Holding On For Dear Life

Global Instability

Escalating geopolitical tensions pose a threat to the global financial system amid heightened risks of higher inflation and slower growth, the Federal Reserve warned on Friday. This was in the bi-annual Financial Stability Report.

Yet again bond market yields rose globally and the US 10 year hit 5.0%. More than US$140B 2, 5 and 7 year being auctioned this week. If the 10 year breaks 5% look out below!

Interest rate swap spreads, currencies that are not perceived to be flight to safety and stocks down, shows increasing lack of liquidity and extreme risk off.

Federal Reserve warns of growing geopolitical risks to global financial system[FT}

Financial Stability Report [Federal Reserve]

US bond market is losing its strategic footing [FT]

Bond Yields Freak Out

Although bonds rallied into the close Friday, risk off is everywhere.

Flight to Safety

CHF in, AUD out

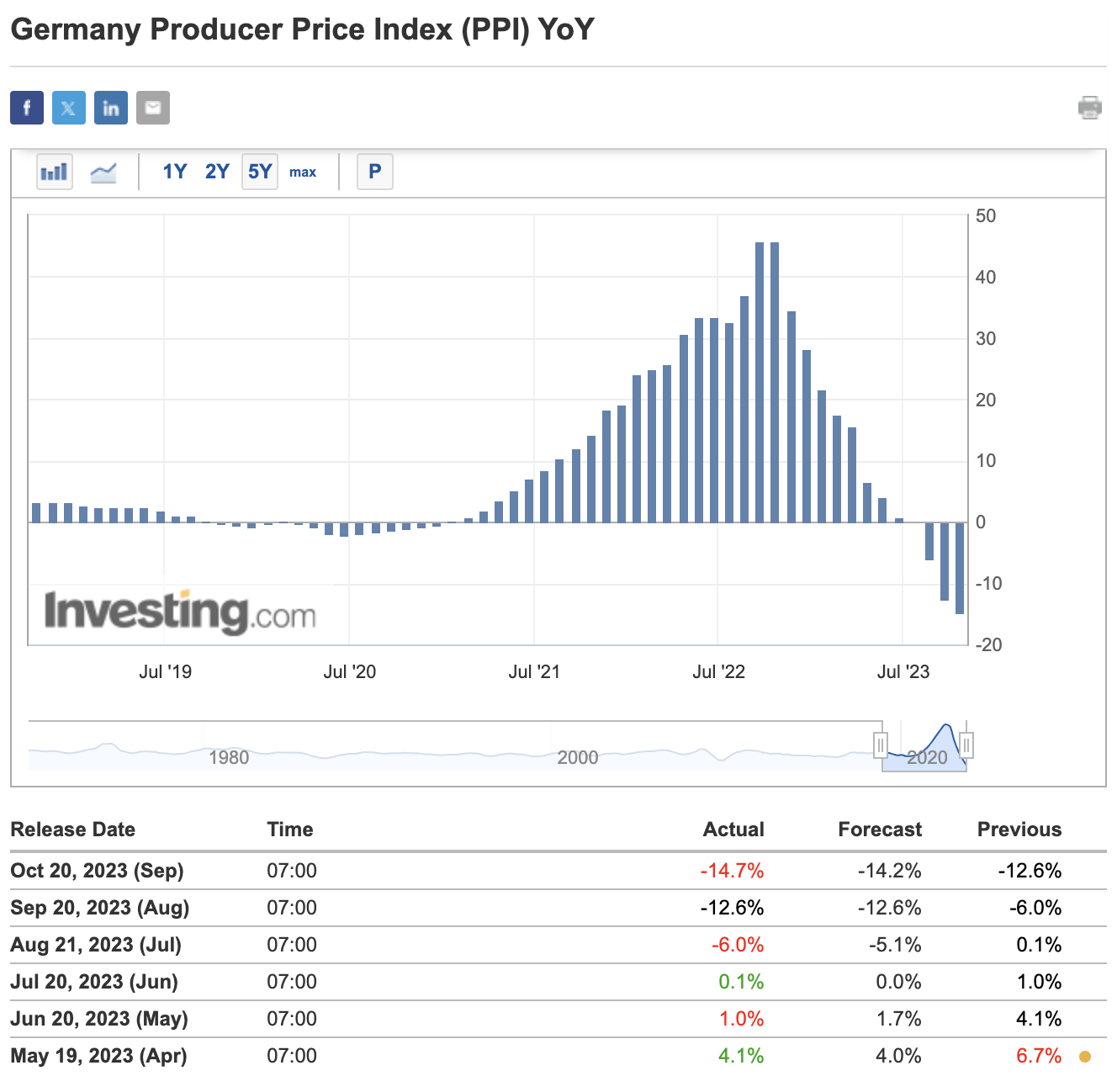

In The Background

Gold

An incredible turnaround after everyone got washed out, leaving Gold looking at the triple top at the all time high.

