring into Silver and Gold. Read more

Oil

At last the trend seems to be in place for a move a lot lower. With Chinese economy still slowing and US economy only kept alive by AI spending, a big slowdown in oil consumption is coming, and the world is awash with it. Read more

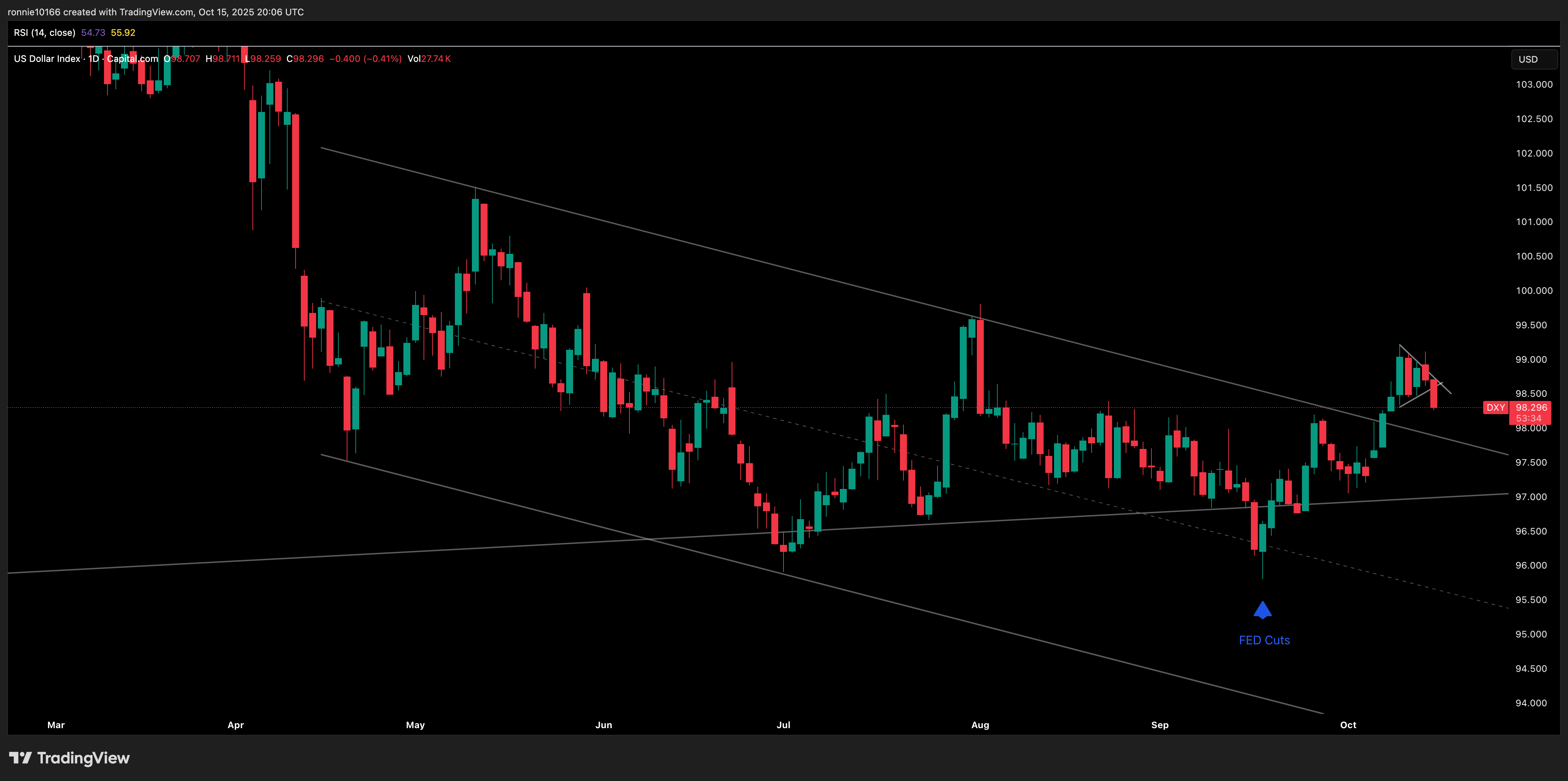

Foreign Exchange

Long-term view of the USD having bottomed out still doesn’t have a resolution. AUD/USD supports this. Short-term we’ve broken lower to revisit the scene of the crime at 97.90 and there will be plenty of support before then. Read more

Equities

Not much to go for on the NASDAQ. Price is rangebound. All background says price should rise: FED will cut, QT is ending, maybe QE on the way. Powell saying tightened economic conditions is the excuse to fire all the guns. But price is still here.

