Bitcoin > Silver

It's official: the market capitalisation of Bitcoin is greater than that of Silver.

Actually they flipped in March and were similar for 6 months, but now BTC is way ahead.

The real winner of the US election was Bitcoin, and it was always going to be.

Biden has left the US finances in a total mess and Trump will have a big job to fix them.

Trump has always been friendly to private money but, of course, has always preferred the good, old US Dollar. But the US Dollar is past it's sell-by date. Far too much of it in existence, purchasing power totally collapsed, and a relic in the face of the digital money of the Internet.

Only the old recidivists of the Biden administration and the US deep state would get in the way of the next big thing. And the US is about to pay for their stupidity.

FED Semi-Annual Stability Report: US Debt Load Tops Fed’s Survey of Financial Stability Risks [Bloomberg]

Breaking

Gary Gensler Plans to Step Down From SEC in January [Bloomberg]

In Focus

Bitcoin

Bitcoin continued upwards to almost 100,000 USD. And a wave of companies are adopting it for their balance sheets along with countries for their strategic reserve (supposedly).

I mean it's obvious isn't it. If the Swiss National Bank can buy US tech stocks then why not Bitcoin.

The realisation is that it's the continued devaluation of fiat currencies that is at play here. Why put your money in the bank when the Govt debases the currency quicker than the interest rate can keep up.

Allianz bought 24.75% of MicroStrategy’s corporate 2031 bond [TradingView]

Polish Presidential Candidate Promises To Adopt Bitcoin if He Wins Election [Newsweek]

China

The PBOC left Loan Prime Rates unchanged as it seems the almost continual stimulus has finished now. But stock markets fell Friday. There have been many hedge funds (and others) piling into China but stocks and property falling further may cause a rush for the exits.

Shanghai Daily

China's bond issuance this week in Riyadh is a big, fat red herring. Europe has been printing USD for decades - it's just another offshore dollar bond and the only interesting thing was that the Saudi push as a banking centre is coming along nicely.

China borrows almost as cheaply as US in return to dollar bond market [FT]

Chinese Steel Exports Are Booming But Here’s Why That Won’t Last [Bloomberg]

Japanese Businesses Grow More Pessimistic on China’s Economy [Bloomberg]

Japan

Japan National Core CPI October 2024

Famously, Winston Churchill defined Russia as "a riddle, wrapped in a mystery, inside an enigma."

Surely Japan's monetary and fiscal policies are even more inscrutable.

Q. Who hikes rates and has a stimulus package at the same time ?

A. The country where the central bank owns more half of the country debt ( Debt to GDP higher than 250% ).

Japan’s Ishiba Set to Announce $140 Billion Stimulus Package [Bloomberg]

BOJ sees progress in wage-driven inflation, keeps Dec rate hike on table [Reuters]

BOJ chief sees higher chance of wage-driven inflation in Japan [investing.com]

US

Target Share Price Daily

Source Federal Reserve Bank of NY

The story that the US economy is falling apart is everywhere. Credit card rates and delinquencies, auto loans, buy now pay later schemes, mass layoffs, bankrupt municipalities and government.

But that recession still hasn't happened, the jobs market hasn't fallen apart and the US Govt can still find buyers for it's debt. As can China. Despite well know investors shorting treasuries and poor auction results, treasuries are still the "risk-free" asset for the world.

The Biden administration was great at kicking the can down the road, but will Trump and new boy Bessant be able to pick up Biden's poisonous legacy? The debt ceiling reappears on 1st Jan but Trump won't be in power until 20 Jan.

There is still a lot of potential for the deep state to disrupt the new president's first few months.

Twenty-Year Bond Auction Attracts Well Below Average Demand [NASDAQ]

DOJ Will Push Google to Sell off Chrome to Break Search Monopoly [Bloomberg]

US is vulnerable to inflation shocks, top Fed official warns [FT]

US Funding Costs Surge in Anticipation of Year-End Pressures [Bloomberg]

Household Debt Rose Modestly; Delinquency Rates Remain Elevated [FED NY]

In The Background

CRE / Banks / CLOs

|

|

|

|

Chicago's PMI report on Friday will tell us the current state of the US's big city horror story.