A rising dollar and global interest rates make this even more incredible.

Offshore Yuan

Approaching all time hight amongst property developers defaulting and reports of systemised ways of rich citizens getting cash out of the country

Argentines vote in pivotal election as economy crumples [FT]

Argentines vote in national elections on Sunday amid triple-digit inflation and intense anger over chronic economic crises and corruption, with radical libertarian economist Javier Milei narrowly leading the polls.

Japanese Government Bonds

Bank of Japan intervenes as 10-year JGB yield hits new decade high[Reuters}

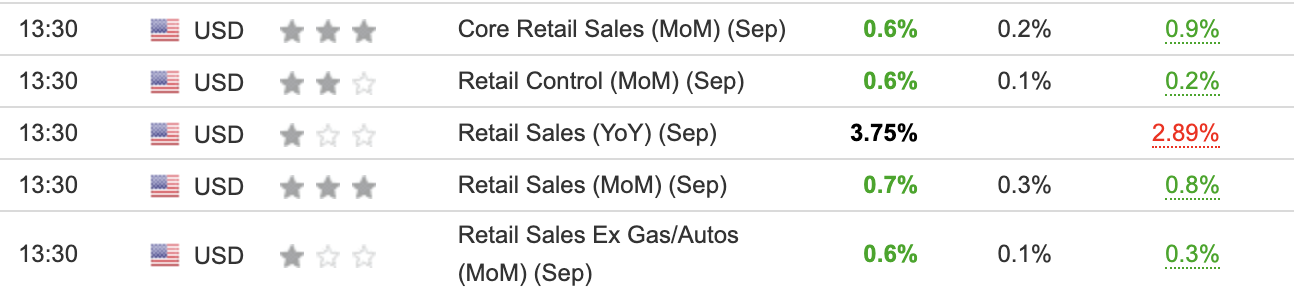

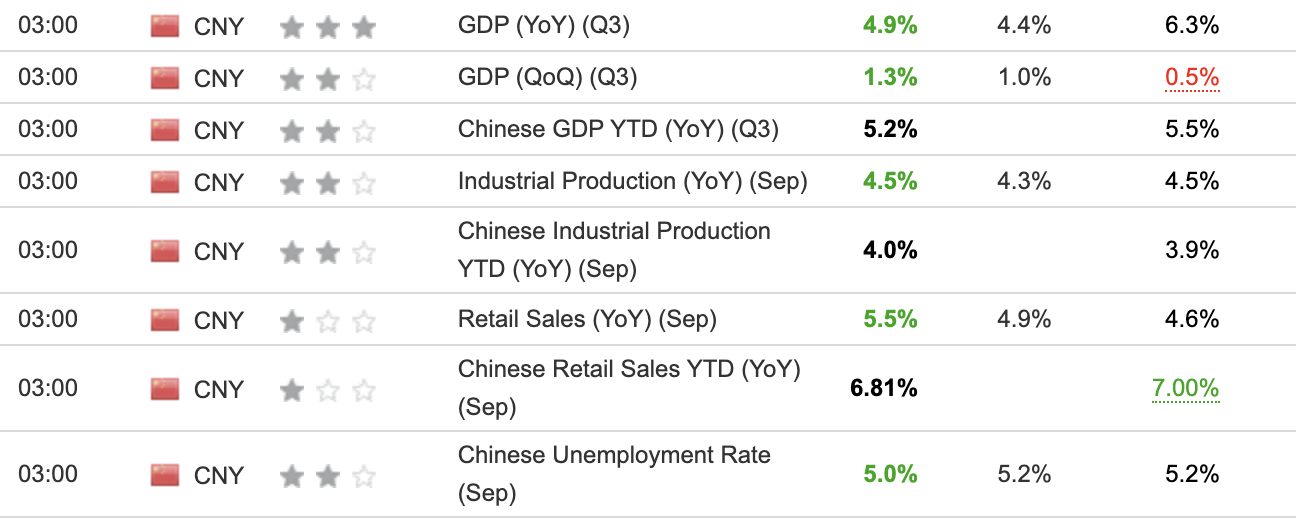

In Case You Missed It

Higher than expected US retail sales confirmed that the recession narrative is over.

Better Chinese GDP allayed some fears although the accuracy of the numbers are always of concern.