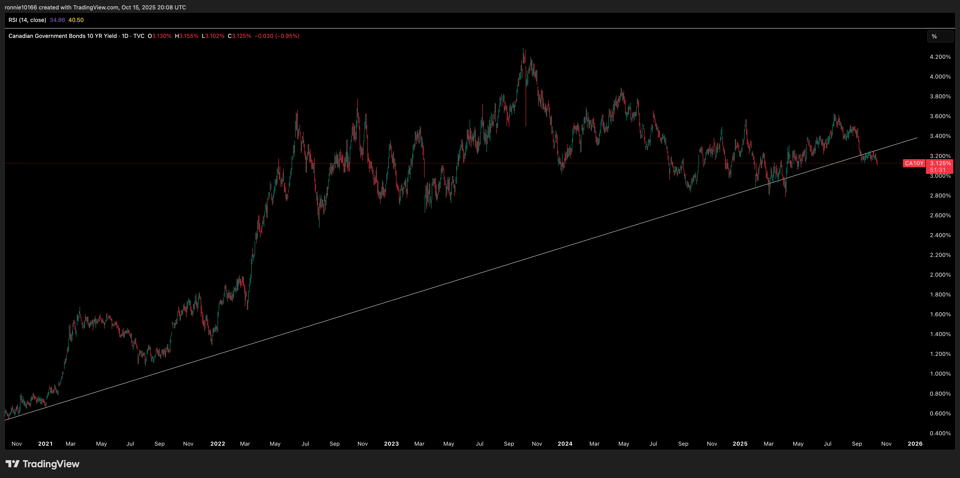

Bonds

More rate cuts are coming to Canada as yield breaks support from COVID. Unlike US, UK and Europe, where rate cuts are supporting yields because inflation and debt won’t let yields lower, the Canadian economy is in real trouble.

Canada 10 Year Government Bond Yield Daily

More on Substack

AUD/USD Update 16 October 2025

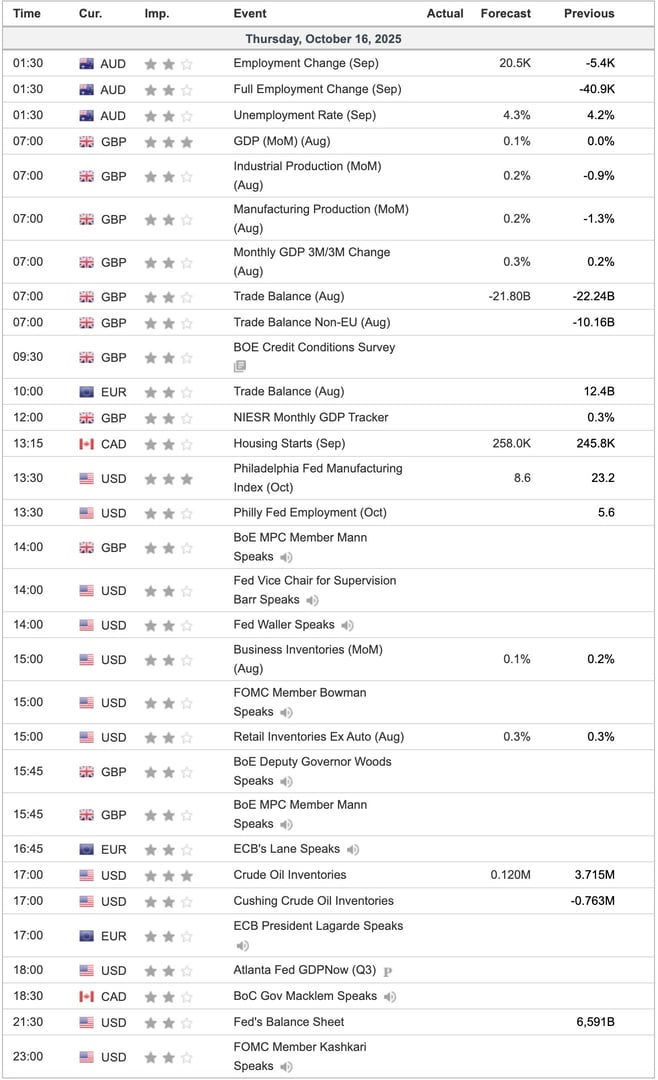

Economic Indicators Today

Ian Reynolds

Ian Reynolds

.jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(75).jpg)