Limit Up! 14th April 2025

Links

Daily LinkedIn | Weekly LinkedIn | Check out the website

Overnight

We flipped then we flopped yet again

Trump exempts smartphones and computers from new tariffs [BBC]

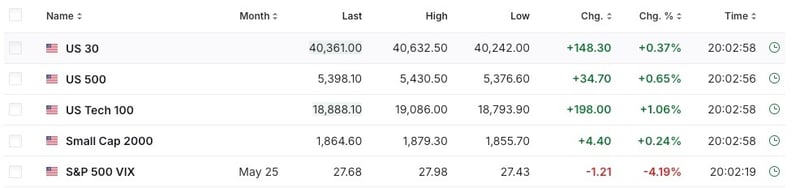

US Equity Futures

Breaking

US tech tariff exemption will be temporary, says Trump [FT]

Germany Wants to Be a Military Powerhouse. Can It Pull It Off? [Bloomberg]

Trump says he sent letter to Iran leader to negotiate nuclear deal [Reuters]

Hegseth Says U.S. Partnering With Panama to Secure Canal, Deter China [US Dept Defense]

Important from NY Fed President John Williams

- Expects inflation to rise this year to 3.5%-4%

- Expects GDP growth of "somewhat below 1%."

- Expects the unemployment rate to rise to 4.5%-5%.

- Inflation expectations have remained "well anchored" Monetary policy "is in the right place."

Williams is not the once a week FED speaker and prefers to sit in the background and push the core agenda, but this agenda seems to say Expect Stagflation.

Fed's Williams says tariffs will push up inflation, unemployment [Reuters]

Equities

Unlike US markets, the ASX has breached support from the COVID low.

ASX Monthly

Bitcoin

BTC breaking higher but not confirming yet. A close above 89k should be positive in that we should break the lower highs and lower lows currently keeping prices from accelerating upwards.

BITCOIN / USD Daily

Commodities

Gold and Silver quiet so let's see how oil is looking after last week's crazy moves. Loking to establish a bear flag and anything under $70 can be sold. The more chop around current levels, the less likely the price action is a bear trap.

SPOT BRENT Daily

Bonds

Despite yields rising in the US, the opposite has been the case for Bunds. The sell-off in price as markets reassessed the funding needed to defend Ukraine has almost been negated.

10 Year German Government Bond Yield Daily

Foreign Exchange

Critical for future direction is where the Aussie closes today. Latest red candle has just started so plenty of time.

AUD / USD Daily

Economic Indicators Today

Ian Reynolds

Ian Reynolds

.jpg)

.jpg?width=352&name=13042025%20(1).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(18).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(15).jpg)