- Chicago is now the slowest-growing major city in the U.S.; its population now hovers around 1920s levels

- A third of Chicago's schools are less than half full. For example, Frederick Douglass Academy High School was built to hold more than 900 students. Last year, it served just 35 students, nearly two-thirds of whom were chronically absent

- Chicago holds more pension debt than all but seven American states; over 80% of Chicago’s property tax levy goes to pensions, and of the overall city budget, pensions and debt service eat 40 cents of every dollar

- In 2023, violent crimes in Chicago grew to its highest level in a decade, but just 10.8% resulted in an arrest

- In order to plug annual budget gaps, past administrations have taken to selling off city assets like the parking meters

- Far left mayor Brandon Johnson has done almost nothing but pour gasoline on this dumpster fire. Over the last 18 months, he's attempted to build a migrant camp on toxic land, hired four top staffers who support abolishing the police, ousted all seven members of the Chicago school board after they refused to issue a $300 million high-interest loan, demanded (and failed to secure) a taxpayer-funded stadium for the Chicago Bears, canceled the city’s gunshot detection system over the objections of black and latino aldermen, and broke his promise to not hike property taxes

Source Pirate Wires [X]

Canada

Canada CPI October 2024

Canada IPPI October 2024

Canada Retail Sales September 2024

Canada Average Weekly Earnings

Thursday's average weekly earnings may be a concern for the Bank of Canada. Anything near 5% will give the BoC cause for concern and may stop the rate cuts in their tracks. CPI and IPPI higher this week support this call.

For the fragile real estate market, this is not good news. Activity had seemingly picked up with the rate cuts but it going to be fickle.

Canada will reduce immigration targets as Trudeau acknowledges his policy failed [AP News]

United Kingdom

UK CPI, PPI October 2024

UK Retail Sales October 2024

Higher inflation with lower retail sales tell us the UK will have a long journey trying to fix the economy.

UK Prime Minister Starmer is surely the most unpopular leader (from any country) ever. Liz Truss was a heroine by comparison. And ( maybe ) 2 terms of a Labour Government is a horrifying thought. Remember the UK in the 70s. 3 day week | Arthur Scargill | IMF bailout | Wilson | Callaghan - the UK doesn't want to go there again. And there's no Maggie Thatcher to save the country.

Europe

EU officials were sounding the alarm on the economy this week as CPI and German PPI came in slightly higher than expected ( they had already told us this ). PMIs Friday were really poor and consumer confidence is low. Should retail sales come in lower than expected on Friday, a rate cut is almost certain when the ECB meets on 12 Dec.

EU CPI October 2024

Germany PPI October 2024

![]()

EU Consumer Confidence November 2024

Germany GDP Q3 2024

France & Germany PMIs

Euro Area to See Consumer Pickup But Risks Are High, EU Says [Bloomberg]

ECB must commit to faster rate cuts, says Bank of Italy governor [FT]

ECB sounds warning over prospect of 'bubble' in AI stocks [investing.com]

Welfare state at risk unless Europe halts decline in growth, says Lagarde [FT]

Budget Brinksmanship Raises Risks for France’s Businesses and Bonds [Bloomberg]

EURO / USD Daily

Certainly the market is pricing in further rate cuts as EURO/USD look to test par if it can break support at 1.0350.

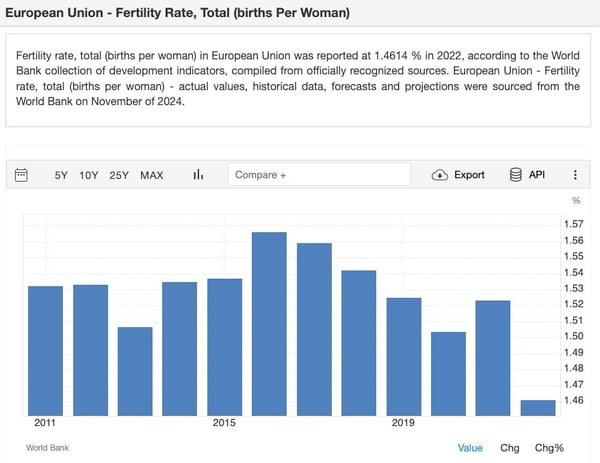

Zooming out the World Bank's latest report on global fertility rates, has the EU's collapsing in 2022 (latest known year ) making the future even more uncertain.

EU Fertility Rates

Australia

More political fiddling with the financial laws of Australia demonstrates the similarity betwen the UK and Australia's governing labour parties. Whereas Australia's finest appear to be incompetant at least they are not manevolent like in the UK.

RBA Policy Effect Is No Stronger Than Other Economies, Kent Says [Bloomberg]

What's Next ?

Probably thin markets this week ahead of Thanksgiving, but also look out for position squaring as we head to Christmas and the end of the quarter.

Much, much more Bitcoin buying is coming and a pause in price would be good. 100k is going to be hard to break before Xmas.

This Week's Important Economic Indicators [London time]

![This Week's Important Economic Indicators [London time]](https://vip.suberia.capital/hs-fs/hubfs/indicators-Nov-22-2024-04-34-24-9547-AM.jpg?width=658&height=507&name=indicators-Nov-22-2024-04-34-24-9547-AM.jpg)

Ian Reynolds

Ian Reynolds

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(12).jpg)

.jpg?width=352&name=Limit%20Up%20Newsletter%20Cover%20(68).jpg)