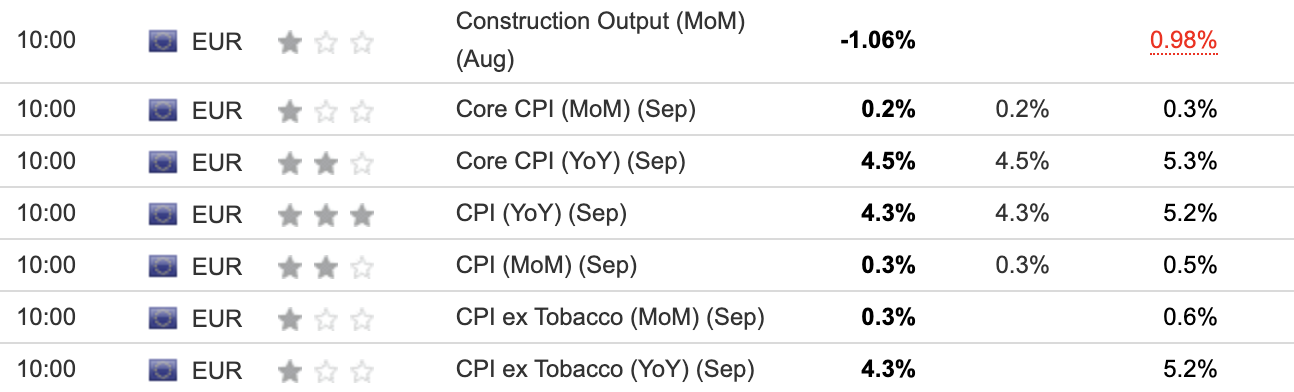

Stubborn EU CPI again makes cutting rates a difficult concept

Japanese imports down 16 YoY in September is yet more evidence of global trade collapsing.

BREAKING: Goldman Sachs has marked down or impaired office holdings down by 50%. [X]

Rite Aid files for bankruptcy protection [Reuters]

One of the largest U.S. pharmacy retailers, stumbled under its high debt, revenue declines, increased competition, and opioid litigation, according to its court filings.

Australia

Pension funds hit reverse on $A bets

Big global real money investors – the slow-moving pension funds, mutuals and insurers that usually think long-term and provide the undercurrent for the rest of the market – are selling Australian dollars in droves, worried about the global economic slowdown, geopolitics and reining in risk.

Australia’s savings buffer gone by March, consumption to take a hit [AFR]

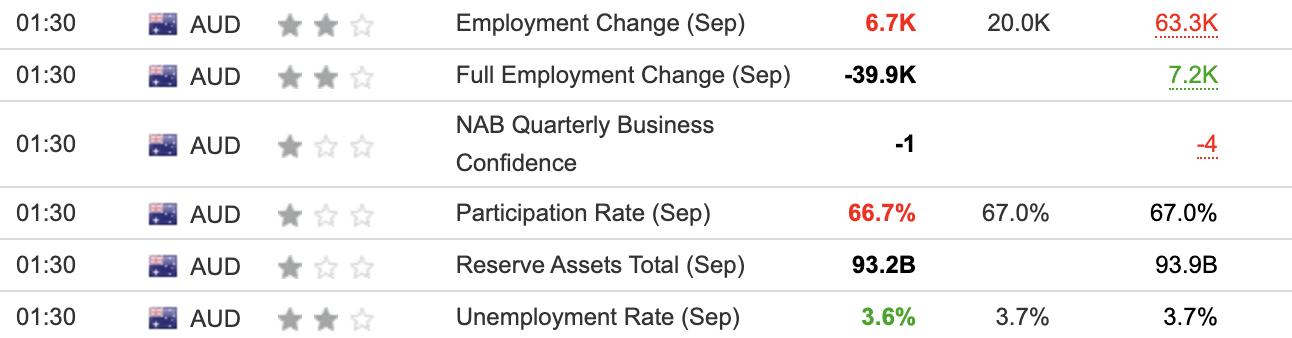

Mixed but that drop in the unemployment rate is unfortunate.

RBA Latest Minutes[RBA]

"The rise in housing prices could also be a signal that the current policy stance was not as restrictive as had been assumed, although there was other evidence that monetary conditions were tight."

Israel-Hamas war may prolong inflation pain: Bullock [AFR]

Gloomiest outlook yet: Economy on knife-edge and facing consumer recession, says Deloitte [SMH]

This Week's Important Economic Indicators [London time]

![This Week's Important Economic Indicators [London time]](https://vip.suberia.capital/hubfs/image-png-Oct-22-2023-07-57-38-7352-AM.png)

Ian Reynolds

Ian Reynolds

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(20).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(23).jpg)