A Change Is Gonna Come

They look like a pair of crypto bro's. They're definitely pleased with themselves. Luckily for everyone they will have much more quality time together now that they don't have a real job any more.

UK Labour set for huge majority as Farage’s Reform grabs first seat [FT]

France: Le Pen set to fall short of French majority: polls [AFR]

Breaking

Putin says he thinks Trump is sincere about ending Ukraine war [Reuters]

Justice Department to Charge Boeing, Seeks Guilty Plea From Planemaker [Bloomberg]

Russian Oil Traders Struggle With Payments [Energy Intelligence]

Russia to allocate $1.4 bln for purchases of currency, gold from July 5 to August 6 [Tass]

In Focus

Rate Cut Fever

Minutes of the Federal Open Market Committee, June 11–12, 2024 [Federal Reserve]

"Participants highlighted a variety of factors that were likely to help contribute to continued disinflation in the period ahead. The factors included continued easing of demand–supply pressures in product and labor markets, lagged effects on wages and prices of past monetary policy tightening, the delayed response of measured shelter prices to rental market developments, or the prospect of additional supply-side improvements. The latter prospect included the possibility of a boost to productivity associated with businesses’ deployment of artificial intelligence–related technology."

And even more dovishness.

"Participants observed that longer-term inflation expectations had remained well anchored and viewed this anchoring as underpinning the disinflation process. Participants affirmed that additional favourable data were required to give them greater confidence that inflation was moving sustainably toward 2 percent"

However some voting members have been vocal about not cutting yet

'Several' Fed officials want more rate hikes if inflation persists, minutes show [investing.com]

However you want to slice and dice the minutes, markets took this as super dovish and 2 year rates plummeted, partially driven by short covering by hedge funds, who had built up record positions.

US 2 Year Note Yield Daily

Japan

Japan Household Spending May 2024

Japan's economy continues to be performing badly and it's GDP is moving sharply lower and is currently back to the same level as 1990. 35 years without economic growth !

.

But don't fear, the YEN is safe.

Atsushi Mimura, a financial regulation veteran, replaces Masato Kanda, who launched the biggest yen-buying intervention on record this year and aggressively jawboned speculators against pushing down the Japanese currency too much.

As a FX Diplomat. The markets will be howling with laughter at the job title.

Japan names new FX diplomat as yen hits 38-year low [Reuters]

Japan’s Wavering GDP Revisions Leave Investors Unimpressed [Bloomberg]

US Economy

Jerome Powell Speaks At The ECB Forum on Central Banking 2024 [CNBC]

- The trend of disinflation appears to be resuming

- Need to be more confident before reducing rates

- Fed doesn't see 2% inflation "this year or next year"

- Budget deficit is very large and unsustainable

- 4% unemployment is still a very low unemployment rate

- Moving too fast creates risk of inflation returning

- The Fed needs more data before rate cuts can begin.

An Update to the Budget and Economic Outlook: 2024 to 2034 [Congressional Budget Office]

LA County Superior Courts to Offer $35,000 to Full-Time Workers to Leave Jobs [Pasadena Now]

Highest Inventory of New US Homes Since 2008 Threatens Building [Bloomberg]

US Manufacturing ISMs June 2024

US Non-Manufacturing ISMs June 2024

The FED minutes, Powell's remarks and a surge in short government bond prices set markets on fire as some US stock markets hit record highs.

Underpinning the rate cut fever was the sharp declines in both the manufacturing and non-manufacturing ISMs.

The ISM manufacturing index or purchasing managers' index is considered a key indicator of the state of the U.S. economy. It indicates the level of demand for products by measuring the amount of ordering activity at the nation's factories. Investopedia

In The Background

Bitcoin / US Election

Trump Sparks Talks Of Bitcoin As A Strategic Reserve Asset [Forbes]

Bitcoin Daily

And now would be a good time for Mr Trump to buy some.

Bitcoin has been smashed by the German and US governments selling seized coins as well as the release of funds from the Mount Gox trust.

CRE / Banks / CLOs

CRE issues getting worse (really !) and spreading to other areas of the housing market in the US. Banks are dumping distressed debt and CLO credit ratings are taking a beating. We've seen some investors buying distressed assets but mainly, especially in office, the buildings are being handed back to the lenders.

|

|

|

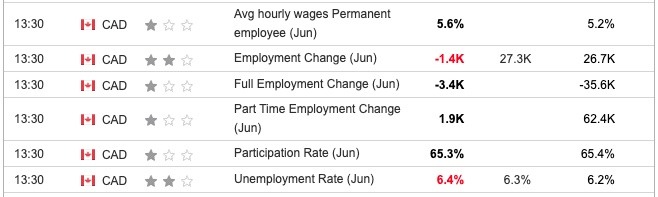

Canada

China

With nothing worth investing in ( interest rates, stocks, housing ) China's savers are finding refuge in government bonds, reflecting an economy in big trouble and burdened by debt.

China’s 10-Year Yield Falls to Record as Economic Gloom Deepens [Bloomberg]

Europe

EU PPI May 2024

Germany Industrial Production May 2024

Germany is no better, as industrial production is still cratering.

United Kingdom

A new era starts here. Anyone that has experienced a Labour party in power from the 60s and 70s would be correct to fear the future. We need another Thatcher to create a paradigm shift in a country which could revert to unionism at the flick of a switch.

Wealthy sell UK assets amid fears Labour would raise capital gains tax [FT]

Australia

Australia Retail Sales May 2024

Australia finds itself in a much better situation than the rest of the western world but slowing growth and CPI higher than desired means policy makers will be disinclined to make changes.

That's the trouble with stagflation

RBA Minutes - considered rate hike [RBA]

What's Next ?

Federal Reserve Chair Jerome Powell is to testify on the economic outlook and recent monetary policy actions before the Joint Economic Committee, in Washington DC. The testimony is in two parts; the first is a prepared statement, then the committee conducts a question and answer session. The Q&A portion of the testimony can see heavy market volatility for the duration.

Markets will be fixated on US CPI but watch those bond auctions.

Remember Biden's train-wreck punch up with Trump pushed 10 year yields up a massive 25bps.

This Week's Important Economic Indicators [London time]

Ian Reynolds

Ian Reynolds