Limit Up! 15th July 2025

Podcasts | Daily LinkedIn | Weekly LinkedIn | Check out the website

Overnight

China Trade Balance

China's trade report underlined that the export machine is still working.

-

Trade surplus jumped to approximately $109.0 billion in June, up from May’s $103.2 billion .

-

Month‑on‑month gain was around 11.2%, indicating a strong jump from $103.2 b in May to $114.8 b in June .

-

Year‑on‑year increase of about 16.2%, growing from roughly $98.7 b a year ago to $114.8 b now .

-

Exports rose modestly (5–6% YoY) while imports lagged behind, contributing to a larger surplus .

-

This marks the highest monthly surplus since at least May, underscoring strong export performance amid weaker domestic demand.

China M2 Money Stock

And stimulus from new loans and increase in M2 underscored the continual attempt to jump start the economy

In markets, risk assets came off their highs as Powell didn't resign again but the FED did post a Q&A regarding renovations to the buildings on their website. Still billions of USD! It's such as bad look.

Equities gave a sigh of relief but bonds globally are still under pressure.

US Equities

Breaking

EU poised to impose €21 billion tariffs on U.S. if no trade deal, Tajani says [investing.com]

Bitcoin

BTC hit 123k before pulling back, but still above the Bollinger Bands.

Commodities

Massive spike in Silver past $39 as exchanges struggle to find the physical Silver to settle trades. Whilst Bitcoin is in a trend, Silver in particular is in a vortex, where the derivatives market is being decimated by physical demand.

Bonds

Canada rates marching up overnight, like Australia and Japan.

Canada 10 Year Government Bond Yield Daily

Foreign Exchange

Cable reaches support as the USD consolidates after a year long decline.

GBP/USD Daily

Equities

First support for the S&P as retail continues to buy but institutions are offloading into them.

Interesting

Bank of Japan wraps up stock divestment, weighs timing to sell ETFs [Nikkei Asia]

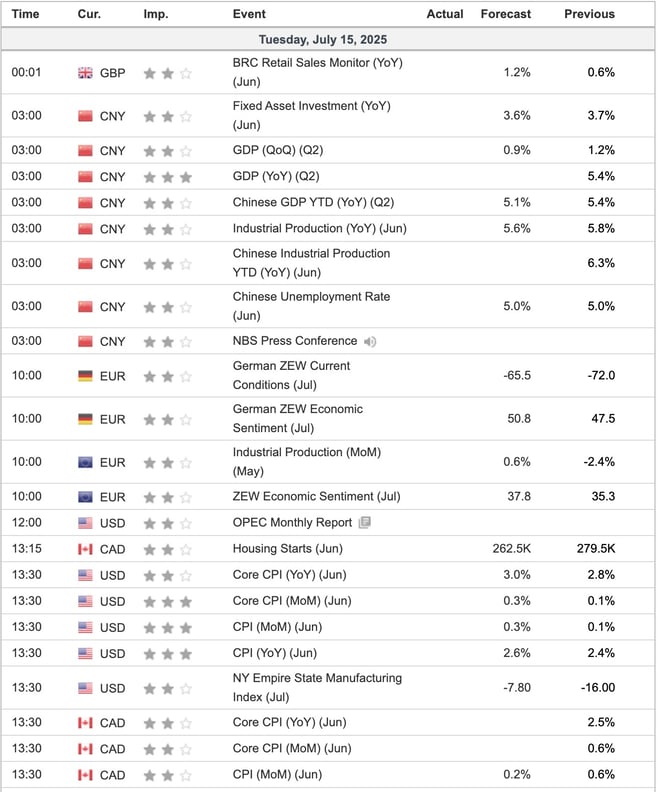

Economic Indicators Today

Ian Reynolds

Ian Reynolds

.jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(16).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(63).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(15).jpg)