Extreme Greed

One minute extreme fear[Limit Up]

The next minute extreme greed (in China anyway)

Global investors continue to pile into anything Chinese as the Govt and PBoC continue unprecedented stimulus. And the world has taken note. Rather than fearing the problem that caused such a solution, politicians will be jumping on this globally.

The new Prime Minister in Japan is already on it, and Europe surely can't be far behind.

Only in the US does the economy seem to be good. At least until the election. This week's Nonfarm Payroll report suggested a solid economy but breaking down the numbers suggests something worse. And are the numbers reported actually correct? 20 months of extreme revisions suggest that, at the very least, they should be taken with a grain of salt.

Record Seasonal Adjustment Tones Down Blowout US Jobs Report[Bloomberg]

Breaking

Samsung to Cut Thousands of Jobs Amid Struggles in AI Market[Bloomberg]US buys 6 million barrels of oil for Strategic Petroleum Reserve[Reuters]

Biden Says Discussing Israel Striking Iran Oil Facilities[Bloomberg]

Russian court freezes funds of US banks JP Morgan and Mellon[Reuters]

In Focus

China

Last week China announced its biggest economic stimulus package since 2008, aimed at addressing multiple economic challenges it currently faces, including a property market collapse and very weak consumer spending.

The stimulus package includes cutting interest rates by 30 basis points, from 2.3% to 2%, and lowering banks' reserve requirements. The government also plans to issue an additional 2 trillion yuan in bonds, equivalent to about 1.5% of China's GDP.

In response to the announcement, Chinese and Hong Kong stock markets rallied, with Chinese stocks posting their best week in 16 years and Hong Kong stocks surging at a pace unseen since 1998.

Shanghai Composite Daily

Hong Kong Distressed Sellers Flood Market With Assets at Fire Sale Prices[Bloomberg]

China Shorts Can't Cover Margin Calls After Biggest One-Day Faceripper Since Lehman[Zerohedge]

Why Another Chinese Gold Mania May Be Starting][Zerohedge]

Chinese Homebuyers Scout Showrooms at Midnight After Easing[Bloomberg]

Japan

Chaos in Japan

The Nikkei opened the week down 5% on new PM in favour of raising rates, then rallied as he decided the economy is in no shape to withstand another rate hike. Then he decided there was to be a stimulus package.

And he called a snap election.

USD / YEN is back at 148 as the market looks to challenge the Bank of Japan's rate hike resolve.

USD / YEN Daily

Nikkei 225 Daily

Japan PM Ishiba tells cabinet to compile stimulus package[Reuters]

Japan’s Ishiba Pledges Early General Election in October[Bloomberg]

Ishiba Ally Sends Signal to Warn BOJ Against Rate Hike Too Soon[Bloomberg]

PM Ishiba says Japan not ready for rate hike after meeting BOJ governor [Reuters]

Japan Industrial Production August 2024

Japan Construction Orders August 2024

Japan Unemployment August 2024

US Economy

An apparently resilient US economy (said Powell and Nonfarm Payroll report) is at odds with market expectations of multiple rate cuts this year, although those expectations have been dialled back a bit.

An election in 4 weeks may be distorting the rhetoric.

Powell hit the airwaves on Monday at the NABE annual meeting on economic outlook.

US JOLTS

![]()

ADP Nonfarm Employment Change September 2024

US Non-manufacturing ISMs

US Nonfarm Payroll September 2024

Exclusive: Fed's Bostic open to another large rate cut if job market weakens[Reuters]

Fed's Goolsbee reiterates case for extended path of rate cuts[Reuters]

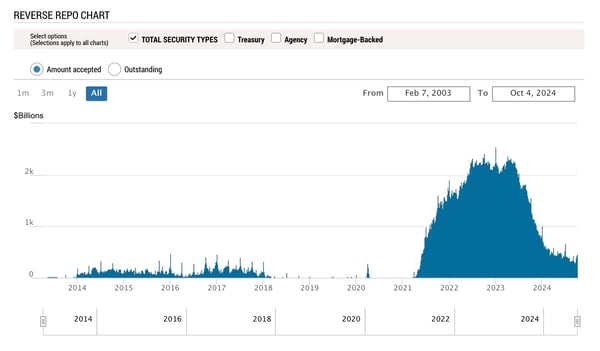

Repos surged this week suggesting a bank in trouble but the reverse repo facility still elevated confuses the issue.

What central bank would be running reverse repos and repos at the same time? Obviously one borrower in the repos could be different to many lenders in reverse repos, but what chaos.

No wonder they're technically insolvent.

In The Background

CRE / Banks / CLOs

|

|

|

How Soft is the Denver Office Market?[Savills]

Assessed office values in Philly plummet by $1B[The Real Deal]

Bitcoin | US Election

SWIFT to trial live digital currency transactions next year[Reuters]

Canada

Canada Just Saw 1 In 20 Businesses Close In A Month, Biggest Wave Since Pandemic[Better Dwelling]

England

Sterling slides after Bailey says BoE could be ‘a bit more aggressive’ on rates

Europe

Germany CPI September 2024

EU CPI September 2024

EU PPI August 2024

The Eurozone CPI is still easing and the ECB should be looking to cut further.

Italy Aims to Get More Tax Out of Most Profitable Companies [Bloomberg]

Australia

Australia Building Approvals August 2024

IMF puts Chalmers on notice over rates, super tax and spending[AFR]

Victoria slumps for business, as execs warn: ‘It’s really struggling’[AFR]

What's Next ?

US CPI / PPI the focus.

This Week's Important Economic Indicators [London time]

![This Week's Important Economic Indicators [London time]](https://vip.suberia.capital/hs-fs/hubfs/indicators-Oct-05-2024-04-32-25-6763-AM.jpg?width=658&height=464&name=indicators-Oct-05-2024-04-32-25-6763-AM.jpg)

Ian Reynolds

Ian Reynolds

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(86).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(63).jpg)